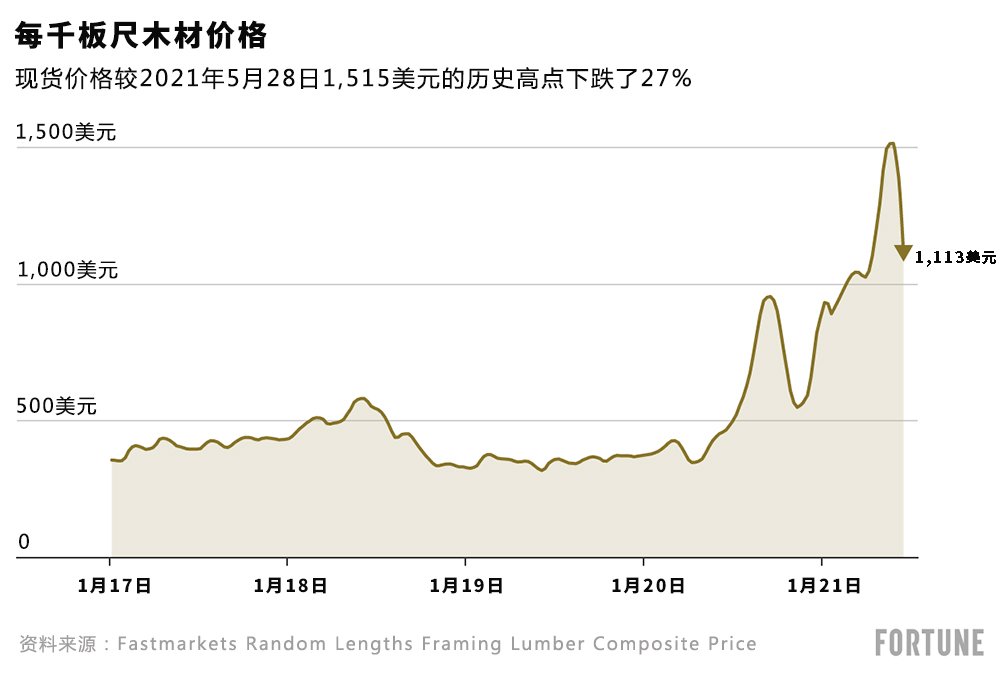

在今年春天攀升至歷史高點之后,木材價格正在迅速回落。根據行業出版物Random Lengths發布的數據,每千板尺木材的現貨價格在上周下跌211美元至1,113美元,較5月28日1,515美元的歷史高點下跌了27%。

Sherwood Lumber公司的首席執行官安迪?古德曼告訴《財富》雜志:“我們正處于自由落體狀態。”在木材期貨市場,價格的下跌幅度更大——自5月10日突破1,700美元以來,已經下跌了47%。

為什么木材價格現在才開始回落?過高的木材價格終于讓一些房屋建筑商和自己動手修繕的房主被迫放棄了原有計劃。5月的新屋開工量較3月創下的14年高點下降了8.8%。與此同時,自3月創下歷史新高以來,家裝銷量下降了8.1%。此外,在創紀錄高價的激勵下,鋸木廠和伐木場爭相提高產量。而供給上升和需求下降,向來都是促使價格調整的完美配方。

Deacon Lumber公司的首席執行官斯廷森?迪恩也認為,直沖云霄的價格讓許多買家望而卻步,這在一定程度上緩解了木材短缺問題。但他隨即指出,木材價格回落的另一個原因是,導致春季木材歷史性軋空的動力已經出盡,而且不會再發生。

“當木材價格在春季被空頭擠壓至1,700美元的時候,建筑商的感受并不像他們的供應商那么強烈。早在去年冬季,建筑商就向供應商鎖定了價格;供應商不得不高價買單。現在,供應商不再提供遠期價格鎖定,所以他們不會再次受到空頭擠壓。”斯廷森告訴《財富》雜志,“現在的市場形勢不同于春季,不再有軋空動能了。”

木材的價格或許正在崩潰——但仍然遠高于新冠疫情前的水平。現貨價格仍然比2020年春季高211%。在新冠疫情爆發前,木材價格一直在每千板尺350美元到500美元之間波動。

“在未來幾周,木材價格還會繼續下探,然后逐漸趨穩。買家需要在未來幾周填補庫存。”古德曼告訴《財富》雜志。他認為,高企的價格可能會持續數年。“一般來說,一切都會回歸均值,但我們認為,未來一至三年的均值將高于過去10至15年的均值。這是因為除通脹因素之外,我們預計需求將維持高位。”

《財富》雜志在過去幾周采訪的業內人士一致認為,木材價格可能在今年年底前跌至每千板尺600美元。隨著木材的現貨或批發價格下跌,這些折扣需要一段時間才能夠體現在諸如家得寶(Home Depot)這類大賣場的價格標簽上。不過,即使木材價格有所緩解,你家新圍欄或露臺的建造成本仍然會比危機前高很多。

