當木槌敲下,聲音響徹全世界。

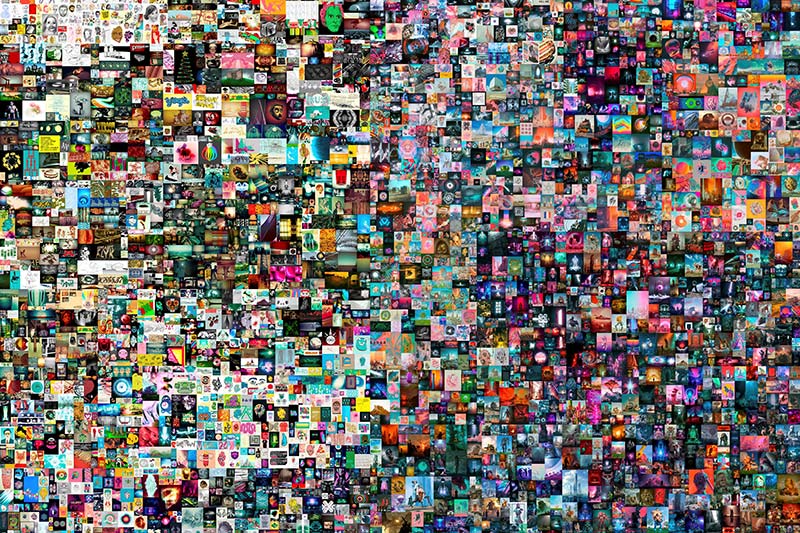

今年2月的佳士得拍賣行,邁克·溫克爾曼的一幅由電腦繪制素描畫組成的龐大拼貼畫以6930萬美元售出,引發軒然大波。這一刻,數碼收藏熱潮也沖上頂峰。

拍賣臺上的競拍品是非同質化代幣,也叫NFT,即記錄獨特虛擬商品在區塊鏈上的編碼引用,而區塊鏈正是比特幣等加密貨幣背后的分布式賬本,更常見的則是以太坊。

過去一年里,隨著加密貨幣價格飆升,NFT狂熱愈演愈烈。時而叫Beeple,時而又化名為Beeple Crap的溫克爾曼就充分體現了這種趨勢,還有其他很多的例子,都可以證明當前的爆發性繁榮。

從搖滾樂隊萊昂國王到R&B歌星威肯,多位音樂人以數百萬美元價格出售了限量版音軌。《紐約時報》的專欄作家凱文·魯斯以80多萬美元賣出了一篇評論。推特的創始人及首席執行官杰克·多爾西以290萬美元賣出了第一條推文,內容是“剛剛設置好了我的推特”。(部分人將所得捐給了慈善機構。)

顯然,人們能夠靠出售NFT賺錢。盡管自嘲“很爛”,但迄今為止,全球所謂加密藝術家里收入最高的溫克爾曼的作品已經售出1.15億美元。

與此同時,支付巨頭Visa負責加密業務的主管庫伊·謝菲爾德認為,NFT為之前的弱勢群體提供了重要的財富積累機會。

他寫道,該技術的出現“是最令人興奮的新途徑之一,可以刺激數字時代黑人社區的復興,未來十年會為全世界黑人社區創造并獲取數十億美元。”

它會是曇花一現嗎?或者只是搶錢?還是說,全世界突然迷上藝術作品加密代幣是對未來財富的一瞥?人們自然會想:投資NFT真的能夠賺錢嗎?

NFT是什么?

首先,人們應該知道自己真正買的是什么。

NFT只是對特定作品的引用,而并不是作品本身。它可以將代幣當成基于區塊鏈的真實性證書,一種代表全球條目的可交易文件。

“NFTweets”市場Cent公司的首席執行官及聯合創始人卡梅隆·赫賈齊將相關物品比作“數字簽名棒球卡,只是變成數字內容。”當然了,棒球卡本身也是虛擬的,只是一串數字和字母,是用電腦編碼代指的其他物品,它能夠是藝術品,也可以是虛擬房地產、推文,甚至是放的屁。

