如果說2021年的投資主題是新冠疫情之后的反彈,而2022年的主題是應對通脹,那么應該把2023年看作是投資者為經濟低迷全力以赴的一年。瑞萬通博(Vontobel)的高質量增長板塊(Quality Growth Boutique)的投資組合經理拉米茲·切拉特說:“誠然,我們陷入經濟衰退的可能性增加了。”事實上,在世界大型企業聯合會(Conference Board)最近進行的一項調查中,高達98%的受訪首席執行官表示,他們正在為2023年美國陷入經濟衰退做準備。

最終,通貨膨脹加劇了人們對經濟衰退的擔憂,還促使美聯儲(Federal Reserve)持續加息,給企業利潤帶來威脅,并在過去一年中推動股市進入熊市。人們看到了通脹最終見頂的一線希望,但2023年的格言仍然是謹慎。

盡管如此,普通投資者可能只感受到了痛苦,投資專業人士卻發現了機會。帕納瑟斯投資公司(Parnassus Investments)的研究主管兼投資組合經理洛里·基思稱,2023年的投資“真正關乎質量”——換句話說,我們投資的公司“不僅能夠經受住更嚴重、更持久的衰退(如果這種情況發生的話),而且當最終看到美聯儲加息策略逆轉時,還可以主動出擊”。

對業余投資者和專業投資者而言,發現這些優質股票可能需要改變心態。詹森投資管理公司(Jensen Investment Management)的董事總經理兼投資組合經理埃里克·索恩斯坦說,他在評估股票時一直在調整自己的思路,更加關注利潤率而非收入增長。鑒于俄烏沖突和持續的高通脹,以及未來可能會有更多輪加息,“我認為現在的環境不容易實現頂線增長,(而且)這種情況將持續一段時間。”他表示。

在這一背景下,《財富》雜志邀請五位頂級投資組合經理,為2023年挑選最佳投資股票。這些股票的范圍很廣,從防御性大宗商品到押注新興市場。但這里列出的許多公司擁有幾項共同的超能力,這些能力應該能夠幫助它們平穩度過來年,包括產生大量經常性收入的商業模式、強勁的資產負債表,以及定價權,這應該有助于它們將不斷上升的成本轉嫁給客戶,而不會嚴重影響其利潤。在這些公司中,科技公司并不是很多:當利率高企時,科技公司的短期前景往往會受到影響。盡管如此,在投資者深呼吸,為新的一年做準備,并等待最終反彈之際,這些公司應該會提供穩定的增長和利潤率。

“粘性”服務,穩定收益

如果2023年出現經濟衰退,基金經理們認為,那些具有“粘性”產品和服務的企業(這些產品往往可以保持客戶忠誠度),會表現良好,并為投資者帶來穩定的收入來源。

Republic Services公司是基思多年來的最愛,該公司是美國第二大廢品管理公司。基思認為,鑒于其市場份額,在艱難時期,該公司“能夠提供相應程度的防御能力”。她還指出,該公司有“非常可觀的經常性、年金型收入”:事實上,該公司約80%的收入來自這種經常性來源:為商業和住宅客戶提供“關鍵業務”服務。Republic Services公司的客戶保留率接近95%,其合同(通常長達數年)包括根據通脹自動進行價格調整條款,允許公司在成本上升時提高價格。基思還稱贊了該公司的資本配置戰略,并強調了收購案例,比如它最近收購了另一家廢品管理公司US Ecology。預計該股未來12個月的市盈率約為28倍,股價不見得便宜。但分析人士預計,Republic Services公司在2023年的收益增長將超過10%,這在增長放緩的環境下是相當不錯的增幅。基思指出,該公司在短期經濟衰退中應該更有抵御能力,因為它的許多合同期限較長,無法修改。

奧的斯國際集團(Otis Worldwide)是一家電梯設備制造商,雖然它“并不屬于非常光鮮亮麗的行業”,但在基思看來,“就可以持續產生利潤和現金流來說,它是一家非常優秀的企業”。奧的斯國際集團是全球電梯行業的龍頭企業,2021年的收入超過140億美元,其業務分為新設備銷售和現有電梯的服務和升級。基思指出,商業樓宇中有很多老化的電梯系統需要更換,所以“擺在我們面前的是相當不錯的更換周期。”與此同時,服務和維護為奧的斯國際集團提供了經常性收入,使其收益更加可預測。雖然該公司受到大宗商品成本和美元走強帶來的不利影響,但基思相信,該公司能夠實現收益穩步增長。奧的斯國際集團派發的股息率接近1.5%,今年迄今為止已經回購了價值7億美元的股票。雖然預計2023年奧的斯國際集團的收入不會大幅增長,但華爾街預計奧的斯國際集團明年的每股收益將大幅增長12%。該公司股票的預期市盈率約為24倍,基思認為投資者可以在這個“非常寬廣的護城河”上搭上順風船,但愿如此。

追求穩定并不需要犧牲增長。詹森投資管理公司的索恩斯坦仍然認為,微軟(Microsoft)能夠滿足投資者的這兩種要求。微軟也被列入了我們的2022年應該買入股票的名單。索恩斯坦指出:“因為它以商業為中心,對他們來說,與其說是收入增長,不如說是商業客戶持續需要他們的服務。除非大規模出現業務問題,否則微軟的服務仍將有相當強勁的需求。”這包括這家科技巨頭的企業辦公和生產力軟件,以及其強大的云計算部門;他指出,這些服務“實際上是在讓各大公司提高效率,可以在經濟衰退時期幫助各大公司”。微軟2022財年于今年6月結束,營收略低于2,000億美元。分析師預計,在截至2023年6月的財年,微軟營收將增長約7%,下一財年將增長14%。這雖然低于該公司過去五年15%左右的平均增長率,但在經濟低迷的背景下,這仍然是一個不錯的增速。微軟的預期市盈率約為25倍,也遠沒有一些成長型科技同行那么貴。

帕納瑟斯投資公司的基思認為,西斯科公司(Sysco)也屬于“抗衰退的范疇”。西斯科公司是世界上最大的食品分銷商,為餐廳、酒店和醫院等提供服務。基思指出,該公司得益于在美國擁有“非常可觀的市場份額”,在該細分領域約占17%。行業領導地位在很多方面都對公司大有裨益:“西斯科公司在技術和員工方面進行了投資,并且有能力為客戶提供高效服務。”基思說,這有助于他們獲得更多的市場份額。她還指出,該公司過往都能夠安然度過經濟衰退期,并指出該公司還度過了2008年的金融危機:“有充分的理由表明,該公司可以經受住再一輪的經濟低迷。”盡管經濟衰退通常會促使消費者減少在餐館的消費,但基思指出,由于人口結構和消費習慣的變化,如果2023年出現經濟衰退,消費者可能就會繼續外出就餐。如果明年通脹確實開始明顯降溫,西斯科公司也會因為降低燃料和其他開支而受益。分析師預計,在截至2023年6月的財年中,該公司每股收益將大幅增長53%;該股未來12個月的市盈率為20倍,屬于合理估值區間,股息率為2.3%。

