2020年3月,在美國首次祭出“居家令”時,project44的首席執行官及創始人杰特·麥坎德利斯已經在家儲備了足夠三個月之用的食物和水。

這種“未雨綢繆”的習慣他已經堅持了幾年時間,作為浸淫供應鏈和物流行業多年的資深專業人士,他早就十分清楚:全球供應鏈的運行體系陳舊不堪,只要有一個環節出現問題,整個供應鏈就都會受到嚴重沖擊。而隨著新冠疫情的爆發,公眾也將很快發現這一問題。

麥坎德利斯在接受《財富》雜志采訪時說:“我很清楚,供應鏈比人們想象的要脆弱得多,只要蘇伊士運河通航受阻或者出現大規模疫情,貨架很快就會被一搶而空。這個世界并不存在‘取用不盡’的神奇倉庫。”

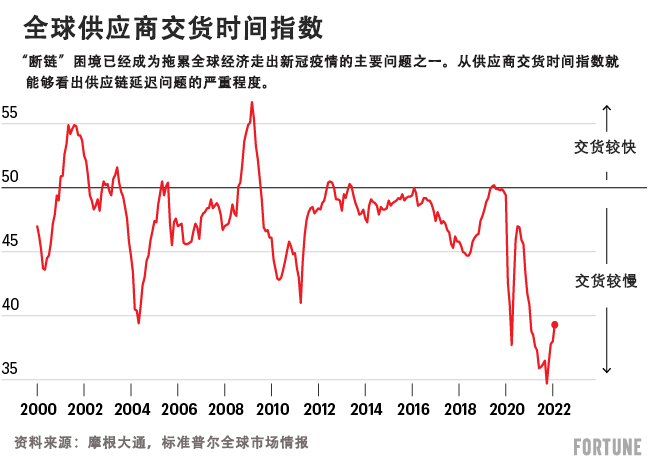

新冠疫情爆發后,工廠停工、邊境關閉,消費習慣也出現變化,而這還僅僅是最初幾個月的情況。過去兩年,包括勞動力短缺、封控、抗議示威和戰爭在內,各種災難接連不斷,全球商品流動也因之受到干擾。此外,據世界氣象組織(World Meteorological Organization)公布的數據顯示,過去50年間,天氣相關災害的發生頻率增加了5倍之多,這表明,類似2021年因為中國臺灣地區干旱而引發半導體供應短缺的情況將會越來越頻繁。這些都會對全球供應鏈的可持續性造成額外壓力,各界人士對該問題的關注度也因此日益提高。

據研究咨詢公司Gartner和相關行業專家提供的數據顯示,在供應鏈的實時可見性和預測性分析領域,project44已經成為行業領頭羊。過去一段時間,project44的成長勢頭極為迅猛,2021年5月,在完成一輪2.02億美元的融資之后,該公司的估值達到12億美元,正式躋身“獨角獸”行列。今年1月,該公司再獲由TPG、Thoma Bravo和高盛集團(Goldman Sachs)領投的最新一輪2.4億美元融資,估值進一步躍升至24億美元。2021年年底,project44的年度經常性收入達到1億美元,較2021年5月的5000萬美元再上新臺階。

project44的總部位于美國芝加哥,可以為貨物提供實時動態更新與跟蹤服務,同時還能夠提供預計到達時間等預測性信息,其追蹤的貨物遍及170多個國家,涉及的貨值高達數十億美元。通過使用近期獲得的融資收購其他企業,該公司在既有網絡的基礎之上進一步擴大了業務覆蓋范圍,得以更為全面的掌握全球商品流動情況。此外,該公司還著眼可持續發展,于2021年推出一款全新工具,可以幫助企業更好地跟蹤自己供應鏈的溫室氣體排放情況及(對環境造成的)其他影響。

企業韌性快速提升

在新冠疫情爆發之前,供應鏈管理者已經開始進行戰略轉型。新冠疫情的突然爆發對整個供應鏈體系構成嚴重沖擊,加之而后又出現許多其他變故導致“斷鏈”問題時有發生,供應鏈管理者進一步加快了轉型腳步。

今年3月,中國深圳的工廠因為新冠疫情爆發而停工停產;“永進”號(曾經堵塞蘇伊士運河的“長賜”號貨輪的姊妹船)在美國的切薩皮克灣擱淺;而俄烏沖突又攪亂了石油、天然氣、小麥等核心商品的物流運輸。