如果說這一切聽起來像是蒸汽一樣虛無縹緲,也不算完全錯。

Arweave是一個提供無限永久數字存儲的項目,其首席執行官及聯合創始人薩姆·威廉姆斯警告稱,如果沒有適當保護,原始藝術品就可能從互聯網上消失。已經有NFT鏈接的物品已經出現了類似的情況。

撇開技術不談,NFT從財務角度能夠被視為收藏品。顧問稱之為“另類投資”,因為無法實現標準化。專家一般不建議用此類投資當成退休主要準備。(他們傾向建議用大部分財富投資于費率較低、跟蹤指數的交易所交易基金,即ETF。)

不過,一些富裕人士還是通過收藏藝術品、名車、頂級葡萄酒和其他珍品,實現投資組合多樣化。還有人收集硬幣、棒球卡、漫畫書等。收藏者往往是為了熱愛,而不是單純追求財富。從這個意義上說,NFT之于互聯網就像現實世界中,郵票之于集郵愛好者。

無限供給

當然,收藏品并不是每件都可以成功。

多數人認為,NFT代表的一些龐大而卓越的作品將占據食物鏈的頂端,而且價值高企,下面則翻騰著無數沒有那么值錢的物品。

“從推文到動圖再到視頻,人們可能很快就會發現看似的限量版,其實是無限供應,其中只有少數才能夠經得起時間的考驗。”咨詢公司安永負責全球區塊鏈業務的保羅·布羅迪寫道。

不過從長遠來看,他相信背后的技術。他表示,想象一下高效利用NFT獲得稀缺資源,比如核磁共振成像設備、建筑設備,甚至是付款發票等,他稱該項技術是“前途光明的重要經濟基礎設施”。

“炒作可能會在短期內會退散,技術則是長期的,只要時間夠長,市場就會繼續增長。”Variant Fund的創始人杰西·沃爾登稱。Variant Fund是專注于加密的投資機構,對NFT作品特別感興趣。

事實上,市場已經出現了降溫跡象。然而真正看多加密市場的人可能會反駁說,其他人不那么感興趣,而且藝術品價格合適時就像狂熱過后的宿醉,正是投資最佳時機。

畢竟,看看比特幣和以太坊等加密貨幣的分裂市場就知道。在最近加密貨幣回升到歷史高點之前,它們就已經低位徘徊了數年。

風險與回報

即便在最精明的人看來,投資NFT充滿風險,當然也蘊含機會。但有些隱藏成本不得不考慮。

投機者要小心。由于所謂的礦工費,即以太坊網絡上的交易成本,特定的NFT交易可能比掛牌價高得多。(以太坊網絡是大多數NFT綁定的區塊鏈系統。)最后真正支付的金額可能比想象中多出數百美元。(以太坊正計劃未來升級技術以降低交易費用,而Tezos或EOS等區塊鏈以提供更便宜的交易系統而得意。)

此外,還有納稅問題。安永的加密貨幣稅務中心負責人邁克爾·邁斯勒表示,如果快速倒手NFT就得付出代價。

他說,購買后一年內出售可能要繳納短期資本利得稅,“該稅率最高可達37%。”他表示。

即便長期持有也好不了多少。因為現在大多數NFT可能歸類為收藏品,會因為長期資本收益率更高而特殊對待。像股票之類的資產稅率最高也就是20%,而“收藏品的稅率可能達到28%。”

“這方面沒有明確指導,但我觀察拍賣行出售的NFT物品實際情況時發現,美國國稅局很可能根據藝術品的定義,將其認定為收藏品。”邁斯勒指出,法律上的認定可能意味著高額稅率。這個問題很難解決。另一方面,代表虛擬房地產或其他數字商品的NFT仍然是懸而未決的問題。

“我認為,必須看看代幣,看看背后具體的數字資產,再仔細核查它們到底代表了何種利益,才可以弄清楚可能使用怎樣的稅收政策。”邁斯勒說。

回報豐厚

不過,有些人動身非常早,采取了頗具創意的方法投資這一冷門前沿領域,后來則轉為團隊運動。

網名為Twobadour Paanar的阿南德·文卡特斯瓦蘭是印度的一名加密貨幣投資者,也是Metapurse(專門收集NFT的基金)的合伙人之一。在競拍Beeple最昂貴的巨作《日常:第一個5000天》(Everydays: The First 5000 Days)之前,文卡特斯瓦蘭和昵稱為MetaKovan的搭檔維格尼什·孫達雷桑為Beeple的其他作品已經花費了數百萬美元。