典型的抗衰退期股票

在經濟困難時期,回歸你熟悉的領域能夠獲得安慰,也是一種謹慎的選擇。一些基金經理建議這樣做,他們推薦那些在經濟衰退和經濟放緩環境下表現良好的行業股票。

折扣零售巨頭TJX是埃里克·索恩斯坦長期以來的最愛,TJX旗下的門店包括T.J. Maxx和Marshalls。TJX屬于索恩斯坦所說的“尋寶”商店的范疇,精打細算的顧客會在這些商店里尋找特價商品。他指出:“在經濟衰退時期,消費者更傾向于購買廉價商品。”如果2023年像一些首席執行官擔心的那樣低迷,這對TJX來說應該就是一件好事情。該公司從全價百貨商店購買一些無法出售的庫存。索恩斯坦認為,如果出現經濟衰退,TJX應該就可以獲得更多的過剩庫存進行打折銷售。晨星公司(Morningstar)的分析師扎因·阿克巴里也持同樣觀點,他在最近的一份報告中寫道:“在經濟前景不穩定的情況下,消費者更看重價值,我們認為TJX處于有利地位。”華爾街預計TJX明年的每股收益將增長約11%,到2024年將增長近一倍。該股的預期市盈率為23倍,股息率為1.5%。

對于那些擔心2023年可能出現經濟衰退的投資者來說,索恩斯坦推薦久經考驗的寶潔公司(Procter & Gamble),他認為這是“在經濟衰退期間應該相當暢銷的典型必需消費品”。他指出,這家消費品巨頭的業務重點是“個人護理、美容、家庭護理、織物護理和嬰兒護理”。“這些產品的消費需求是不會中斷的。”索恩斯坦說,即使經濟不景氣和通脹居高不下促使消費者在貨架上尋找更便宜的品牌,寶潔公司的產品系列中仍然有一些低價品牌。

作為標準普爾500指數(S&P 500)的大公司(其市值遠遠超過3,000億美元),寶潔公司受到了市場整體拋售的打擊;今年以來,該公司股價下跌了13%以上,基準指數也是如此。但索恩斯坦表示,該公司仍然“表現出強勁、有彈性、有機的收入增長”;在他看來,這是一大有利因素,能夠抵消匯率問題對寶潔業務造成的沖擊,因為美元相對于全球其他貨幣大幅升值。預計寶潔公司明年的利潤和收入增長都將放緩,但索恩斯坦強調,寶潔公司2.5%的股息率加強了其對投資者的吸引力。他說,如果該公司實現了預期的增長,那么“隨著其他一切發展都在放緩,該公司將更有機會在投資者心目中脫穎而出。”

聯博有限公司(AllianceBernstein)負責美國集中增長的首席投資官詹姆斯·蒂爾尼看好碩騰公司(Zoetis),該公司為寵物和牲畜生產藥品和疫苗。蒂爾尼指出:“動物保健相關產品始終是你需要購買的產品,不管經濟是否陷入衰退。”該股遇到了一些阻力,包括匯率問題,因為其相當大的一部分業務在美國以外;供給限制;以及在診所工作的獸醫短缺。這些因素促使碩騰公司下調了今年的銷售預期,其股價在2022年下跌了近40%。但蒂爾尼稱,公司的資產負債表“堅如磐石”,并相信獸醫短缺等問題將在明年得到改善。碩騰公司的首席執行官克里斯汀·派克在最近的財報電話會議上表示,她很樂觀,該公司擁有藥品供應渠道、市場主導地位和財務實力,將在動物保健市場“繼續領跑”。碩騰公司預計今年將實現近80億美元的營收,分析師預計該公司2023年的利潤增長將超過8%,而收入增長將超過6%。

不管經濟是否陷入衰退,如果你的車需要修理,你就得去修理它。這就是為什么帕納瑟斯投資公司的基思喜歡汽車零部件零售商O’Reilly Automotive公司。基思指出,在經濟困難時期,“司機們會繼續駕駛舊車,進行更多的維修,而不是購買新車”,這一趨勢應該會讓O’Reilly Automotive公司受益。她對該公司強勁的現金流和資產負債表表示贊賞,并表示該公司在經濟衰退時通常表現良好。在第三季度財報表現強勁的背景下,華爾街分析師上調了O’Reilly Automotive公司的目標股價。在第三季度財報中,該公司表現優于預期,并上調了全年收益預期。華爾街估計,該公司明年的每股收益將增長12%以上,遠快于他們對該公司2022年6%的預期。與此同時,O’Reilly Automotive公司股票在未來一年的預期市盈率為23倍左右。

押注新興市場

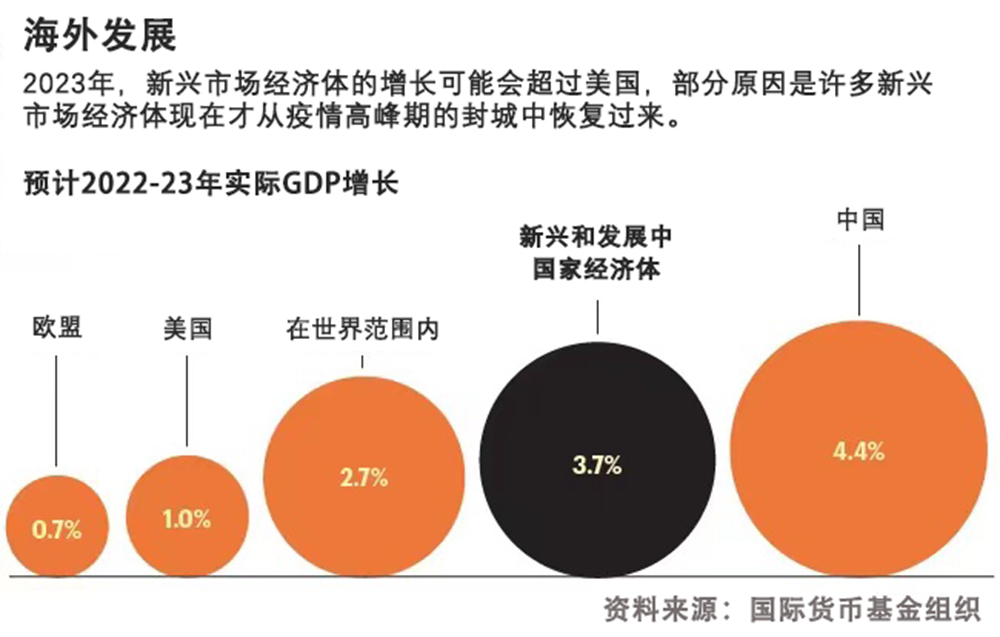

瑞萬通博的拉米茲·切拉特表示,投資者可能會驚訝地發現,一些新興市場在2023年將“相當有彈性”,特別是印度和巴西,在進入明年后,這兩個國家的經濟表現可能超過美國等市場,同時還有降息的空間。切拉特說,明年,在這些國家和其他國家,諸如此類的因素可能會讓新興市場某些領域的增長看起來比發達國家市場的增長更有吸引力。