眼見供應鏈問題接二連三上演,各家企業也被迫做出調整。為提高自身網絡的端到端監控速度、靈活性和嚴密性,相關企業紛紛開始投資新技術,并將全新系統應用到自己的業務流程之中。在提升業務運作效率的同時,這些進步也為企業開拓創新、提高環境、社會與治理方面的合規追蹤水平創造了可能。

此外,“斷鏈”日益頻繁也促使更多的企業開始展開合作,使得像project44這樣的供應鏈可見性平臺得以實現更快發展,并為客戶提供更加可靠、更為全面的數據。

供應鏈專家認為,當前的情況與2008年金融危機后的金融技術進步頗有相似之處。

供應鏈經理意識到,要想維持業務正常運轉,他們需要能夠更快地作出決定和調整,而project44自新冠疫情爆發伊始就在對業務成長和擴張進行投資。2021年,隨著各界對供應鏈越發關注以及大量風險資本的涌入,該公司向新運輸行業擴張的速度大幅提高,其在供應鏈上所覆蓋的業務面也顯著增加。

貨運行業數據與新聞運營公司FreightWaves的首席執行官及創始人克雷格·富勒稱:“過去有許多公司因為解決了支付問題和資金轉賬與處理問題而大獲成功。”FreightWaves的主要產品是Sonar(貨運數據與預測網站),其中整合了project44的海運跟蹤數據,過去兩年,該網站實現了“創紀錄增長”。

“如今,如何解決產品運輸問題以及如何跟蹤、理解這些產品正在成為經濟發展的核心問題,相關領域的投資也在提速。未來,可以解決相關問題的企業將會脫穎而出,并成為最終贏家。”

供應鏈跟蹤高度依賴電子數據交換這種已經沿用半個多世紀的陳舊技術,雖然借助該種技術,通信雙方能夠傳輸大量信息,但這種方式也存在明顯缺點,那就是滯后極為嚴重。此外,在目前的供應鏈管理中,管理者習慣于監控與直接供應商和直接客戶相關的操作,對二級供應商、消費者和其他供應商則會視而不見。

Project44的服務建立在應用程序接口(API)之上。所謂API是一種軟件“中介”,在其支持之下,兩個應用程序可以實現同步通信,并且能夠更輕松地與其他系統進行集成。2014年誕生后,Project44從服務北美卡車運輸行業起家,目前依舊逐步將業務擴張到更多的地區和更多的運輸行業。

在新冠疫情爆發后,麥坎德利斯通過擴大員工隊伍、并購其他企業擴大了企業的業務覆蓋范圍,隨后又通過一系列戰略性或偶然性的舉措進一步加快了企業的發展速度。

2021年3月4日,project 44宣布收購海洋貨運監控服務商Ocean Insights。19天后,“長賜”號貨輪在蘇伊士運河擱淺,導致這條重要海上通道堵塞超過一個星期之久。今年9月,在許多公司尚未對物流的“最后一公里”給予足夠重視之時,該公司已經率先布局,收購了專營此業務的Convoy公司。

密歇根州立大學(Michigan State University)的供應鏈管理和運營教授史蒂文·梅爾尼克說:“如今的消費者已經習慣于在收貨前知曉準確的送達日期(這在某種程度上要歸功于亞馬遜等企業)。消費者并不關心企業是否遇到了供應鏈問題,而是會預期自己訂購的產品可以準時送達。如今,‘最后一公里’已經成為戰略性要素,并會對整個公司的競爭方式產生影響。”

麥坎德利斯表示,在該公司目前涉足較少的地區(包括亞洲),project44將繼續進行業務拓展,并設法為客戶提供更多選擇,幫助客戶更為全面、詳實地了解商品如何從港口到配送中心、再從商店到家門口實現全球運輸的整個過程。

談及project44在既有的物流網絡中融入“最后一公里”的追蹤能力時,麥坎德利斯指出:“現在我們已經具備了監控整個供應鏈的能力,能夠看到上游變化會對終端消費者產生何種影響,這在以前絕無可能。現在,整個商品世界的運轉情況都在我們的掌握之中。”

2021年5月,project 44又將專門利用人工智能技術提升倉儲與出貨管理水平的公司——ClearMetal收入麾下。

隨著業務網絡日益擴大,Project44也被推到了供應鏈實時可見性平臺的前沿位置,并于2021年促成了多項全新合作。截至2021年9月,已經有超過680家全球性貨運企業和物流服務提供商加入該公司平臺,使其成為全球最大的單一平臺貨運網絡。