隨后兩人將收入與其他數字商品捆綁在一起,例如虛擬現實游戲《Decentraland》里的虛擬房地產、美國知名DJ 3LAU制作的數字音軌等,再分拆成更多的代幣向公眾出售。

盡管在無形的戰利品上花費了大量金錢,Metapurse根據《The Beeple 20 Collection》命名的B.20代幣銷售利潤相當可觀,該作品為去年12月公司出資220萬美元購買。

基金將其分拆為1000萬枚代幣,自己保留了略超過一半,為合作者和其他人預留了約四分之一,其余則以每個0.36美元的價格向公眾出售。如今,代幣價格已經漲到5美元左右(曾經達到略超27美元的高點)。從紙面上看,已經升值1300%。

Metapurse聲稱并不期望獲得財務回報。基金在官網上宣稱:“ROI”,也就是投資回報率,并非“基金的主要驅動力”。基金還進一步聲稱,“不受靈活調整或創造財務傳承需求的影響”。

就文卡特斯瓦蘭而言,他提醒新手通過NFT賺錢“非常困難。無法經過事先準備。不是看到某個NFT就可以說:‘嗯,這個能夠賺錢,或者這個可以幫助我發財。’”

但他對有興趣的人提出建議:“收藏越兼收并蓄就越好。”

至于為何強調涉足NFT是出于熱愛而不是為了潛在的利益,可能只是戰術選擇。如果買賣NFT份額,就可能觸犯證券法,至少在美國如此。

最近,美國證券交易委員會對加密貨幣相當友好的監管者海絲特·皮爾斯警告稱,NFT的代幣化份額可能符合未注冊證券的條件,在當前指導方針下屬于非法。“要注意創造的并不是投資產品,而是證券。”她說。

應該對NFT下注嗎?

如果你自認為眼光超出常人,那么就可以考慮搭建NFT投資組合。

Coinbase的總裁艾米麗·蔡最近告訴《財富》雜志,加密貨幣行業“不適合意志薄弱之人”,當涉及NFT時,她的話可能更值得參考。

然而,人們可以嘗試把自己當成天才球探,努力尋找下一個邁克爾·喬丹,在其他人發覺他會變成巨星之前,出手買下某些精彩時刻。或者人們能夠把自己當成虛擬的土地投機者,就像網絡版的約翰·雅各布·阿斯特一樣。阿斯特是19世紀早期美國移民,因為曾經在曼哈頓島買地而暴富。

要想成功,就要眼光比其他人更敏銳,具備發現趨勢的稀有才能,還要有大把運氣。

作為初出茅廬的NFT投資者,最好默認自己運氣不好,如果能夠跟志同道合的人合作,可能運氣會好些。但無論以哪種方式,最明智的做法是僅把其當成愛好,只用閑置資金投資。

這種投資如今還處于早期階段,NFT收藏應謹慎地當成支持喜歡的藝術家的方式而不是投資,展示審美品味即可。

此外,還有條建議:不要高估自己的技能。

“NFT運動是文化復興,主要是由藝術家、創造者和游戲玩家驅動的。”Metapurse的文卡特斯瓦蘭說道。“除非你很喜歡,除非你在藝術家的世界里很舒服,否則你會發現,很難選擇支持哪種NFT產品。”

老話曾說,淘金熱時應該賣鏟子,而不是買鏟子。或許像素時代也是一樣。(財富中文網)