出于這些原因,切拉特青睞總部位于荷蘭的全球知名啤酒制造商喜力啤酒(Heineken)。切拉特表示,該公司在巴西和東南亞有著深遠的影響力,隨著后疫情時代這些地區加速重新開放,“將出現收入增長”。他認為,從結構上看,這些市場的情況在2023年及以后“應該會比美國更好”。切拉特指出,盡管該公司最近一個季度的收益較弱,喜力啤酒仍然保持著強大的定價能力,同時實現了高單位數的有機銷量增長。分析人士估計,喜力啤酒下一個日歷年的營收增幅在8%左右,每股收益增幅約為7%。到2023年,該股預期市盈率有望達到17倍(目前約為14倍),屬于合理估值區間。

在印度對稅收和破產法進行系統性改革之后,切拉特尤其看好印度。據估計,印度明年的GDP增速將在5%左右,雖然低于2022年的增速,但可能會超過美國和許多其他國家。切拉特認為,印度是一個抵押貸款和消費信貸方面有望實現增長的市場。這種信念反映在他對HDFC銀行(HDFC Bank)的熱情上,瑞萬通博長期持有HDFC銀行的股份,他表示,HDFC銀行仍然在“搶占其核心領域的市場份額,尤其是抵押貸款領域”。隨著該公司完成與印度領先的住房金融公司之一的合并,這一業務有望變得更加強大。切拉特表示,合并后將可以“通過更廣泛的分支網絡銷售抵押貸款,并利用HDFC銀行的存款優勢。”分析師對此持樂觀態度,他們預計截至2024年3月的財年將實現近21%的營收增長(分析師預計截至明年3月的當前財年營收將超過140億美元),而同期每股收益可能增長約17%。HDFC銀行股票未來12個月的預期市盈率約為19倍,是《財富》雜志榜單上價格較低的股票之一,對那些愿意押注新興市場的投資者來說,這可能是一個不錯的切入點。

對于那些對東南亞的消費需求有信心的人而言,聯博有限公司負責全球集中增長的聯席首席信息官戴夫·查克拉巴蒂推薦總部位于菲律賓的Universal Robina公司。這是一家生產零食、杯面和飲料的必需消費品公司,產品出口到印度尼西亞和越南等國家;2021年,它的收入達到24億美元。查克拉巴蒂認為,制造業轉移到中國以外帶來的好處正在東南亞市場凸顯;他預計,不斷增長的青年人口和不斷增加的收入將結合在一起,成為“品牌消費品需求的主要驅動力”。這應該都有利于Universal Robina的發展,查克拉巴蒂表示,該公司利用新冠疫情期間供應鏈中斷降低了成本,使公司能夠從后疫情時代的亞洲重新開放中獲利。盡管成本上升給該公司的利潤率帶來了壓力,但該公司最近公布的第三季度銷售增長強勁,查克拉巴蒂預計該公司將通過提價來抵消通脹。分析人士預計,Universal Robina今年的盈利將會縮水,但他們預計,該公司2023年的利潤增長將超過15%,而收入增長將在7%左右。與此同時,該股的價格也處于歷史低位:交易價格比五年來的高點低30%,也低于同期的平均市盈率。摩根大通(J.P. Morgan)的分析師認為,該股是一個“被低估的優質食品股”。這可能為投資者提供一種相對廉價的押注東南亞消費者的方式。

****

專家推薦

Republic Services公司(股票代碼:RSG,134美元)

奧的斯國際集團(股票代碼:OTIS,78美元)

微軟公司(股票代碼:MSFT,241美元)

西斯科公司(股票代碼:SYY,85美元)

TJX(股票代碼:TJX,78美元)

寶潔公司(股票代碼:PG,143美元)

碩騰公司(股票代碼:ZTS,146美元)

O’Reilly Automotive公司(股票代碼:ORLY,838美元)

喜力啤酒(股票代碼:OTC:HEINY,45美元)

HDFC銀行(股票代碼:HDB,68美元)

Universal Robina公司(股票代碼:PSE:URC,2美元)

股價截至2022年11月18日。

****

《財富》雜志的表現如何

引用一位同事的話:哎呀。我們相信,我們2022年推選的“收益更穩定的股票”可以抵御通貨膨脹。但房價和利率的上漲速度遠遠超過我們的預期,過去12個月,我們所選股票的跌幅中值為41%。以下是事情發生的經過。——Matt Heimer

疲軟的大型科技公司

科技巨頭遠未達到瀕臨滅絕的狀態。但它們在新冠疫情封城居家辦公和居家購物時代實現的增長是不可持續的——事實證明,我們所選的微軟、亞馬遜和賽富時(Salesforce)一年前的股價估值也是不可持續的。它們分別損失了29%、49%和51%。

芯片公司遭受沖擊

很少有公司能夠像芯片制造商臺積電(Taiwan Semiconductor Manufacturing Co.)那樣占據行業主導地位,在截至2022年1月的五年里,該公司股價幾乎增加了四倍。今年,地緣政治緊張局勢和對經濟衰退的擔憂使其黯淡無光;其股東在過去一年中損失了32%,而標準普爾500指數僅損失了14%。

穩定增長類股票

我們投資組合中唯一表現優異的股票是必需消費品股,當經濟衰退的擔憂逼近時,這些股票通常表現良好。這些股票包括雀巢(Nestlé)、強生公司(Johnson & Johnson),還有薯片制造商百事公司(PepsiCo),菲多利公司(Frito-Lay)的所有者。百事可樂是我們的最佳選擇,總回報率為14%。(財富中文網)

本文另一版本登載于《財富》雜志2022年12月/2023年1月刊,標題是《2023年要堅持的11只股票:看跌時期的看漲前景》(11 stocks to stick with for 2023: Bullish prospects in bearish times)。這篇文章的部分內容之前曾經于2022年10月13日在Fortune.com網上發布,標題為《現在投資哪里:2023年最好買的8只股票》(Where to invest now: The 8 best stocks to buy for 2023)。