除與FreightWaves旗下的Sonar合作之外,project44還是谷歌云(Google Cloud)旗下的Supply Chain Twin的合作伙伴,后者相當于企業供應鏈的數字化表現,其中既包含客戶的專有數據,也包含來自私人及公共來源的數據。在Supply Chain Twin收集私營企業的數據的過程中,Project44將為其提供供應鏈實時跟蹤工具。

隨著各家企業在共享供應鏈信息方面不斷加強合作,供應鏈的可見性和韌性也日漸增強。

谷歌云負責供應鏈與物流解決方案的董事總經理漢斯·塔爾鮑爾稱:“由于各種干擾因素一次次地打斷供應鏈的正常運轉,人們越發認識到,如果彼此之間可以分享信息,則大家就都將從中受益,在此背景之下,各家企業的合作越發緊密,分享信息的意愿也日漸增強。”

承諾改善可持續性

供應鏈管理新浪潮為企業提供了處理并監控環境、社會和治理優先事項的新工具,政府法規也在增加企業承擔的責任,確保供應鏈可持續性且符合道德。此外,管理者也在采取更全面的方法檢查供應鏈的健康狀況,加入了彈性和可持續性以及價格等因素。

“這是綜合性底線方法,考慮的遠不只是成本。”美國杜肯大學(Duquesne University)的商業管理教授羅伯特·斯勞夫說道。“我一直跟供應鏈提供商、服務提供商合作,經常有不同的公司對他們表示:‘如果愿意公布二氧化碳數據,就能夠向你提供更多的業務。’”

2021年,英國政府通過了一項法律,如果公司供應鏈中的產品原料涉及非法砍伐森林,就要征收罰款。歐盟(European Union)正在制定規則,要求企業負責降低供應鏈中的溫室氣體排放,并監督強迫勞動現象。

發現這一需求不斷增長后,project44跟行業其他公司同步推出了跟蹤供應鏈對環境影響的服務。

“去年夏天的歐洲會議上,10個客戶里大概有8個都在談可持續性。”麥坎德利斯表示。“他們都知道供應鏈是碳足跡的重要因素,但無法衡量。”

美國也在采取行動加強監測,今年3月21日,美國證券交易委員會(SEC)推出新規,要求所有上市公司披露面臨氣候變化風險的數據。

“因此,現在企業面臨的風險是,如果不了解供應鏈具體情況,最后可能就會造成損失。”伍斯特理工學院商學院(Worcester Polytechnic Institute Business School)的管理學教授約瑟夫·薩爾基斯說。

薩爾基斯等供應鏈研究者一致認為,想獲得關于特定包裝或產品的碳足跡和其他影響的可靠數據,前路還很漫長。

盡管如此,project44預測到新冠疫情爆發時需求增加,并加大力度實現對端到端實時供應鏈可見的設想,如今已經成為先前被忽視的行業中明顯的領先者。根據網站PitchBook的數據,2021年前三個季度,供應鏈技術初創企業募集資金超過240億美元,比2020年全年總額還多58%。

迄今為止,project44已經募集到8.175億美元,至于2021年10月的Gartner報告中提到唯一的另一家“實時供應鏈可見性平臺”領先公司FourKites,2021年5月在最新一輪融資中共募集到2.005億美元。

FourKites完成最新一輪融資后并未披露新估值。兩家公司都聲稱客戶超過1000家,project44客戶群主要包括零售商、制造商、分銷商和物流服務提供商。同時,FourKites的總部也在美國芝加哥,成立于2014年,主要服務食品飲料、消費品、化工、制造、紙張包裝、制藥和零售行業大型企業。在新冠疫情期間,兩家公司都擴大了業務范圍,不過project44已經擴張到全球17個國家,員工達1200人。FourKites的全球辦事處有6家,即將新設兩處,員工約600人。

Project44以44號公路(Highway 44)命名,也是66號公路(Route 66)的第一條主要支線。成立以來不斷進入新市場,今年2月宣布在日本開設新辦事處,最新一輪融資后計劃2022年在產品和工程方面的投資大概翻一番。

麥坎德利斯設想有一天,企業和消費者都能夠基于可持續性做出明智的決策,根據綜合環境影響對單個產品打分。

他說:“比如買餅干的時候,一種5美元,一種5.50美元,但可以看到5.50美元的餅干碳足跡少得多,因為包裝上有碳排放分數……我希望我們的消費者能夠說:‘我熱愛地球,所以愿意多付50美分。’”(財富中文網)