譯者:馮豐

審校:夏林

當木槌敲下,聲音響徹全世界。

今年2月的佳士得拍賣行,邁克·溫克爾曼的一幅由電腦繪制素描畫組成的龐大拼貼畫以6930萬美元售出,引發軒然大波。這一刻,數碼收藏熱潮也沖上頂峰。

拍賣臺上的競拍品是非同質化代幣,也叫NFT,即記錄獨特虛擬商品在區塊鏈上的編碼引用,而區塊鏈正是比特幣等加密貨幣背后的分布式賬本,更常見的則是以太坊。

過去一年里,隨著加密貨幣價格飆升,NFT狂熱愈演愈烈。時而叫Beeple,時而又化名為Beeple Crap的溫克爾曼就充分體現了這種趨勢,還有其他很多的例子,都可以證明當前的爆發性繁榮。

從搖滾樂隊萊昂國王到R&B歌星威肯,多位音樂人以數百萬美元價格出售了限量版音軌。《紐約時報》的專欄作家凱文·魯斯以80多萬美元賣出了一篇評論。推特的創始人及首席執行官杰克·多爾西以290萬美元賣出了第一條推文,內容是“剛剛設置好了我的推特”。(部分人將所得捐給了慈善機構。)

顯然,人們能夠靠出售NFT賺錢。盡管自嘲“很爛”,但迄今為止,全球所謂加密藝術家里收入最高的溫克爾曼的作品已經售出1.15億美元。

與此同時,支付巨頭Visa負責加密業務的主管庫伊·謝菲爾德認為,NFT為之前的弱勢群體提供了重要的財富積累機會。

他寫道,該技術的出現“是最令人興奮的新途徑之一,可以刺激數字時代黑人社區的復興,未來十年會為全世界黑人社區創造并獲取數十億美元。”

它會是曇花一現嗎?或者只是搶錢?還是說,全世界突然迷上藝術作品加密代幣是對未來財富的一瞥?人們自然會想:投資NFT真的能夠賺錢嗎?

NFT是什么?

首先,人們應該知道自己真正買的是什么。

NFT只是對特定作品的引用,而并不是作品本身。它可以將代幣當成基于區塊鏈的真實性證書,一種代表全球條目的可交易文件。

“NFTweets”市場Cent公司的首席執行官及聯合創始人卡梅隆·赫賈齊將相關物品比作“數字簽名棒球卡,只是變成數字內容。”當然了,棒球卡本身也是虛擬的,只是一串數字和字母,是用電腦編碼代指的其他物品,它能夠是藝術品,也可以是虛擬房地產、推文,甚至是放的屁。

如果說這一切聽起來像是蒸汽一樣虛無縹緲,也不算完全錯。

Arweave是一個提供無限永久數字存儲的項目,其首席執行官及聯合創始人薩姆·威廉姆斯警告稱,如果沒有適當保護,原始藝術品就可能從互聯網上消失。已經有NFT鏈接的物品已經出現了類似的情況。

撇開技術不談,NFT從財務角度能夠被視為收藏品。顧問稱之為“另類投資”,因為無法實現標準化。專家一般不建議用此類投資當成退休主要準備。(他們傾向建議用大部分財富投資于費率較低、跟蹤指數的交易所交易基金,即ETF。)

不過,一些富裕人士還是通過收藏藝術品、名車、頂級葡萄酒和其他珍品,實現投資組合多樣化。還有人收集硬幣、棒球卡、漫畫書等。收藏者往往是為了熱愛,而不是單純追求財富。從這個意義上說,NFT之于互聯網就像現實世界中,郵票之于集郵愛好者。

無限供給

當然,收藏品并不是每件都可以成功。

多數人認為,NFT代表的一些龐大而卓越的作品將占據食物鏈的頂端,而且價值高企,下面則翻騰著無數沒有那么值錢的物品。

“從推文到動圖再到視頻,人們可能很快就會發現看似的限量版,其實是無限供應,其中只有少數才能夠經得起時間的考驗。”咨詢公司安永負責全球區塊鏈業務的保羅·布羅迪寫道。

不過從長遠來看,他相信背后的技術。他表示,想象一下高效利用NFT獲得稀缺資源,比如核磁共振成像設備、建筑設備,甚至是付款發票等,他稱該項技術是“前途光明的重要經濟基礎設施”。

“炒作可能會在短期內會退散,技術則是長期的,只要時間夠長,市場就會繼續增長。”Variant Fund的創始人杰西·沃爾登稱。Variant Fund是專注于加密的投資機構,對NFT作品特別感興趣。

