至少根據(jù)房利美(Fannie Mae)在上周發(fā)表的一份報告,有關(guān)全美房地產(chǎn)市場復(fù)蘇的說法言過其實。該報告預(yù)測住房市場在今年1月和2月的“相對高位”可能是“暫時的”。

房利美的經(jīng)濟(jì)學(xué)家在最新報告中寫道:“盡管樂觀情緒似乎已經(jīng)悄悄潛入房地產(chǎn)行業(yè),但這代表著樓市活動從極低水平上升,如果利率逆轉(zhuǎn),還有再次下降的風(fēng)險。”

2023年年初,一系列因素疊加在一起,讓低迷的房地產(chǎn)市場稍稍回溫。首先,一年中的最初幾個月總是有更多的季節(jié)性需求。30年期固定利率抵押貸款的平均利率從2022年11月初的7.37%下降到今年2月初的5.99%,以及房屋建筑商目前提供的相當(dāng)可觀的抵押貸款利率折扣,這都推動了今年需求的上升。

然而,我們已經(jīng)開始看到房地產(chǎn)市場的環(huán)境再次惡化。事實上,在過去三周內(nèi),30年期固定利率抵押貸款的平均利率從5.99%飆升至6.88%。

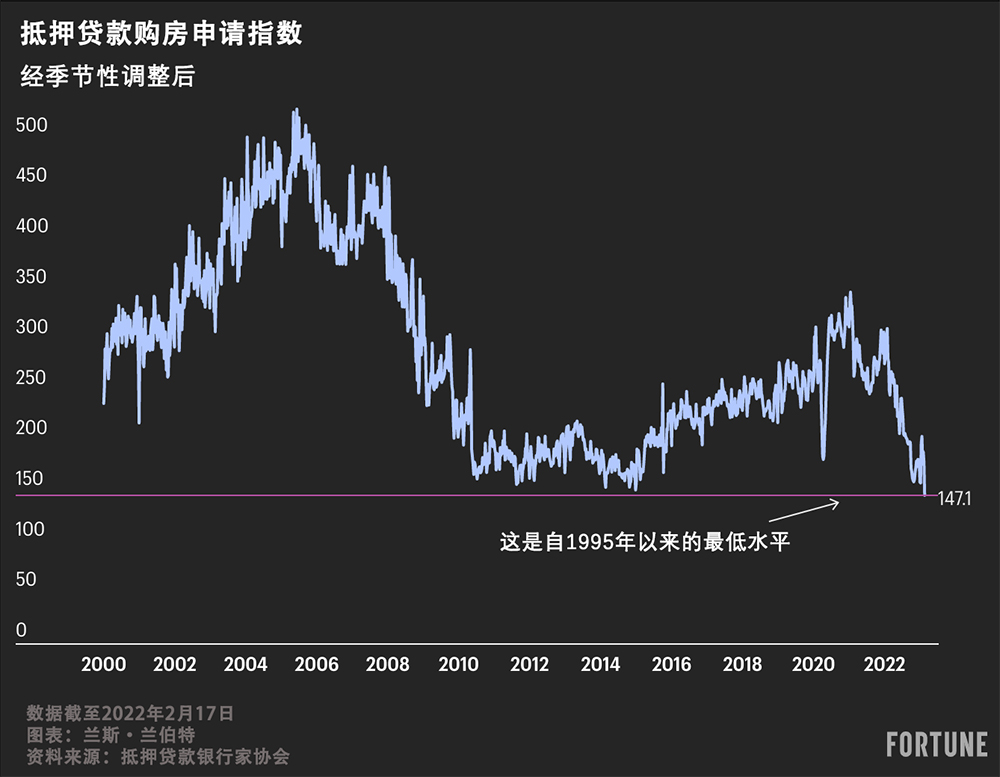

抵押貸款利率的回升已經(jīng)與上周經(jīng)季節(jié)性調(diào)整后的抵押貸款購房申請情況(參見下圖)相一致。目前,抵押貸款購房申請已經(jīng)下降到自1995年以來的最低水平。