譯者:中慧言-王芳

如果說2021年的投資主題是新冠疫情之后的反彈,而2022年的主題是應對通脹,那么應該把2023年看作是投資者為經濟低迷全力以赴的一年。瑞萬通博(Vontobel)的高質量增長板塊(Quality Growth Boutique)的投資組合經理拉米茲·切拉特說:“誠然,我們陷入經濟衰退的可能性增加了。”事實上,在世界大型企業聯合會(Conference Board)最近進行的一項調查中,高達98%的受訪首席執行官表示,他們正在為2023年美國陷入經濟衰退做準備。

最終,通貨膨脹加劇了人們對經濟衰退的擔憂,還促使美聯儲(Federal Reserve)持續加息,給企業利潤帶來威脅,并在過去一年中推動股市進入熊市。人們看到了通脹最終見頂的一線希望,但2023年的格言仍然是謹慎。

盡管如此,普通投資者可能只感受到了痛苦,投資專業人士卻發現了機會。帕納瑟斯投資公司(Parnassus Investments)的研究主管兼投資組合經理洛里·基思稱,2023年的投資“真正關乎質量”——換句話說,我們投資的公司“不僅能夠經受住更嚴重、更持久的衰退(如果這種情況發生的話),而且當最終看到美聯儲加息策略逆轉時,還可以主動出擊”。

對業余投資者和專業投資者而言,發現這些優質股票可能需要改變心態。詹森投資管理公司(Jensen Investment Management)的董事總經理兼投資組合經理埃里克·索恩斯坦說,他在評估股票時一直在調整自己的思路,更加關注利潤率而非收入增長。鑒于俄烏沖突和持續的高通脹,以及未來可能會有更多輪加息,“我認為現在的環境不容易實現頂線增長,(而且)這種情況將持續一段時間。”他表示。

在這一背景下,《財富》雜志邀請五位頂級投資組合經理,為2023年挑選最佳投資股票。這些股票的范圍很廣,從防御性大宗商品到押注新興市場。但這里列出的許多公司擁有幾項共同的超能力,這些能力應該能夠幫助它們平穩度過來年,包括產生大量經常性收入的商業模式、強勁的資產負債表,以及定價權,這應該有助于它們將不斷上升的成本轉嫁給客戶,而不會嚴重影響其利潤。在這些公司中,科技公司并不是很多:當利率高企時,科技公司的短期前景往往會受到影響。盡管如此,在投資者深呼吸,為新的一年做準備,并等待最終反彈之際,這些公司應該會提供穩定的增長和利潤率。

“粘性”服務,穩定收益

如果2023年出現經濟衰退,基金經理們認為,那些具有“粘性”產品和服務的企業(這些產品往往可以保持客戶忠誠度),會表現良好,并為投資者帶來穩定的收入來源。

Republic Services公司是基思多年來的最愛,該公司是美國第二大廢品管理公司。基思認為,鑒于其市場份額,在艱難時期,該公司“能夠提供相應程度的防御能力”。她還指出,該公司有“非常可觀的經常性、年金型收入”:事實上,該公司約80%的收入來自這種經常性來源:為商業和住宅客戶提供“關鍵業務”服務。Republic Services公司的客戶保留率接近95%,其合同(通常長達數年)包括根據通脹自動進行價格調整條款,允許公司在成本上升時提高價格。基思還稱贊了該公司的資本配置戰略,并強調了收購案例,比如它最近收購了另一家廢品管理公司US Ecology。預計該股未來12個月的市盈率約為28倍,股價不見得便宜。但分析人士預計,Republic Services公司在2023年的收益增長將超過10%,這在增長放緩的環境下是相當不錯的增幅。基思指出,該公司在短期經濟衰退中應該更有抵御能力,因為它的許多合同期限較長,無法修改。

奧的斯國際集團(Otis Worldwide)是一家電梯設備制造商,雖然它“并不屬于非常光鮮亮麗的行業”,但在基思看來,“就可以持續產生利潤和現金流來說,它是一家非常優秀的企業”。奧的斯國際集團是全球電梯行業的龍頭企業,2021年的收入超過140億美元,其業務分為新設備銷售和現有電梯的服務和升級。基思指出,商業樓宇中有很多老化的電梯系統需要更換,所以“擺在我們面前的是相當不錯的更換周期。”與此同時,服務和維護為奧的斯國際集團提供了經常性收入,使其收益更加可預測。雖然該公司受到大宗商品成本和美元走強帶來的不利影響,但基思相信,該公司能夠實現收益穩步增長。奧的斯國際集團派發的股息率接近1.5%,今年迄今為止已經回購了價值7億美元的股票。雖然預計2023年奧的斯國際集團的收入不會大幅增長,但華爾街預計奧的斯國際集團明年的每股收益將大幅增長12%。該公司股票的預期市盈率約為24倍,基思認為投資者可以在這個“非常寬廣的護城河”上搭上順風船,但愿如此。

追求穩定并不需要犧牲增長。詹森投資管理公司的索恩斯坦仍然認為,微軟(Microsoft)能夠滿足投資者的這兩種要求。微軟也被列入了我們的2022年應該買入股票的名單。索恩斯坦指出:“因為它以商業為中心,對他們來說,與其說是收入增長,不如說是商業客戶持續需要他們的服務。除非大規模出現業務問題,否則微軟的服務仍將有相當強勁的需求。”這包括這家科技巨頭的企業辦公和生產力軟件,以及其強大的云計算部門;他指出,這些服務“實際上是在讓各大公司提高效率,可以在經濟衰退時期幫助各大公司”。微軟2022財年于今年6月結束,營收略低于2,000億美元。分析師預計,在截至2023年6月的財年,微軟營收將增長約7%,下一財年將增長14%。這雖然低于該公司過去五年15%左右的平均增長率,但在經濟低迷的背景下,這仍然是一個不錯的增速。微軟的預期市盈率約為25倍,也遠沒有一些成長型科技同行那么貴。

帕納瑟斯投資公司的基思認為,西斯科公司(Sysco)也屬于“抗衰退的范疇”。西斯科公司是世界上最大的食品分銷商,為餐廳、酒店和醫院等提供服務。基思指出,該公司得益于在美國擁有“非常可觀的市場份額”,在該細分領域約占17%。行業領導地位在很多方面都對公司大有裨益:“西斯科公司在技術和員工方面進行了投資,并且有能力為客戶提供高效服務。”基思說,這有助于他們獲得更多的市場份額。她還指出,該公司過往都能夠安然度過經濟衰退期,并指出該公司還度過了2008年的金融危機:“有充分的理由表明,該公司可以經受住再一輪的經濟低迷。”盡管經濟衰退通常會促使消費者減少在餐館的消費,但基思指出,由于人口結構和消費習慣的變化,如果2023年出現經濟衰退,消費者可能就會繼續外出就餐。如果明年通脹確實開始明顯降溫,西斯科公司也會因為降低燃料和其他開支而受益。分析師預計,在截至2023年6月的財年中,該公司每股收益將大幅增長53%;該股未來12個月的市盈率為20倍,屬于合理估值區間,股息率為2.3%。