事實上,市場已經出現了降溫跡象。然而真正看多加密市場的人可能會反駁說,其他人不那么感興趣,而且藝術品價格合適時就像狂熱過后的宿醉,正是投資最佳時機。

畢竟,看看比特幣和以太坊等加密貨幣的分裂市場就知道。在最近加密貨幣回升到歷史高點之前,它們就已經低位徘徊了數年。

風險與回報

即便在最精明的人看來,投資NFT充滿風險,當然也蘊含機會。但有些隱藏成本不得不考慮。

投機者要小心。由于所謂的礦工費,即以太坊網絡上的交易成本,特定的NFT交易可能比掛牌價高得多。(以太坊網絡是大多數NFT綁定的區塊鏈系統。)最后真正支付的金額可能比想象中多出數百美元。(以太坊正計劃未來升級技術以降低交易費用,而Tezos或EOS等區塊鏈以提供更便宜的交易系統而得意。)

此外,還有納稅問題。安永的加密貨幣稅務中心負責人邁克爾·邁斯勒表示,如果快速倒手NFT就得付出代價。

他說,購買后一年內出售可能要繳納短期資本利得稅,“該稅率最高可達37%。”他表示。

即便長期持有也好不了多少。因為現在大多數NFT可能歸類為收藏品,會因為長期資本收益率更高而特殊對待。像股票之類的資產稅率最高也就是20%,而“收藏品的稅率可能達到28%。”

“這方面沒有明確指導,但我觀察拍賣行出售的NFT物品實際情況時發現,美國國稅局很可能根據藝術品的定義,將其認定為收藏品。”邁斯勒指出,法律上的認定可能意味著高額稅率。這個問題很難解決。另一方面,代表虛擬房地產或其他數字商品的NFT仍然是懸而未決的問題。

“我認為,必須看看代幣,看看背后具體的數字資產,再仔細核查它們到底代表了何種利益,才可以弄清楚可能使用怎樣的稅收政策。”邁斯勒說。

回報豐厚

不過,有些人動身非常早,采取了頗具創意的方法投資這一冷門前沿領域,后來則轉為團隊運動。

網名為Twobadour Paanar的阿南德·文卡特斯瓦蘭是印度的一名加密貨幣投資者,也是Metapurse(專門收集NFT的基金)的合伙人之一。在競拍Beeple最昂貴的巨作《日常:第一個5000天》(Everydays: The First 5000 Days)之前,文卡特斯瓦蘭和昵稱為MetaKovan的搭檔維格尼什·孫達雷桑為Beeple的其他作品已經花費了數百萬美元。

隨后兩人將收入與其他數字商品捆綁在一起,例如虛擬現實游戲《Decentraland》里的虛擬房地產、美國知名DJ 3LAU制作的數字音軌等,再分拆成更多的代幣向公眾出售。

盡管在無形的戰利品上花費了大量金錢,Metapurse根據《The Beeple 20 Collection》命名的B.20代幣銷售利潤相當可觀,該作品為去年12月公司出資220萬美元購買。

基金將其分拆為1000萬枚代幣,自己保留了略超過一半,為合作者和其他人預留了約四分之一,其余則以每個0.36美元的價格向公眾出售。如今,代幣價格已經漲到5美元左右(曾經達到略超27美元的高點)。從紙面上看,已經升值1300%。

Metapurse聲稱并不期望獲得財務回報。基金在官網上宣稱:“ROI”,也就是投資回報率,并非“基金的主要驅動力”。基金還進一步聲稱,“不受靈活調整或創造財務傳承需求的影響”。

就文卡特斯瓦蘭而言,他提醒新手通過NFT賺錢“非常困難。無法經過事先準備。不是看到某個NFT就可以說:‘嗯,這個能夠賺錢,或者這個可以幫助我發財。’”

但他對有興趣的人提出建議:“收藏越兼收并蓄就越好。”

至于為何強調涉足NFT是出于熱愛而不是為了潛在的利益,可能只是戰術選擇。如果買賣NFT份額,就可能觸犯證券法,至少在美國如此。

最近,美國證券交易委員會對加密貨幣相當友好的監管者海絲特·皮爾斯警告稱,NFT的代幣化份額可能符合未注冊證券的條件,在當前指導方針下屬于非法。“要注意創造的并不是投資產品,而是證券。”她說。

應該對NFT下注嗎?