房利美預(yù)計,2023年全年,新房和現(xiàn)房銷量將分別下降5.4%和19.2%。在此之前,2022年新房銷售下降16.5%,現(xiàn)房銷售下降17.9%。

房利美認(rèn)為住房市場不會在2023年復(fù)蘇,主要有以下兩個原因。

首先,房利美認(rèn)為,高企的抵押貸款利率將繼續(xù)讓許多購房者望而卻步。

其次,房利美經(jīng)濟(jì)學(xué)家認(rèn)為,房屋掛牌出售仍將受到限制,因為很少有賣家急于把3%的固定抵押貸款利率換成6%的抵押貸款利率。當(dāng)然,房屋銷售水平因為庫存短缺也難以上升。

房利美的經(jīng)濟(jì)學(xué)家在最新報告中寫道:“負(fù)擔(dān)能力持續(xù)受到限制,‘鎖定’效應(yīng)導(dǎo)致大多數(shù)目前有抵押貸款的房主不愿意搬家(就財務(wù)原因而言,當(dāng)年他們鎖定的抵押貸款利率較低),庫存仍然緊張,這些因素預(yù)計將繼續(xù)限制房屋銷售……此外,10年期國債近幾周大幅上漲,表明抵押貸款利率可能會開始再次上升。”

雖然房利美預(yù)計庫存水平將繼續(xù)受到限制,但它表示庫存緊張不足以阻止房價回調(diào)。

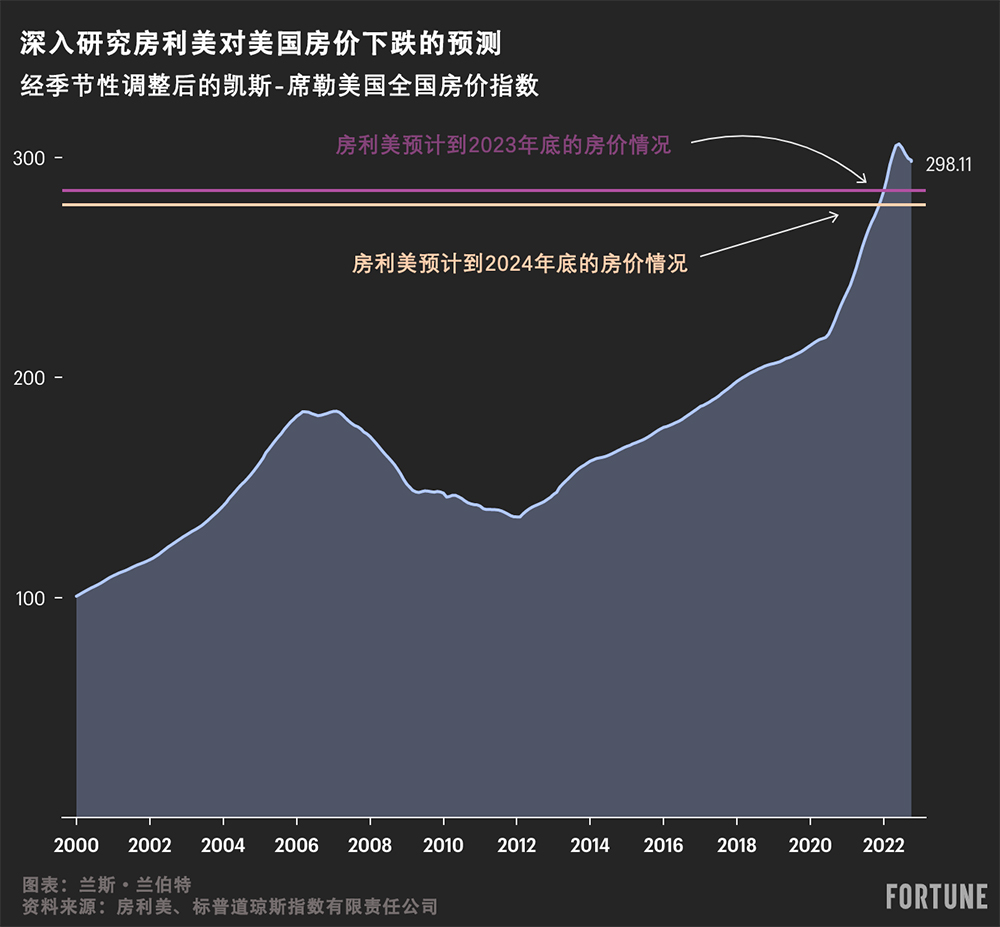

繼2022年下半年美國房價下跌2.5%后,房利美預(yù)計2023年美國房價將再下跌4.2%。房利美的經(jīng)濟(jì)學(xué)家預(yù)計,2024年美國房價將再下跌2.3%。

如果房利美的預(yù)測是正確的,那么這次房市暴跌就將使全美住房市場經(jīng)歷一次溫和的房價修正,而不是全面的房價崩盤。畢竟,如果房價真的下跌,全美房價在2024年年底仍將比2020年3月的價格水平高出29%。

要牢記,每當(dāng)房利美這樣的機(jī)構(gòu)討論美國房價時,討論的都是全美整體房價。在區(qū)域?qū)用嫔希績r走勢各不相同。(財富中文網(wǎng))