譯者:梁宇

審校:夏林

2020年3月,在美國首次祭出“居家令”時,project44的首席執行官及創始人杰特·麥坎德利斯已經在家儲備了足夠三個月之用的食物和水。

這種“未雨綢繆”的習慣他已經堅持了幾年時間,作為浸淫供應鏈和物流行業多年的資深專業人士,他早就十分清楚:全球供應鏈的運行體系陳舊不堪,只要有一個環節出現問題,整個供應鏈就都會受到嚴重沖擊。而隨著新冠疫情的爆發,公眾也將很快發現這一問題。

麥坎德利斯在接受《財富》雜志采訪時說:“我很清楚,供應鏈比人們想象的要脆弱得多,只要蘇伊士運河通航受阻或者出現大規模疫情,貨架很快就會被一搶而空。這個世界并不存在‘取用不盡’的神奇倉庫。”

新冠疫情爆發后,工廠停工、邊境關閉,消費習慣也出現變化,而這還僅僅是最初幾個月的情況。過去兩年,包括勞動力短缺、封控、抗議示威和戰爭在內,各種災難接連不斷,全球商品流動也因之受到干擾。此外,據世界氣象組織(World Meteorological Organization)公布的數據顯示,過去50年間,天氣相關災害的發生頻率增加了5倍之多,這表明,類似2021年因為中國臺灣地區干旱而引發半導體供應短缺的情況將會越來越頻繁。這些都會對全球供應鏈的可持續性造成額外壓力,各界人士對該問題的關注度也因此日益提高。

據研究咨詢公司Gartner和相關行業專家提供的數據顯示,在供應鏈的實時可見性和預測性分析領域,project44已經成為行業領頭羊。過去一段時間,project44的成長勢頭極為迅猛,2021年5月,在完成一輪2.02億美元的融資之后,該公司的估值達到12億美元,正式躋身“獨角獸”行列。今年1月,該公司再獲由TPG、Thoma Bravo和高盛集團(Goldman Sachs)領投的最新一輪2.4億美元融資,估值進一步躍升至24億美元。2021年年底,project44的年度經常性收入達到1億美元,較2021年5月的5000萬美元再上新臺階。

project44的總部位于美國芝加哥,可以為貨物提供實時動態更新與跟蹤服務,同時還能夠提供預計到達時間等預測性信息,其追蹤的貨物遍及170多個國家,涉及的貨值高達數十億美元。通過使用近期獲得的融資收購其他企業,該公司在既有網絡的基礎之上進一步擴大了業務覆蓋范圍,得以更為全面的掌握全球商品流動情況。此外,該公司還著眼可持續發展,于2021年推出一款全新工具,可以幫助企業更好地跟蹤自己供應鏈的溫室氣體排放情況及(對環境造成的)其他影響。

企業韌性快速提升

在新冠疫情爆發之前,供應鏈管理者已經開始進行戰略轉型。新冠疫情的突然爆發對整個供應鏈體系構成嚴重沖擊,加之而后又出現許多其他變故導致“斷鏈”問題時有發生,供應鏈管理者進一步加快了轉型腳步。

今年3月,中國深圳的工廠因為新冠疫情爆發而停工停產;“永進”號(曾經堵塞蘇伊士運河的“長賜”號貨輪的姊妹船)在美國的切薩皮克灣擱淺;而俄烏沖突又攪亂了石油、天然氣、小麥等核心商品的物流運輸。

眼見供應鏈問題接二連三上演,各家企業也被迫做出調整。為提高自身網絡的端到端監控速度、靈活性和嚴密性,相關企業紛紛開始投資新技術,并將全新系統應用到自己的業務流程之中。在提升業務運作效率的同時,這些進步也為企業開拓創新、提高環境、社會與治理方面的合規追蹤水平創造了可能。

此外,“斷鏈”日益頻繁也促使更多的企業開始展開合作,使得像project44這樣的供應鏈可見性平臺得以實現更快發展,并為客戶提供更加可靠、更為全面的數據。

供應鏈專家認為,當前的情況與2008年金融危機后的金融技術進步頗有相似之處。

供應鏈經理意識到,要想維持業務正常運轉,他們需要能夠更快地作出決定和調整,而project44自新冠疫情爆發伊始就在對業務成長和擴張進行投資。2021年,隨著各界對供應鏈越發關注以及大量風險資本的涌入,該公司向新運輸行業擴張的速度大幅提高,其在供應鏈上所覆蓋的業務面也顯著增加。