如果你自認為眼光超出常人,那么就可以考慮搭建NFT投資組合。

Coinbase的總裁艾米麗·蔡最近告訴《財富》雜志,加密貨幣行業“不適合意志薄弱之人”,當涉及NFT時,她的話可能更值得參考。

然而,人們可以嘗試把自己當成天才球探,努力尋找下一個邁克爾·喬丹,在其他人發覺他會變成巨星之前,出手買下某些精彩時刻。或者人們能夠把自己當成虛擬的土地投機者,就像網絡版的約翰·雅各布·阿斯特一樣。阿斯特是19世紀早期美國移民,因為曾經在曼哈頓島買地而暴富。

要想成功,就要眼光比其他人更敏銳,具備發現趨勢的稀有才能,還要有大把運氣。

作為初出茅廬的NFT投資者,最好默認自己運氣不好,如果能夠跟志同道合的人合作,可能運氣會好些。但無論以哪種方式,最明智的做法是僅把其當成愛好,只用閑置資金投資。

這種投資如今還處于早期階段,NFT收藏應謹慎地當成支持喜歡的藝術家的方式而不是投資,展示審美品味即可。

此外,還有條建議:不要高估自己的技能。

“NFT運動是文化復興,主要是由藝術家、創造者和游戲玩家驅動的。”Metapurse的文卡特斯瓦蘭說道。“除非你很喜歡,除非你在藝術家的世界里很舒服,否則你會發現,很難選擇支持哪種NFT產品。”

老話曾說,淘金熱時應該賣鏟子,而不是買鏟子。或許像素時代也是一樣。(財富中文網)

譯者:馮豐

審校:夏林

It was the gavel smack heard round the world: Mike Winkelmann made waves in February when he sold, through Christie’s auction house, a gargantuan collage of frequently crass computer-crafted sketches for $69.3 million. The moment signaled the apex of a digital collectible craze. On the auction block were non-fungible tokens, or NFTs, coded references to one-of-a-kind virtual goods that are logged on a blockchain, the distributed accounting ledger that underpins cryptocurrencies such as Bitcoin and, more often, in this case, Ethereum.

NFT mania crescendoed over the past year, like the buildup to an EDM drop, as prices of the cryptocurrencies to which they’re tied soared. Winkelmann, who goes by the alias Beeple, or sometimes Beeple Crap, represents the apotheosis of the trend, but there are plenty other examples of unbridled exuberance. Musical artists ranging from the rock band Kings of Leon to the R&B pop star the Weeknd have sold limited-edition audio tracks for millions of dollars. New York Times columnist Kevin Roose pawned off an op-ed for $804,354.50. Jack Dorsey, Twitter’s founder and chief executive, hocked his first-ever tweet—“just setting up my twttr”—for $2.9 million. (Some of them donated the proceeds to charity.)

Clearly, people can make money selling NFTs. Winklemann, the world’s highest-grossing so-called crypto artist, has off-loaded $115 million worth of works to date, despite self-deprecating disclaimers that “I suck ass.” Meanwhile, Cuy Sheffield, head of crypto at Visa, the payments giant, argues that NFTs present a significant wealth-building opportunity for historically disadvantaged groups. He writes that the advent of the technology “is one of the most exciting new avenues that could spur a Black Digital Renaissance that would create and capture billions of dollars of value for Black communities across the world over the next decade.”

Is this all just a flash in the pan? A cash grab? Or is the world’s sudden infatuation with artsy crypto tokens an early glimpse of fortunes to be made? One must naturally wonder: Can people make money by investing in NFTs?

What is an NFT?

First, people ought to know what they’re really buying.