譯者:中慧言-王芳

至少根據(jù)房利美(Fannie Mae)在上周發(fā)表的一份報告,有關(guān)全美房地產(chǎn)市場復(fù)蘇的說法言過其實。該報告預(yù)測住房市場在今年1月和2月的“相對高位”可能是“暫時的”。

房利美的經(jīng)濟(jì)學(xué)家在最新報告中寫道:“盡管樂觀情緒似乎已經(jīng)悄悄潛入房地產(chǎn)行業(yè),但這代表著樓市活動從極低水平上升,如果利率逆轉(zhuǎn),還有再次下降的風(fēng)險。”

2023年年初,一系列因素疊加在一起,讓低迷的房地產(chǎn)市場稍稍回溫。首先,一年中的最初幾個月總是有更多的季節(jié)性需求。30年期固定利率抵押貸款的平均利率從2022年11月初的7.37%下降到今年2月初的5.99%,以及房屋建筑商目前提供的相當(dāng)可觀的抵押貸款利率折扣,這都推動了今年需求的上升。

然而,我們已經(jīng)開始看到房地產(chǎn)市場的環(huán)境再次惡化。事實上,在過去三周內(nèi),30年期固定利率抵押貸款的平均利率從5.99%飆升至6.88%。

抵押貸款利率的回升已經(jīng)與上周經(jīng)季節(jié)性調(diào)整后的抵押貸款購房申請情況(參見下圖)相一致。目前,抵押貸款購房申請已經(jīng)下降到自1995年以來的最低水平。

房利美預(yù)計,2023年全年,新房和現(xiàn)房銷量將分別下降5.4%和19.2%。在此之前,2022年新房銷售下降16.5%,現(xiàn)房銷售下降17.9%。

房利美認(rèn)為住房市場不會在2023年復(fù)蘇,主要有以下兩個原因。

首先,房利美認(rèn)為,高企的抵押貸款利率將繼續(xù)讓許多購房者望而卻步。

其次,房利美經(jīng)濟(jì)學(xué)家認(rèn)為,房屋掛牌出售仍將受到限制,因為很少有賣家急于把3%的固定抵押貸款利率換成6%的抵押貸款利率。當(dāng)然,房屋銷售水平因為庫存短缺也難以上升。

