去年夏天,“房貸延期支付計劃”(Mortgage forbearance program)實施時,最高有超400萬美國人申請延期償還房貸。目前,參與該緊急援助項目的房主仍有約174萬人。

該計劃屬于《關懷法案》,是美國聯(lián)邦政府推出的延期償付規(guī)定,且主要面對因新冠危機遭遇困難的借款人,只要是從政府支持的房貸機構貸款,就可享受延期還貸,最長可延期360天。除了幫助房利美和房地美等聯(lián)邦機構的借款人,美國也鼓勵其他貸款機構為房主提供避免違約的解決方案。

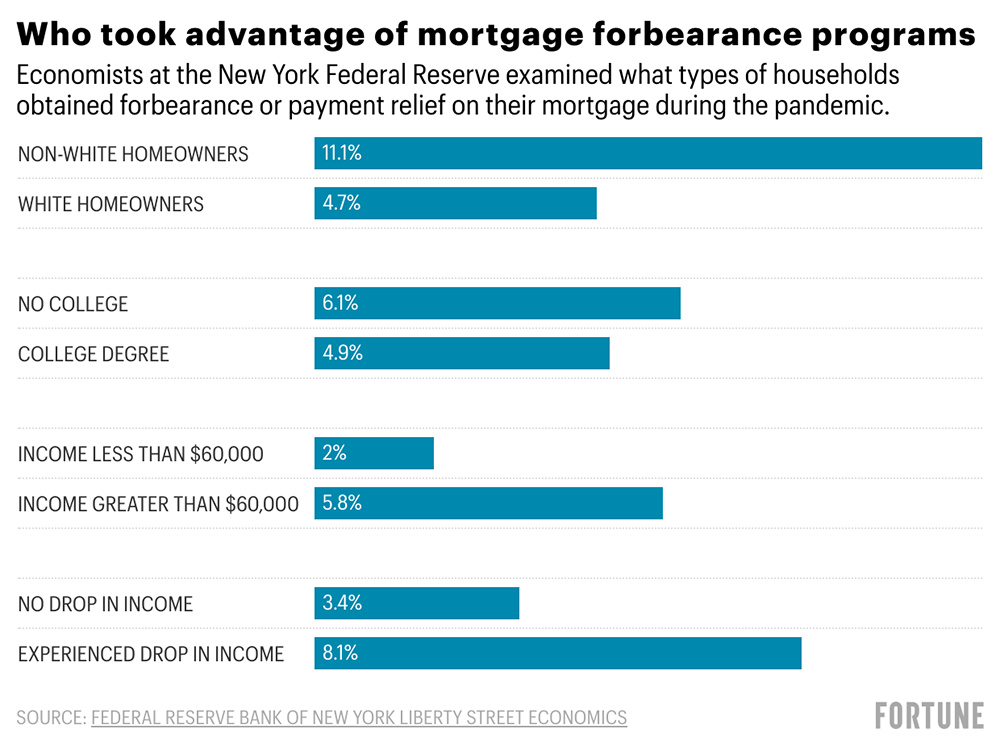

但如今回望,類似項目最大的受益者是誰?紐約聯(lián)邦儲備銀行的經(jīng)濟學家分析了2020年8月《消費者預期調查》的數(shù)據(jù)發(fā)現(xiàn),相比年收入低于6萬美元的家庭,高收入家庭實際上受益更多。

當經(jīng)濟學家詢問借款人,疫情期間是否獲得過房貸延期或還款減免時,約5.5%的受訪家庭給出了肯定答案。如果按收入細分,在年收入超過6萬美元的高收入受訪家庭中,約有5.8%表示獲得了房貸寬限,而收入低于6萬美元的家庭中僅有2%。

這一趨勢與租金、信用卡和汽車貸款援助項目不同,因為這些項目中低收入的美國人獲得幫助的可能性更大。

不過,雖然高收入家庭從房貸延期支付計劃中獲益更多,租金、信用卡和汽車貸款計劃更加普遍。調查數(shù)據(jù)顯示,約9.8%的租房者、11%的信用卡用戶和13.6%的汽車貸款借款人獲得了某種形式的還款減免。

研究人員發(fā)現(xiàn),從類似救助項目中獲益最多的通常是經(jīng)歷了失業(yè)或收入下降的家庭,與大多數(shù)項目的目標一致。

當然,隨著救濟項目結束,仍在依靠救濟項目的美國人要如何度過難關還有待觀察。比如,暫停驅逐令于2021年7月31日到期后,目前估計有1100萬租房者有可能被迫搬離。

與此同時,很多房主要面臨的現(xiàn)實是,多項聯(lián)邦房貸延期支付計劃將在今秋結束。6月美國消費者金融保護局為陷入困境的房主敲定了新保護措施,但拒絕全面禁止房屋止贖。(財富中文網(wǎng))