An NFT is a reference to a given work, not the work itself. Consider the token as a sort of blockchain-based certificate of authenticity, a kind of tradable file representing a global bibliographic entry. Cameron Hejazi, the chief executive and cofounder of Cent, a marketplace for “NFTweets,” compares these items to “the digital analog of the signed baseball card, just for digital content.” Of course, the card is virtual in this case—a string of numbers and letters, a computer coded allusion to something else, whether that be artwork, virtual real estate, tweets, or even, apparently, farts.

If that all sounds like Byzantine vaporware to you, you’re not exactly wrong. Sam Williams, the chief executive and cofounder of Arweave, a project that aims to offer unlimited, permanent digital storage, warns that original pieces of art can vanish from the Internet if not properly secured. That’s already happened to some NFT-linked wares, at least temporarily, such as a video of a spear-wielding, planet-size baby angel created by Grimes, the eccentric singer-songwriter.

Technology aside, NFTs can be thought of financially as collectibles. Advisers call them “alternative investments,” in the sense that they are nonstandard. Experts generally do not recommend them as one’s first line of defense in preparing for retirement. (They tend to recommend stashing the bulk of one’s wealth funds in low-fee, index-tracking exchange-traded funds, or ETFs.)

Nevertheless, some well-to-do people do diversify their portfolios by collecting things such as fine art, fancy cars, premier wines, and other rarities. Other people hoard coins, baseball cards, comic books, etcetera. Often these people are guided by passion, rather than lucre. In that sense, NFTs are to the Internet what postage stamps are to philately in the physical world.

Infinite supply

Collectibles don’t always pan out, of course. (Remember Pogs? Beanie Babies?) And how NFTs shake out monetarily in the years ahead is anyone’s guess.

Most people assume some titanic, towering works, represented as NFTs, will account for the vast majority of wealth at the top of the food chain, while a seemingly endless amount of shlock churns beneath. “From tweets to GIFs to video highlights, people may soon discover there is an infinite supply of limited editions, and only a few of these may stand the test of time,” writes Paul Brody, the global blockchain leader at consultancy EY. Still, he believes in the technology behind them over the long haul. Imagine, he says, if access to scarce resources, such as MRI machines, construction equipment, or even payment invoices, was more efficient through NFTs, he says, calling the tech “an essential economic infrastructure with a bright future.”

“While the hype may dissipate in the short term, the technology's going to be around long term, and the markets will only continue to grow over a long enough time horizon,” says Jesse Walden, founder of Variant Fund, a crypto-focused investment outfit with a special interest in NFT works. Indeed, the market is already showing signs of a drawdown. Yet true crypto bulls might counter that post-mania hangovers are the perfect time to invest, when other people are less interested, and pieces become more affordable.

Just look at what happened in the schizophrenic market for cryptocurrencies such as Bitcoin and Ethereum, after all. Their value lagged for years before rocketing back up to all-time highs recently.

Risk vs. Reward

Investing in NFTs is an activity fraught with risk—yet possible opportunity—for the savviest people. But there are hidden costs to consider.

Speculators, beware. A given NFT could run up much more than the listed price because of so-called gas fees, the transaction costs on the Ethereum network, the blockchain system to which most NFTs are tied. You might end up paying hundreds of dollars more than you imagined. (Ethereum is planning to deploy technological upgrades that will reduce the transaction fees in time to come, while other blockchains, like Tezos or EOS, pride themselves on offering cheaper transactional systems.)

Also, there are taxes. Michael Meisler, who leads EY’s cryptocurrency tax center, says that if you quickly flip an NFT, you’ll pay a price. Selling an NFT within a year of purchase likely causes short-term capital gains taxes to kick in, “which max out at ordinary rates of 37%, effectively,” he says. The outcome isn’t much better for long-term holdings. Because today most NFTs are likely classified as collectibles, they get treated specially with a higher-than-normal long-term capital gains rate. Instead of maxing out at 20%, as is the case with stock sales, “you would now have a rate of 28%.”

“There's no clear guidance on this, but when I look at the facts and circumstances behind an NFT that is sold in an auction house, it suggests that the IRS would assert that it is in fact a collectible, as in, under the definition of a work of art,” Meisler says, noting that this legal distinction entails higher tax rates. But the matter is hardly settled: NFTs representing virtual real estate, or other digital goods, on the other hand, remain an open question.