貨運行業數據與新聞運營公司FreightWaves的首席執行官及創始人克雷格·富勒稱:“過去有許多公司因為解決了支付問題和資金轉賬與處理問題而大獲成功。”FreightWaves的主要產品是Sonar(貨運數據與預測網站),其中整合了project44的海運跟蹤數據,過去兩年,該網站實現了“創紀錄增長”。

“如今,如何解決產品運輸問題以及如何跟蹤、理解這些產品正在成為經濟發展的核心問題,相關領域的投資也在提速。未來,可以解決相關問題的企業將會脫穎而出,并成為最終贏家。”

供應鏈跟蹤高度依賴電子數據交換這種已經沿用半個多世紀的陳舊技術,雖然借助該種技術,通信雙方能夠傳輸大量信息,但這種方式也存在明顯缺點,那就是滯后極為嚴重。此外,在目前的供應鏈管理中,管理者習慣于監控與直接供應商和直接客戶相關的操作,對二級供應商、消費者和其他供應商則會視而不見。

Project44的服務建立在應用程序接口(API)之上。所謂API是一種軟件“中介”,在其支持之下,兩個應用程序可以實現同步通信,并且能夠更輕松地與其他系統進行集成。2014年誕生后,Project44從服務北美卡車運輸行業起家,目前依舊逐步將業務擴張到更多的地區和更多的運輸行業。

在新冠疫情爆發后,麥坎德利斯通過擴大員工隊伍、并購其他企業擴大了企業的業務覆蓋范圍,隨后又通過一系列戰略性或偶然性的舉措進一步加快了企業的發展速度。

2021年3月4日,project 44宣布收購海洋貨運監控服務商Ocean Insights。19天后,“長賜”號貨輪在蘇伊士運河擱淺,導致這條重要海上通道堵塞超過一個星期之久。今年9月,在許多公司尚未對物流的“最后一公里”給予足夠重視之時,該公司已經率先布局,收購了專營此業務的Convoy公司。

密歇根州立大學(Michigan State University)的供應鏈管理和運營教授史蒂文·梅爾尼克說:“如今的消費者已經習慣于在收貨前知曉準確的送達日期(這在某種程度上要歸功于亞馬遜等企業)。消費者并不關心企業是否遇到了供應鏈問題,而是會預期自己訂購的產品可以準時送達。如今,‘最后一公里’已經成為戰略性要素,并會對整個公司的競爭方式產生影響。”

麥坎德利斯表示,在該公司目前涉足較少的地區(包括亞洲),project44將繼續進行業務拓展,并設法為客戶提供更多選擇,幫助客戶更為全面、詳實地了解商品如何從港口到配送中心、再從商店到家門口實現全球運輸的整個過程。

談及project44在既有的物流網絡中融入“最后一公里”的追蹤能力時,麥坎德利斯指出:“現在我們已經具備了監控整個供應鏈的能力,能夠看到上游變化會對終端消費者產生何種影響,這在以前絕無可能。現在,整個商品世界的運轉情況都在我們的掌握之中。”

2021年5月,project 44又將專門利用人工智能技術提升倉儲與出貨管理水平的公司——ClearMetal收入麾下。

隨著業務網絡日益擴大,Project44也被推到了供應鏈實時可見性平臺的前沿位置,并于2021年促成了多項全新合作。截至2021年9月,已經有超過680家全球性貨運企業和物流服務提供商加入該公司平臺,使其成為全球最大的單一平臺貨運網絡。

除與FreightWaves旗下的Sonar合作之外,project44還是谷歌云(Google Cloud)旗下的Supply Chain Twin的合作伙伴,后者相當于企業供應鏈的數字化表現,其中既包含客戶的專有數據,也包含來自私人及公共來源的數據。在Supply Chain Twin收集私營企業的數據的過程中,Project44將為其提供供應鏈實時跟蹤工具。

隨著各家企業在共享供應鏈信息方面不斷加強合作,供應鏈的可見性和韌性也日漸增強。

谷歌云負責供應鏈與物流解決方案的董事總經理漢斯·塔爾鮑爾稱:“由于各種干擾因素一次次地打斷供應鏈的正常運轉,人們越發認識到,如果彼此之間可以分享信息,則大家就都將從中受益,在此背景之下,各家企業的合作越發緊密,分享信息的意愿也日漸增強。”

承諾改善可持續性

供應鏈管理新浪潮為企業提供了處理并監控環境、社會和治理優先事項的新工具,政府法規也在增加企業承擔的責任,確保供應鏈可持續性且符合道德。此外,管理者也在采取更全面的方法檢查供應鏈的健康狀況,加入了彈性和可持續性以及價格等因素。