典型的抗衰退期股票

在經濟困難時期,回歸你熟悉的領域能夠獲得安慰,也是一種謹慎的選擇。一些基金經理建議這樣做,他們推薦那些在經濟衰退和經濟放緩環境下表現良好的行業股票。

折扣零售巨頭TJX是埃里克·索恩斯坦長期以來的最愛,TJX旗下的門店包括T.J. Maxx和Marshalls。TJX屬于索恩斯坦所說的“尋寶”商店的范疇,精打細算的顧客會在這些商店里尋找特價商品。他指出:“在經濟衰退時期,消費者更傾向于購買廉價商品。”如果2023年像一些首席執行官擔心的那樣低迷,這對TJX來說應該就是一件好事情。該公司從全價百貨商店購買一些無法出售的庫存。索恩斯坦認為,如果出現經濟衰退,TJX應該就可以獲得更多的過剩庫存進行打折銷售。晨星公司(Morningstar)的分析師扎因·阿克巴里也持同樣觀點,他在最近的一份報告中寫道:“在經濟前景不穩定的情況下,消費者更看重價值,我們認為TJX處于有利地位。”華爾街預計TJX明年的每股收益將增長約11%,到2024年將增長近一倍。該股的預期市盈率為23倍,股息率為1.5%。

對于那些擔心2023年可能出現經濟衰退的投資者來說,索恩斯坦推薦久經考驗的寶潔公司(Procter & Gamble),他認為這是“在經濟衰退期間應該相當暢銷的典型必需消費品”。他指出,這家消費品巨頭的業務重點是“個人護理、美容、家庭護理、織物護理和嬰兒護理”。“這些產品的消費需求是不會中斷的。”索恩斯坦說,即使經濟不景氣和通脹居高不下促使消費者在貨架上尋找更便宜的品牌,寶潔公司的產品系列中仍然有一些低價品牌。

作為標準普爾500指數(S&P 500)的大公司(其市值遠遠超過3,000億美元),寶潔公司受到了市場整體拋售的打擊;今年以來,該公司股價下跌了13%以上,基準指數也是如此。但索恩斯坦表示,該公司仍然“表現出強勁、有彈性、有機的收入增長”;在他看來,這是一大有利因素,能夠抵消匯率問題對寶潔業務造成的沖擊,因為美元相對于全球其他貨幣大幅升值。預計寶潔公司明年的利潤和收入增長都將放緩,但索恩斯坦強調,寶潔公司2.5%的股息率加強了其對投資者的吸引力。他說,如果該公司實現了預期的增長,那么“隨著其他一切發展都在放緩,該公司將更有機會在投資者心目中脫穎而出。”

聯博有限公司(AllianceBernstein)負責美國集中增長的首席投資官詹姆斯·蒂爾尼看好碩騰公司(Zoetis),該公司為寵物和牲畜生產藥品和疫苗。蒂爾尼指出:“動物保健相關產品始終是你需要購買的產品,不管經濟是否陷入衰退。”該股遇到了一些阻力,包括匯率問題,因為其相當大的一部分業務在美國以外;供給限制;以及在診所工作的獸醫短缺。這些因素促使碩騰公司下調了今年的銷售預期,其股價在2022年下跌了近40%。但蒂爾尼稱,公司的資產負債表“堅如磐石”,并相信獸醫短缺等問題將在明年得到改善。碩騰公司的首席執行官克里斯汀·派克在最近的財報電話會議上表示,她很樂觀,該公司擁有藥品供應渠道、市場主導地位和財務實力,將在動物保健市場“繼續領跑”。碩騰公司預計今年將實現近80億美元的營收,分析師預計該公司2023年的利潤增長將超過8%,而收入增長將超過6%。

不管經濟是否陷入衰退,如果你的車需要修理,你就得去修理它。這就是為什么帕納瑟斯投資公司的基思喜歡汽車零部件零售商O’Reilly Automotive公司。基思指出,在經濟困難時期,“司機們會繼續駕駛舊車,進行更多的維修,而不是購買新車”,這一趨勢應該會讓O’Reilly Automotive公司受益。她對該公司強勁的現金流和資產負債表表示贊賞,并表示該公司在經濟衰退時通常表現良好。在第三季度財報表現強勁的背景下,華爾街分析師上調了O’Reilly Automotive公司的目標股價。在第三季度財報中,該公司表現優于預期,并上調了全年收益預期。華爾街估計,該公司明年的每股收益將增長12%以上,遠快于他們對該公司2022年6%的預期。與此同時,O’Reilly Automotive公司股票在未來一年的預期市盈率為23倍左右。

押注新興市場

瑞萬通博的拉米茲·切拉特表示,投資者可能會驚訝地發現,一些新興市場在2023年將“相當有彈性”,特別是印度和巴西,在進入明年后,這兩個國家的經濟表現可能超過美國等市場,同時還有降息的空間。切拉特說,明年,在這些國家和其他國家,諸如此類的因素可能會讓新興市場某些領域的增長看起來比發達國家市場的增長更有吸引力。

出于這些原因,切拉特青睞總部位于荷蘭的全球知名啤酒制造商喜力啤酒(Heineken)。切拉特表示,該公司在巴西和東南亞有著深遠的影響力,隨著后疫情時代這些地區加速重新開放,“將出現收入增長”。他認為,從結構上看,這些市場的情況在2023年及以后“應該會比美國更好”。切拉特指出,盡管該公司最近一個季度的收益較弱,喜力啤酒仍然保持著強大的定價能力,同時實現了高單位數的有機銷量增長。分析人士估計,喜力啤酒下一個日歷年的營收增幅在8%左右,每股收益增幅約為7%。到2023年,該股預期市盈率有望達到17倍(目前約為14倍),屬于合理估值區間。

在印度對稅收和破產法進行系統性改革之后,切拉特尤其看好印度。據估計,印度明年的GDP增速將在5%左右,雖然低于2022年的增速,但可能會超過美國和許多其他國家。切拉特認為,印度是一個抵押貸款和消費信貸方面有望實現增長的市場。這種信念反映在他對HDFC銀行(HDFC Bank)的熱情上,瑞萬通博長期持有HDFC銀行的股份,他表示,HDFC銀行仍然在“搶占其核心領域的市場份額,尤其是抵押貸款領域”。隨著該公司完成與印度領先的住房金融公司之一的合并,這一業務有望變得更加強大。切拉特表示,合并后將可以“通過更廣泛的分支網絡銷售抵押貸款,并利用HDFC銀行的存款優勢。”分析師對此持樂觀態度,他們預計截至2024年3月的財年將實現近21%的營收增長(分析師預計截至明年3月的當前財年營收將超過140億美元),而同期每股收益可能增長約17%。HDFC銀行股票未來12個月的預期市盈率約為19倍,是《財富》雜志榜單上價格較低的股票之一,對那些愿意押注新興市場的投資者來說,這可能是一個不錯的切入點。