房利美的經(jīng)濟(jì)學(xué)家在最新報告中寫道:“負(fù)擔(dān)能力持續(xù)受到限制,‘鎖定’效應(yīng)導(dǎo)致大多數(shù)目前有抵押貸款的房主不愿意搬家(就財務(wù)原因而言,當(dāng)年他們鎖定的抵押貸款利率較低),庫存仍然緊張,這些因素預(yù)計將繼續(xù)限制房屋銷售……此外,10年期國債近幾周大幅上漲,表明抵押貸款利率可能會開始再次上升。”

雖然房利美預(yù)計庫存水平將繼續(xù)受到限制,但它表示庫存緊張不足以阻止房價回調(diào)。

繼2022年下半年美國房價下跌2.5%后,房利美預(yù)計2023年美國房價將再下跌4.2%。房利美的經(jīng)濟(jì)學(xué)家預(yù)計,2024年美國房價將再下跌2.3%。

如果房利美的預(yù)測是正確的,那么這次房市暴跌就將使全美住房市場經(jīng)歷一次溫和的房價修正,而不是全面的房價崩盤。畢竟,如果房價真的下跌,全美房價在2024年年底仍將比2020年3月的價格水平高出29%。

要牢記,每當(dāng)房利美這樣的機(jī)構(gòu)討論美國房價時,討論的都是全美整體房價。在區(qū)域?qū)用嫔希績r走勢各不相同。(財富中文網(wǎng))

譯者:中慧言-王芳

Talk about a national housing market recovery is overblown. At least that’s according to a Fannie Mae report published last week that predicts the housing market’s “relative high note” in January and February is likely to “prove temporary.”

“While some optimism appears to have crept into the housing sector, it represents an increase from very low levels of activity and is at risk of declining again if rates reverse,” wrote economists at Fannie Mae in their latest report.

In early 2023, a combination of factors came together to make the slumped housing market feel a little warmer. For starters, the early months of the year always see more seasonal demand. That demand uptick this year was aided by the average 30-year fixed mortgage rate slipping from 7.37% in early November to 5.99% by early February, and the fact that homebuilders are now offering substantial mortgage rate buydowns.

However, we’re already starting to see the housing market backdrop sour again. Indeed, over the past three weeks the average 30-year fixed mortgage rate spiked from 5.99% back up to 6.88%.

That resurgence in mortgage rates has already corresponded with seasonally adjusted mortgage purchase applications (see chart below) falling last week to their lowest level since 1995.

For full-year 2023, Fannie Mae expects volumes of both new and existing home sales to fall 5.4% and 19.2%, respectively. That comes after last year’s 16.5% drop in new home sales and the 17.9% drop in existing home sales.

There are two main reasons why Fannie Mae doesn’t think housing will recover in 2023.

First, Fannie Mae thinks high mortgage rates will continue to keep many buyers sidelined.

Second, Fannie Mae economists think home listings will remain constrained as few sellers are eager to trade their fixed 3% mortgage rate for a plus 6% mortgage rate. That lack of inventory, of course, would make it hard for home sales levels to rise.

“Ongoing affordability constraints, the ‘lock-in’ effect creating a financial disincentive for the majority of current homeowners with mortgages to move, and still-tight inventories are expected to continue to limit home sales…Additionally, the 10-year Treasury has increased meaningfully in recent weeks, suggesting that mortgage rates are likely to begin rising again,” wrote Fannie Mae economists in their latest report.

While Fannie Mae expects inventory levels to remain constrained, it says tight inventory alone won’t be enough to stop the home price correction.

Following the 2.5% drop in U.S. home prices in the second half of 2022, Fannie Mae expects U.S. home prices to fall another 4.2% in 2023. Then in 2024, Fannie Mae economists expect U.S. home prices to fall another 2.3%.

If Fannie Mae is right, this housing slump would see the national housing market pass through a mild home price correction—not a full-blown housing price crash. After all, if these price drops do happen, national home prices would end 2024 still up 29% over March 2020 price levels.

Keep in mind, anytime a group like Fannie Mae discusses U.S. home prices, it’s a national aggregate. On a regional level, price movements vary.