“這是綜合性底線方法,考慮的遠不只是成本。”美國杜肯大學(Duquesne University)的商業管理教授羅伯特·斯勞夫說道。“我一直跟供應鏈提供商、服務提供商合作,經常有不同的公司對他們表示:‘如果愿意公布二氧化碳數據,就能夠向你提供更多的業務。’”

2021年,英國政府通過了一項法律,如果公司供應鏈中的產品原料涉及非法砍伐森林,就要征收罰款。歐盟(European Union)正在制定規則,要求企業負責降低供應鏈中的溫室氣體排放,并監督強迫勞動現象。

發現這一需求不斷增長后,project44跟行業其他公司同步推出了跟蹤供應鏈對環境影響的服務。

“去年夏天的歐洲會議上,10個客戶里大概有8個都在談可持續性。”麥坎德利斯表示。“他們都知道供應鏈是碳足跡的重要因素,但無法衡量。”

美國也在采取行動加強監測,今年3月21日,美國證券交易委員會(SEC)推出新規,要求所有上市公司披露面臨氣候變化風險的數據。

“因此,現在企業面臨的風險是,如果不了解供應鏈具體情況,最后可能就會造成損失。”伍斯特理工學院商學院(Worcester Polytechnic Institute Business School)的管理學教授約瑟夫·薩爾基斯說。

薩爾基斯等供應鏈研究者一致認為,想獲得關于特定包裝或產品的碳足跡和其他影響的可靠數據,前路還很漫長。

盡管如此,project44預測到新冠疫情爆發時需求增加,并加大力度實現對端到端實時供應鏈可見的設想,如今已經成為先前被忽視的行業中明顯的領先者。根據網站PitchBook的數據,2021年前三個季度,供應鏈技術初創企業募集資金超過240億美元,比2020年全年總額還多58%。

迄今為止,project44已經募集到8.175億美元,至于2021年10月的Gartner報告中提到唯一的另一家“實時供應鏈可見性平臺”領先公司FourKites,2021年5月在最新一輪融資中共募集到2.005億美元。

FourKites完成最新一輪融資后并未披露新估值。兩家公司都聲稱客戶超過1000家,project44客戶群主要包括零售商、制造商、分銷商和物流服務提供商。同時,FourKites的總部也在美國芝加哥,成立于2014年,主要服務食品飲料、消費品、化工、制造、紙張包裝、制藥和零售行業大型企業。在新冠疫情期間,兩家公司都擴大了業務范圍,不過project44已經擴張到全球17個國家,員工達1200人。FourKites的全球辦事處有6家,即將新設兩處,員工約600人。

Project44以44號公路(Highway 44)命名,也是66號公路(Route 66)的第一條主要支線。成立以來不斷進入新市場,今年2月宣布在日本開設新辦事處,最新一輪融資后計劃2022年在產品和工程方面的投資大概翻一番。

麥坎德利斯設想有一天,企業和消費者都能夠基于可持續性做出明智的決策,根據綜合環境影響對單個產品打分。

他說:“比如買餅干的時候,一種5美元,一種5.50美元,但可以看到5.50美元的餅干碳足跡少得多,因為包裝上有碳排放分數……我希望我們的消費者能夠說:‘我熱愛地球,所以愿意多付50美分。’”(財富中文網)

譯者:梁宇

審校:夏林

In March 2020, when the first COVID-19 stay-at-home orders were just being introduced in the United States, project44 CEO and founder Jett McCandless already had three months of food and water stored at home.

He committed to the practice years earlier. As a seasoned supply-chain and logistics professional, he knew what the general public was about to discover: The global supply chain runs on antiquated systems and is susceptible to major disruptions if just one link is fractured.

“I know the supply chains are much more fragile than people think, and all it takes is a Suez Canal shutdown or pandemic, and shelves empty out quickly,” McCandless says in an interview with Fortune. “And there's not some magic warehouse where all this stuff is located.”

COVID-19 shuttered factories, closed borders, and shifted consumption habits, and that was just the first few months. Over the past two years various calamities have snarled the global movement of goods, including labor shortages, lockdowns, protests, and war. Moreover, over the past 50 years the weather-related disasters have increased fivefold, according to the World Meteorological Organization, suggesting in the future we’re more likely to see events like the 2021 drought in Taiwan that helped trigger the semiconductor shortage. All of this has put additional strain on and drawn attention to the sustainability of global supply chains.