對于那些對東南亞的消費需求有信心的人而言,聯博有限公司負責全球集中增長的聯席首席信息官戴夫·查克拉巴蒂推薦總部位于菲律賓的Universal Robina公司。這是一家生產零食、杯面和飲料的必需消費品公司,產品出口到印度尼西亞和越南等國家;2021年,它的收入達到24億美元。查克拉巴蒂認為,制造業轉移到中國以外帶來的好處正在東南亞市場凸顯;他預計,不斷增長的青年人口和不斷增加的收入將結合在一起,成為“品牌消費品需求的主要驅動力”。這應該都有利于Universal Robina的發展,查克拉巴蒂表示,該公司利用新冠疫情期間供應鏈中斷降低了成本,使公司能夠從后疫情時代的亞洲重新開放中獲利。盡管成本上升給該公司的利潤率帶來了壓力,但該公司最近公布的第三季度銷售增長強勁,查克拉巴蒂預計該公司將通過提價來抵消通脹。分析人士預計,Universal Robina今年的盈利將會縮水,但他們預計,該公司2023年的利潤增長將超過15%,而收入增長將在7%左右。與此同時,該股的價格也處于歷史低位:交易價格比五年來的高點低30%,也低于同期的平均市盈率。摩根大通(J.P. Morgan)的分析師認為,該股是一個“被低估的優質食品股”。這可能為投資者提供一種相對廉價的押注東南亞消費者的方式。

****

專家推薦

Republic Services公司(股票代碼:RSG,134美元)

奧的斯國際集團(股票代碼:OTIS,78美元)

微軟公司(股票代碼:MSFT,241美元)

西斯科公司(股票代碼:SYY,85美元)

TJX(股票代碼:TJX,78美元)

寶潔公司(股票代碼:PG,143美元)

碩騰公司(股票代碼:ZTS,146美元)

O’Reilly Automotive公司(股票代碼:ORLY,838美元)

喜力啤酒(股票代碼:OTC:HEINY,45美元)

HDFC銀行(股票代碼:HDB,68美元)

Universal Robina公司(股票代碼:PSE:URC,2美元)

股價截至2022年11月18日。

****

《財富》雜志的表現如何

引用一位同事的話:哎呀。我們相信,我們2022年推選的“收益更穩定的股票”可以抵御通貨膨脹。但房價和利率的上漲速度遠遠超過我們的預期,過去12個月,我們所選股票的跌幅中值為41%。以下是事情發生的經過。——Matt Heimer

疲軟的大型科技公司

科技巨頭遠未達到瀕臨滅絕的狀態。但它們在新冠疫情封城居家辦公和居家購物時代實現的增長是不可持續的——事實證明,我們所選的微軟、亞馬遜和賽富時(Salesforce)一年前的股價估值也是不可持續的。它們分別損失了29%、49%和51%。

芯片公司遭受沖擊

很少有公司能夠像芯片制造商臺積電(Taiwan Semiconductor Manufacturing Co.)那樣占據行業主導地位,在截至2022年1月的五年里,該公司股價幾乎增加了四倍。今年,地緣政治緊張局勢和對經濟衰退的擔憂使其黯淡無光;其股東在過去一年中損失了32%,而標準普爾500指數僅損失了14%。

穩定增長類股票

我們投資組合中唯一表現優異的股票是必需消費品股,當經濟衰退的擔憂逼近時,這些股票通常表現良好。這些股票包括雀巢(Nestlé)、強生公司(Johnson & Johnson),還有薯片制造商百事公司(PepsiCo),菲多利公司(Frito-Lay)的所有者。百事可樂是我們的最佳選擇,總回報率為14%。(財富中文網)

本文另一版本登載于《財富》雜志2022年12月/2023年1月刊,標題是《2023年要堅持的11只股票:看跌時期的看漲前景》(11 stocks to stick with for 2023: Bullish prospects in bearish times)。這篇文章的部分內容之前曾經于2022年10月13日在Fortune.com網上發布,標題為《現在投資哪里:2023年最好買的8只股票》(Where to invest now: The 8 best stocks to buy for 2023)。

譯者:中慧言-王芳

If the investment theme for 2021 was the post-COVID rebound, and the theme for 2022 was bracing for inflation, think of 2023 as the year investors should buckle up for a downturn. “Certainly the odds have increased that we’re heading into a recession,” says Ramiz Chelat, a portfolio manager for Vontobel’s Quality Growth Boutique. In fact, a whopping 98% of CEOs polled in a recent survey by the Conference Board said they were preparing for a recession in the U.S. in the next year.

The engine driving those recession fears, ultimately, is inflation—which in turn has launched the Federal Reserve on a campaign of interest rate hikes that has threatened corporate profits and helped drive the stock markets into bear territory over the past year. There are glimmers of hope that inflation may finally be peaking, but the watchword for 2023 remains caution.

Still, where regular investors may just see pain, investing pros see opportunity. Investing in 2023 is “really about quality,” says Lori Keith, director of research and portfolio manager at Parnassus Investments—in other words, owning companies “that not only can weather a deeper, more prolonged recession, should we see that, but also [are] able to participate when we do finally see a reversal” of the Fed’s rising-rate strategy.

Spotting those quality stocks may involve a change in mindset, for amateurs and pros alike. Eric Schoenstein, a managing director and portfolio manager at Jensen Investment Management, says he’s been tweaking his thinking when evaluating stocks, focusing more on profit margins than revenue growth. With war in Ukraine and persistently high inflation, and likely more rate hikes ahead, “I don’t think this is an environment where top-line growth is as easy to achieve, [and] that’s going to be with us for a period of time,” he says.

With that backdrop in mind, Fortune asked five top portfolio managers for their best stock picks for 2023. The stocks run the gamut from defensive staples to bets on emerging markets. But many of the companies listed here have a few superpowers in common that should help them navigate the coming year, including business models that generate lots of recurring revenue; strong balance sheets; and pricing power that should help them pass rising costs through to customers without severely denting their profits. You won’t find as many tech companies in the bunch: Their near-term prospects tend to suffer when interest rates are high. Still, the companies here should provide stable growth and profit margins as investors prepare for—deep breath—a new year, and wait for an eventual rebound.

“Sticky” services, steady earnings

If a recession is in the cards for 2023, money managers believe that businesses with “sticky” products and services—offerings that tend to generate and retain customer loyalty—will deliver steady revenue streams and perform well for investors.