“I think you almost have to look at the token, look at that digital asset, and almost look through it to see what does it actually represent an interest in, in order to figure out what the appropriate tax treatment might be,” Meisler says.

Many returns

Some people taking the earliest, most creative approaches to this far-out frontier of investing are turning it into a team sport.

Anand Venkateswaran, an Indian cryptocurrency investor who goes by the online alias Twobadour Paanar, is one of the partners of Metapurse, a fund that specializes in collecting NFTs. Before placing the winning bid on Beeple’s priciest monstrosity, Everydays: The First 5000 Days, Venkateswaran and his partner, Vignesh Sundaresan, who goes by the nickname MetaKovan, laid out millions for other Beeple works. The pair then bundled their haul together with other digital goodies—virtual real estate in video games like Decentraland, techno-tunes by DJ 3LAU—and sold fractionalized shares of the ensemble to the public as yet more tokens. (You can visit parts of that bundle, virtually, here.)

Despite spending lavishly on their immaterial trophies, Metapurse’s so-called B.20 tokens—named after The Beeple 20 Collection it purchased for $2.2 million in December—yielded a tidy profit. The fund created 10 million fractional tokens, reserving a little more than half the supply for itself, setting aside about a quarter portion for collaborators and others, and selling the rest to the public for $0.36 a pop. The price has increased to about $5 today (once reaching a high of just over $27). On paper, that’s a 1,300% markup.

Metapurse claims that it doesn’t expect a financial return from its endeavors. On its website, the fund says that “ROI”—or return on investment—"is not the primary driver of this fund.” It further claims the fund “is unencumbered by the need to flex or to create a financial legacy.”

Venkateswaran, for his part, cautions novices that making money on NFTs "is very difficult. It's not cut-and-dried. It's not like you look at an NFT and go, Okay, this one's gonna make me money, or this one will gain me wealth.” But for those who have an interest, he advises, “the more eclectic your collection is, I think, the better it is.”

All that emphasis on dabbling in NFTs for the love of the game, rather than for the potential upside, may be a tactical choice. If you’re buying and selling fractional shares of NFTs, you could run afoul of securities laws, at least in the U.S. Hester Peirce, the crypto-friendliest regulator on the U.S. Securities and Exchange Commission, warned recently that tokenized shares of NFTs could qualify as unregistered securities, making them illegal under current guidelines. "You better be careful that you're not creating something that's an investment product, that's a security," she said.

Should you bet on NFTs?

If you think you’ve got an eye for masterpieces unlike anyone else, go ahead and consider starting an NFT portfolio.

Coinbase's president, Emilie Choi, recently told Fortune that the cryptocurrency industry is "not for the faint of heart," and her words may ring even truer when it comes to NFTs. Nevertheless, you could attempt to be like an athletics talent scout, trying to identify the next Michael Jordan, and buying that athlete’s early moments—in this case, maybe, as NBA Top Shots—before anyone realizes that person is going to be a star. Or perhaps you could consider yourself a virtual land speculator, like an online version of John Jacob Astor, the early 19th-century American immigrant who became filthy rich by buying up land on Manhattan island. To succeed, you need a keener eye than just about anyone else, a rare talent for spotting trends, and unfathomable loads of luck.

It’s best to assume the odds are stacked against you as a budding NFT investor—you might have better luck teaming up with like-minded individuals. Either way, it's most advisable to participate merely as a hobby, using dispensable cash only. NFT collecting ought, at this early stage, to be more prudently considered as spending—supporting your favorite artists, showing off your aesthetic taste—versus investing.

A piece of advice: Don't overestimate your skills. “The NFT movement is a cultural renaissance. It's driven by artists. It's driven by creators. It's driven by gamers, and so on,” Metapurse’s Venkateswaran says. “Unless you're comfortable in their company, unless you're comfortable in their world, you're going to find it very difficult to pick the right NFTs to back.”

An age-old adage advises people to sell pickaxes—not buy them—during a gold rush. Maybe the same holds true of pixels.