For project44, which has emerged as a leader in real-time visibility and predictive analytics for supply chains according to research and consulting company Gartner and industry experts, it has fueled rapid growth, culminating in a $2.4 billion valuation as of the latest $240 million round of funding led by TPG, Thoma Bravo, and Goldman Sachs in January. It’s a jump from a $1.2 billion valuation after a $202 million round of funding completed just a year ago (May 2021) that officially tagged project44 as a unicorn. At the close of 2021, project44 hit annual recurring revenue of $100 million, after reaching $50 million ARR in May 2021.

The Chicago-based company provides real-time updates and tracking, along with predictive information such as estimated times of arrival, on billions of shipments across more than 170 countries. It has used the recent rounds of funding to acquire companies that help it develop a more complete picture of the global movement of goods, differentiating itself with the extent of its network. And the company is also targeting its tools at sustainability, launching a tool in 2021 that allows companies to better track greenhouse gas emissions and other impacts from their supply chains.

Rapid growth in resiliency

The pandemic was a shock to the system, but it hasn’t been alone in roiling the supply chain. One disruption after another has prompted supply-chain managers to expedite a shift in strategy that began prior to COVID-19.

In March 2022 factories in Shenzhen, China, closed down due to a COVID-19 outbreak; the Ever Forward, sister ship to the Ever Given that clogged the Suez Canal, ran aground in the Chesapeake Bay; and Russia’s invasion of Ukraine muddied the movement of oil, gas, wheat, and other core commodities.

The continuous supply-chain turmoil has prompted businesses to adjust. They’ve invested in new technology and adopted new systems to get information faster, be more nimble, and more closely monitor their network from end to end. Along with boosting business operations, these advancements hold promise for innovating how companies track compliance with environmental, social, and governance standards.

Additionally, the quickening pace of disruption has incentivized more businesses to collaborate, allowing supply-chain visibility platform companies like project44 to grow faster and offer more robust and comprehensive data to their clients.

Supply-chain experts liken the current moment to the advancement of financial technology following the 2008 crisis.

Supply-chain managers realized they need to be able to make decisions and adjustments faster in order to keep their operations running, and project44 from the start of the pandemic invested in growth and expansion. As more attention came to supply chains, and venture capital poured in during 2021, the company was able to greatly expedite its expansion into new modes of transportation and portions of the supply chain.

“We've seen a lot of companies become really massively successful and valuable because they helped solve the payment issues and the frustration of how you move and deal with money,” said Craig Fuller, CEO and founder of FreightWaves, a freight industry data and news operation. FreightWaves’ main product, Sonar, is a freight data and forecasting site that incorporates project44’s ocean shipment tracking and has seen “record growth” in the past two years.

“Now we’re reorienting the economy around how products move and how we track and understand them, and that is accelerating investment. And the winners that are emerging are able to solve these issues.”

Supply-chain tracking has largely relied on Electronic Data Interchange, a technology more than a half-century old that allows for the transfer of large swaths of information between two parties but suffers from long lag times. Additionally, there was a habit within supply-chain management of monitoring operations with direct suppliers and customers, while ignoring secondary suppliers, consumers, and beyond.

Project44 is based on Application Program Interface, which acts as a software intermediary allowing two applications to synchronously communicate and offers easier integration with other systems. Following its launch in 2014, project44 started with a focus on trucking in North America before branching into other regions and modes of transportation.

When the pandemic arrived, McCandless hired more staff and pursued acquisitions to expand the company’s reach. Then a series of both strategic and fortuitous moves lifted its trajectory.

On March 4, 2021, project44 announced the acquisition of Ocean Insights, an ocean freight monitoring service. Nineteen days later the Ever Given ran aground in the Suez Canal, clogging the crucial maritime thoroughfare for more than a week. In September, it acquired Convey, a specialist in last-mile delivery tracking, an area many companies previously ignored.

“Thanks in part to companies like Amazon, consumers have been conditioned to expect delivery dates will be identified in advance and will be accurate,” says Steven Melnyk, a Michigan State University professor of supply-chain management and operations. “Consumers don't care that you have a supply-chain problem, they have an expectation that what they order will arrive on time. Last-mile delivery has now become strategic and affects how the company competes.”

McCandless says project44 is continuing to expand into regions where the company has less coverage, including Asia, and finding other ways to offer clients a more expansive and detailed look at how goods are moving around the world from ports to distribution centers to shops and homes.

“Now we're able to connect that entire story and see upstream how something will be impacted all the way to the consumer’s doorstep, and this has never been possible before,” McCandless says, referring to the addition of the last-mile tracking to project44’s existing network of freight carriers. “We’re able to see how the whole world of goods is flowing.”