A favorite of Keith’s for years, Republic Services is the second-largest waste management company in the U.S. Keith argues that in rough times it “provides that degree of defensiveness,” given its market share. She also notes that the company has a “very significant amount of recurring, annuity-type revenue”: In fact, about 80% of its revenue comes from such recurring sources, through services that are “mission critical” to commercial and residential customers alike. Republic has a nearly 95% customer retention rate, and its contracts—which often span multiple years—include inflation escalators that allow the company to increase prices as it deals with higher costs. Keith also applauds the company’s capital-allocation strategy and highlights acquisitions, like its recent purchase of US Ecology, another waste management firm. Trading at around 28 times its estimated earnings for the next 12 months, the stock isn’t necessarily cheap. But analysts project that Republic can grow earnings by over 10% in 2023—a decent clip in a slower growth environment. And the company should be more insulated in a short-term recession, Keith notes, since many of its contracts are of longer duration and can’t be modified.

Otis Worldwide is an elevator equipment manufacturer that, though not in “exactly a super glamorous industry,” is what Keith considers a “very good business in terms of being able to generate consistent profits and cash flow.” Otis is the leading firm in the elevator industry worldwide, with over $14 billion in revenue in 2021, and its business is split between new equipment sales and servicing and upgrades of existing elevators. There are a lot of aging elevator systems that need to be replaced in commercial buildings, Keith notes, so there’s a “nice replacement cycle in front of us.” Service and maintenance, meanwhile, provide recurring revenue for Otis and make its earnings more predictable. While the company has been hurt by commodity costs and unfavorable exchange rates driven by the strong dollar, Keith believes it can keep steadily growing earnings. Otis also doles out a nearly 1.5% dividend yield, and year to date has repurchased $700 million worth in shares. Although revenues aren’t expected to go gangbusters in 2023, the Street expects Otis to increase earnings per share by a hefty 12% next year. Its shares trade at around 24 times estimated forward earnings, and Keith believes investors can take a ride—hopefully, upward—on this “very wide-moat business.”

Seeking steadiness doesn’t require sacrificing growth. Jensen’s Schoenstein still believes Microsoft, which was also featured on our stocks to buy for 2022 list, could provide investors with both. “Because it’s commercially focused, it’s not so much about the economy growing for them as it is about their business customers continuing to need their services,” Schoenstein points out. “Unless you have large-scale business failures, Microsoft’s services are still going to be in pretty strong demand.” That includes the tech titan’s enterprise office and productivity software as well as its powerhouse cloud unit; those offerings “are actually allowing companies to be more efficient, which helps them in recessionary times,” he notes. Microsoft ended its 2022 fiscal year in June with just shy of $200 billion in revenue, and analysts project it can grow revenues by about 7% in the fiscal year ending June 2023, and 14% the following fiscal year. That would be below the company’s average of around 15% or so in the past five years, but it still represents a decent pace, given the lackluster economic backdrop. With its shares trading at about 25 times forward earnings, Microsoft also doesn’t come nearly as expensive as some of its growthy tech peers.

Parnassus’s Keith believes that Sysco also fits into the “recession-proof bucket.” Sysco is the world’s largest food distributor, servicing the likes of restaurants, hotels, and hospitals. Keith notes that the company has benefited from having “very significant market share” in the U.S., at about 17% of the fragmented field. That leadership position helps the company on many fronts: “Sysco is investing in their business in terms of technology, in terms of their employees, [and] having the ability to service customers more efficiently,” Keith says, which should help them gain even more market share. She also points to the firm’s track record for surviving downturns well, noting that it navigated the 2008 financial crisis deftly: “There’s a really strong case here that the company can weather additional downturns.” Although recessions often prompt consumers to spend less money at restaurants, Keith notes that owing to changes in demographics and spending habits, consumers will likely continue eating out if the economy slumps in 2023. And if inflation does begin to meaningfully cool next year, that should also help Sysco by lowering its costs for fuel and other expenses. Analysts expect the company to post a whopping 53% earnings per share growth in the fiscal year ending June 2023; the stock trades at a reasonable 20 times the next 12 months’ earnings, with a 2.3% dividend yield.

Classic recession stocks

In difficult times, it can be comforting—and prudent—to return to what you know. And some money managers suggest doing just that, recommending stocks in industries that historically hold up well in recessions and lower-growth environments.

TJX, the off-price retailing giant whose stores include T.J. Maxx and Marshalls, is a longtime favorite of Eric Schoenstein’s. TJX falls into the category of what Schoenstein calls “treasure hunt” stores, where budget-conscious customers search for deals. He points out that there’s a “good track record of strong consumer trade-down spending in recessionary periods,” which should be a boon for TJX if 2023 is as glum as some CEOs fear. The company buys some of its inventory from full-price department stores that can’t sell it—and Schoenstein believes that if there is a recession, TJX should be able to get more of that discounted overstock. Morningstar analyst Zain Akbari is of the same mind, writing in a recent note that “with consumers increasingly looking for value amid an unsettled economic landscape, we believe TJX is well positioned.” The Street expects TJX to increase earnings per share by about 11% next year and to almost double that in 2024. The stock trades at 23 times forward earnings and comes with a 1.5% dividend yield.

For investors who are really wringing their hands about the possibility of a 2023 recession, Schoenstein recommends tried-and-true Procter & Gamble, what he considers “your classic consumer staple that ought to be pretty good during a recession.” The consumer goods titan’s business focuses on “personal care, grooming, home care, fabric care, baby care,” he notes. “People don’t stop spending on those things.” And even if tougher times and sticky inflation prompt consumers to look for the cheaper brand on the shelf, Schoenstein says, P&G has some lower-price brands within its family of products.

As a large holding in the S&P 500 (it has a market cap of well over $300 billion), P&G has been hit by the overall selloff in the market; its share price has declined over 13% so far this year, as has the benchmark index. But Schoenstein says the company is still “showing strong, resilient, organic revenue growth”; from his perspective, that’s an upside that offsets hits to P&G’s business that have been driven by currency issues, with the U.S. dollar having soared compared with other global currencies. Both earnings and revenue growth are expected to be muted next year, but Schoenstein highlights P&G’s 2.5% dividend yield as something that strengthens its case for investors. If the company posts the anticipated growth, he says, it “will have a better opportunity to stand out in investors’ minds as everything else slows.”