譯者:梁宇

審校:夏林

去年夏天,“房貸延期支付計劃”(Mortgage forbearance program)實施時,最高有超400萬美國人申請延期償還房貸。目前,參與該緊急援助項目的房主仍有約174萬人。

該計劃屬于《關懷法案》,是美國聯(lián)邦政府推出的延期償付規(guī)定,且主要面對因新冠危機遭遇困難的借款人,只要是從政府支持的房貸機構貸款,就可享受延期還貸,最長可延期360天。除了幫助房利美和房地美等聯(lián)邦機構的借款人,美國也鼓勵其他貸款機構為房主提供避免違約的解決方案。

但如今回望,類似項目最大的受益者是誰?紐約聯(lián)邦儲備銀行的經(jīng)濟學家分析了2020年8月《消費者預期調查》的數(shù)據(jù)發(fā)現(xiàn),相比年收入低于6萬美元的家庭,高收入家庭實際上受益更多。

誰從房貸延期支付計劃當中得利。紐約聯(lián)邦儲備銀行的經(jīng)濟學家對疫情期間獲得房貸延期或還款減免的家庭進行了研究。資料來源: 紐約聯(lián)邦儲備銀行自有經(jīng)濟博客

當經(jīng)濟學家詢問借款人,疫情期間是否獲得過房貸延期或還款減免時,約5.5%的受訪家庭給出了肯定答案。如果按收入細分,在年收入超過6萬美元的高收入受訪家庭中,約有5.8%表示獲得了房貸寬限,而收入低于6萬美元的家庭中僅有2%。

這一趨勢與租金、信用卡和汽車貸款援助項目不同,因為這些項目中低收入的美國人獲得幫助的可能性更大。

不過,雖然高收入家庭從房貸延期支付計劃中獲益更多,租金、信用卡和汽車貸款計劃更加普遍。調查數(shù)據(jù)顯示,約9.8%的租房者、11%的信用卡用戶和13.6%的汽車貸款借款人獲得了某種形式的還款減免。

研究人員發(fā)現(xiàn),從類似救助項目中獲益最多的通常是經(jīng)歷了失業(yè)或收入下降的家庭,與大多數(shù)項目的目標一致。

當然,隨著救濟項目結束,仍在依靠救濟項目的美國人要如何度過難關還有待觀察。比如,暫停驅逐令于2021年7月31日到期后,目前估計有1100萬租房者有可能被迫搬離。

與此同時,很多房主要面臨的現(xiàn)實是,多項聯(lián)邦房貸延期支付計劃將在今秋結束。6月美國消費者金融保護局為陷入困境的房主敲定了新保護措施,但拒絕全面禁止房屋止贖。(財富中文網(wǎng))

譯者:梁宇

審校:夏林

There are only about 1.74 million homeowners left in mortgage forbearance plans these days, down from the highs of over 4 million Americans in these emergency relief programs last summer.

As part of the CARES Act, the U.S. established a foreclosure moratorium and made borrowers with federally backed mortgages who experienced COVID-19-related hardships eligible for forbearance programs that would defer their monthly mortgage payments for up to 360 days. In addition to helping borrowers who used federal agencies like Fannie Mae and Freddie Mac, the U.S. encouraged other lenders to offer homeowners ways to avoid defaulting.

But looking back, who received the most help from these programs? New York Fed economists analyzed data from the August 2020 Survey of Consumer Expectations and found that higher-income households actually benefited in greater numbers from these programs than households with incomes of less than $60,000.

Economists asked borrowers if they obtained any type of forbearance or payment relief on their mortgage during the pandemic. About 5.5% of households surveyed responded that they had. When broken down by income, about 5.8% of higher income respondents (earning over $60,000) reported receiving forbearance, compared to just 2% of households earning less than $60,000.

This is a different trend than seen in rental, credit card, and auto loan assistance programs, in which lower-income Americans were more likely to take advantage of relief measures.

Yet while more higher-income households took advantage of the mortgage forbearance programs, rental, credit card, and auto loan programs were more popular as a whole. About 9.8% of renters, 11% of credit card users, and 13.6% of auto loan borrowers received some type of payment relief, according to the survey data analyzed.

Researchers, however, found that it was generally households that experienced job loss or decreased income who took advantage of these programs the most—in line with what most of these programs aimed to accomplish.

Of course, it remains to be seen how Americans who are still in these relief programs will fare as these programs end. The eviction moratorium, for example, was allowed to expire on July 31, 2021, meaning an estimated 11 million renters are now at risk of losing their home.

Meanwhile, many of the federal mortgage forbearance programs are set to end this fall for many homeowners. The Consumer Financial Protection Bureau issued a final rule in June that provided more protections for struggling homeowners but declined to outright ban foreclosures