In May 2021 project44 also acquired ClearMetal, a company that specialized in using artificial intelligence to improve inventory and shipment management.

Project44’s network growth has pushed it to the forefront of supply-chain real-time visibility platforms, and led to several new collaborations in 2021. The company includes more than 680 global shippers and logistics service providers around the world as of September 2021, making it the largest carrier network available in a single platform.

In addition to its partnership with FreightWaves’ Sonar product, project44 is a partner with Google Cloud’s Supply Chain Twin, a digital representation of a business’s supply chain that incorporates proprietary data from the client along with data from private and public sources. Project44 will provide its real-time supply-chain tracking tools as part of the Supply Chain Twin’s collection of data provided by private companies.

The increased collaboration among companies to share supply-chain information has helped expand visibility and resiliency.

“Companies are working closer together, and companies are more willing to share information,” says Hans Thalbauer, Google Cloud managing director for supply-chain and logistics solutions. “This is because of all these disruptions, and everyone understands if I share information, then all of us are better off.”

Promise to improve sustainability

The new wave in supply-chain management provides new tools for companies to address and monitor environmental, social, and governance priorities, just as government regulations are placing more of the onus on businesses to ensure their supply chain is both sustainable and ethical. And the managers are also taking a more holistic approach to examining their supply-chain health—incorporating resiliency and sustainability along with price considerations.

“It’s an integrated bottom line approach that goes well beyond cost,” says Robert Sroufe, Duquesne University professor of business management. “I've been working with supply-chain providers, service providers, and they have different companies that come to them and say, ‘If you get us your CO2 data, we'll provide you more business.’”

The U.K. government passed a law in 2021 that levies fines on companies whose supply chains include products that come from illegally deforested land. The European Union is working on rules that would hold companies responsible for reducing greenhouse gas emissions from their supply chains and monitoring for forced labor.

Recognizing rising demand, project44, like other companies in the field, launched a service for tracking environmental impact in supply chains.

“At meetings last summer in Europe, about eight out of every 10 customers raised sustainability as a talking point,” McCandless says. “They knew the supply chain was a big contributor to their carbon footprints, but they didn't have ways to measure it.”

The United States is also moving to increase monitoring, with the SEC proposing new rules on March 21 that would require all public companies in the country to disclose data about their exposure to climate change risks.

“So the risk that companies are now facing is if they don't know what's going on in their supply chain they could lose money,” said Joseph Sarkis, professor of management at the Worcester Polytechnic Institute Business School.

Supply-chain researchers like Sarkis agree there is still a long way to go before good, reliable data is available on the carbon footprint and other impacts of a particular package or product.

Still, by forecasting increased demand at the onset of the pandemic and doubling down on its vision for end-to-end real-time supply-chain visibility, project44 has emerged as one of the clear frontrunners in a previously overlooked sector that in the first three quarters of 2021 saw supply-chain technology startups raise more than $24 billion in funding, 58% more than in all of 2020, according to PitchBook.

To date project44 has raised $817.5 million, while FourKites, the only other company labeled a leader in the field of “real-time transportation visibility platforms” in Gartner’s October 2021 report, has raised a total of $200.5 million as of its last round of funding in May 2021.

FourKites did not disclose a new valuation after that round of funding. Both companies claim to have client rosters in excess of 1,000, with project44’s customer base made up of retailers, manufacturers, distributors, and logistics service providers. Meanwhile, FourKites, also based in Chicago and launched in 2014, serves large enterprises in the food and beverage, CPG, chemicals, manufacturing, paper and packaging, pharmaceuticals, and retail industries. While both companies have expanded their reach during the pandemic, project44 has set the pace with 1,200 employees in 17 offices around the world to FourKites’ roughly 600 employees in six global offices, with two more on the way.

Project44—named after Highway 44, the first major bypass to Route 66—continues to make inroads into new markets, announcing an expansion with a new office in Japan in February, and after the latest round of funding the company plans to roughly double its investment in product and engineering in 2022.

McCandless envisions a day when both businesses and consumers will be able to make informed decisions based on sustainability, with scores for individual products based on their comprehensive environmental impact.

“So let's say that we're going to buy a biscuit, and there's one for $5 and there’s one for $5.50,” he says. “But we see the carbon footprint on the one that's $5.50 is significantly less because it actually has a carbon score…And I'm hoping that we as consumers will say, ‘I'll pay the extra 50 cents, because I like this planet Earth.’”