James Tierney, chief investment officer of concentrated U.S. growth at AllianceBernstein, favors Zoetis, which makes medicines and vaccines for pets and livestock. “Animal health is going to be something that you need year in, year out, whether you have a recession or not,” Tierney notes. The stock has encountered some headwinds, including exchange rate issues, since a sizable portion of its business is outside the U.S.; supply constraints; and a shortage of veterinarians working in clinics. These factors have prompted Zoetis to lower sales guidance for the year, and its stock is down nearly 40% in 2022. But Tierney says the company’s balance sheet is “ironclad,” and believes that issues like vet supply will correct themselves next year. CEO Kristin Peck said on Zoetis’s recent earnings call that she’s optimistic the firm has the drug pipeline, market dominance, and financial fortitude to “continue outpacing” growth in the animal health market. Zoetis is expected to bring in nearly $8 billion in revenue this year, and analysts estimate the company can grow earnings by over 8% in 2023, while revenues could grow more than 6%.

Recession or not, if your car needs to be fixed, you’re going to fix it. That’s why Parnassus’s Keith likes O’Reilly Automotive, the auto-parts retailer. In tougher economic times, Keith notes, “drivers hold on to their cars for longer [and] look to do more repairs versus purchasing new cars,” a trend that should benefit O’Reilly. She applauds the company’s strong cash flow generation and sturdy balance sheet, and says it has typically performed well in recessions. On the back of a strong third-quarter earnings report, during which the company beat estimates and raised earnings guidance for the full year, analysts across Wall Street upped their price target for O’Reilly. And the Street estimates the company can grow earnings per share by over 12% next year, a hearty clip faster than the 6% they expect for 2022. O’Reilly’s stock, meanwhile, is expected to trade around 23 times forward earnings in the coming year.

Emerging-market bets

Ramiz Chelat of Vontobel says investors may be surprised to find that some emerging markets will be “quite resilient” in 2023—in particular India and Brazil, whose economies could outperform markets like the U.S. heading into next year while at the same time having room to cut interest rates. Factors like these, in those and other countries, could make emerging-market growth look more appealing than developed-market growth in certain areas next year, Chelat argues.

For those reasons among others, Chelat likes Heineken, the globally known brewer based in the Netherlands. Chelat says the company has a strong presence in Brazil and Southeast Asia, “which are seeing improving growth” as they accelerate their post-COVID pandemic reopening. He believes those markets structurally “should be in better shape in 2023 and beyond” than the U.S. Chelat notes that despite weaker earnings in the most recent quarter, Heineken has maintained strong pricing power, while generating organic volume growth in the upper single digits. Analysts estimate that Heineken can grow revenue in the 8% range and earnings per share by about 7% for the next calendar year. In 2023, the stock is expected to trade at a reasonable 17 times forward earnings (it’s currently trading at around 14).

Chelat is particularly bullish on India in the wake of systemic reforms of the country’s tax and bankruptcy laws. India’s GDP is estimated to grow at around 5% next year, a rate which, while slower than in 2022, will likely outpace that of the U.S. and many other countries. Chelat argues that India is a market that’s poised for growth in mortgages and consumer credit. That belief is reflected in his enthusiasm for HDFC Bank, a longtime holding of Vontobel’s, which he says is still “taking market share in its core segments, in mortgages in particular.” That business is only expected to get stronger as the company completes its merger with one of India’s leading housing finance firms. Chelat says the combined network will be able “to sell mortgages across a much wider branch network and leverage HDFC Bank’s deposit strength.” Analysts are optimistic, predicting nearly 21% revenue growth for the fiscal year ending in March 2024 (for the current fiscal year, ending next March, analysts estimate it will bring in over $14 billion in revenue), while earnings per share could grow roughly 17% in the same time frame. Trading at around 19 times the next 12 months’ estimated earnings, HDFC’s stock is among the cheaper picks on Fortune’s list—a potentially nice entry point for investors willing to bet on emerging markets.

For those who have faith in consumer demand in Southeast Asia, AllianceBernstein’s co-CIO of concentrated global growth Dev Chakrabarti recommends Philippines-based Universal Robina. It’s a consumer staples company that makes snacks, cup noodles, and beverages, exporting its wares to countries like Indonesia and Vietnam; it brought in $2.4 billion in revenue in 2021. Chakrabarti believes that Southeast Asian markets are seeing the benefit of manufacturing moving outside of China; he expects that a growing youth demographic and rising incomes will combine to “be a key driver of demand for branded consumer goods.” That should all benefit Universal Robina, which Chakrabarti says has taken advantage of the pandemic’s disruptions to improve its costs, poising the company to profit from Asia’s post-COVID reopening. Though higher costs have put pressure on the company’s margins, it recently reported strong sales growth in its third quarter, and Chakrabarti expects it will be able to push through price increases to offset inflation. Analysts expect Universal Robina’s earnings to shrink this year, but they estimate the company can deliver over 15% earnings growth in 2023 while growing revenues at around 7%. The stock, meanwhile, comes historically cheap: It’s trading 30% below its five-year high as well as below its average price-to-earnings ratio for that period. J.P. Morgan analysts consider the stock an “underappreciated high-quality staples name.” That could offer investors an inexpensive way to bet on the Southeast Asian consumer.

*****

Picks from the experts

Republic Services (RSG, $134)

Otis Worldwide (OTIS, $78)

Microsoft (MSFT, $241)

Sysco (SYY, $85)

TJX (TJX, $78)

Procter & Gamble (PG, $143)

Zoetis (ZTS, $146)

O’Reilly Automotive (ORLY, $838)

Heineken (OTC:HEINY, $45)

HDFC Bank (HDB, $68)

Universal Robina (PSE:URC, $2)

Prices as of 11/18/22

*****

How Fortune did

To quote a colleague: Oof. We believed our “Stocks for Smoother Sailing” for 2022 would withstand inflation. But prices and interest rates rose far faster than we expected, and our picks lost a median of 41% over the past 12 months. Here’s how it went down.—Matt Heimer

Big Tech, tamed

Tech giants are hardly teetering on the verge of extinction. But the growth they saw in the COVID work-and-shop-from-home lockdown era wasn’t sustainable—nor, it turns out, were the share valuations that our picks Microsoft, Amazon, and Salesforce were commanding a year ago. They racked up losses of 29%, 49%, and 51%, respectively.

Chip shot

Few companies dominate their industry like chipmaker Taiwan Semiconductor Manufacturing Co., and in the five years through January 2022, its stock nearly quintupled. This year, the combination of geopolitical tensions and recession fears dimmed its luster; its shareholders lost 32% over the past year, while the S&P 500 lost just 14%.

Comfort stocks

Our portfolio’s only outperformers were consumer staples stocks, which often do well when recession fears loom. Those included Nestlé, Johnson & Johnson, and—speaking of chipmakers—PepsiCo, owner of Frito-Lay. Pepsi was our best pick, with a 14% total return.

A version of this article appears in the December 2022/January 2023 issue of Fortune with the headline, “11 stocks to stick with for 2023: Bullish prospects in bearish times.” Parts of this article were previously published online on Oct. 13, 2022, under the title, “Where to invest now: The 8 best stocks to buy for 2023.”