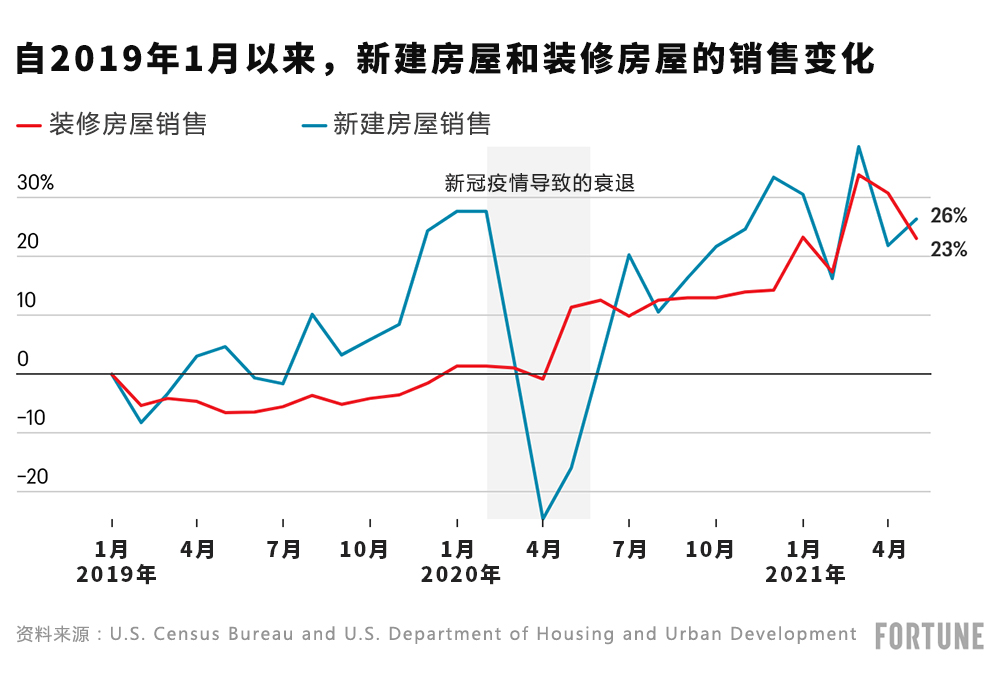

為什么價格不太可能很快回歸到新冠疫情爆發前的水平呢?盡管建造房屋和自己動手修繕房屋的熱潮有所消退,但仍然十分火爆。5月,新屋開工量比2019年1月的水平高出26%。與此同時,家裝銷量在同一時期增長了23%。

正如《財富》雜志此前報道的那樣,這場歷史性木材短缺是新冠疫情掀起的完美風暴造成的。疫情在2020年春天爆發時,正值鋸木廠因為擔心房地產市場崩潰而削減產量并清理庫存之際。房地產市場并未崩潰——相反的一幕發生了。美國人競相涌入家得寶和勞氏(Lowe 's)購買自建項目所需的材料,而經濟衰退引發的低利率也刺激了房地產市場的繁榮。與此同時,大批千禧一代開始進入購房高峰期,讓原本就熱火朝天的房地產市場變得如火如荼。這波景氣導致住房庫存枯竭,促使買家爭先尋找新房源。家庭裝修和建造新房需要大量的木材,但鋸木廠無法跟上井噴的市場需求。(財富中文網)

譯者:任文科

在今年春天攀升至歷史高點之后,木材價格正在迅速回落。根據行業出版物Random Lengths發布的數據,每千板尺木材的現貨價格在上周下跌211美元至1,113美元,較5月28日1,515美元的歷史高點下跌了27%。

Sherwood Lumber公司的首席執行官安迪?古德曼告訴《財富》雜志:“我們正處于自由落體狀態。”在木材期貨市場,價格的下跌幅度更大——自5月10日突破1,700美元以來,已經下跌了47%。

為什么木材價格現在才開始回落?過高的木材價格終于讓一些房屋建筑商和自己動手修繕的房主被迫放棄了原有計劃。5月的新屋開工量較3月創下的14年高點下降了8.8%。與此同時,自3月創下歷史新高以來,家裝銷量下降了8.1%。此外,在創紀錄高價的激勵下,鋸木廠和伐木場爭相提高產量。而供給上升和需求下降,向來都是促使價格調整的完美配方。

Deacon Lumber公司的首席執行官斯廷森?迪恩也認為,直沖云霄的價格讓許多買家望而卻步,這在一定程度上緩解了木材短缺問題。但他隨即指出,木材價格回落的另一個原因是,導致春季木材歷史性軋空的動力已經出盡,而且不會再發生。

“當木材價格在春季被空頭擠壓至1,700美元的時候,建筑商的感受并不像他們的供應商那么強烈。早在去年冬季,建筑商就向供應商鎖定了價格;供應商不得不高價買單。現在,供應商不再提供遠期價格鎖定,所以他們不會再次受到空頭擠壓。”斯廷森告訴《財富》雜志,“現在的市場形勢不同于春季,不再有軋空動能了。”

木材的價格或許正在崩潰——但仍然遠高于新冠疫情前的水平。現貨價格仍然比2020年春季高211%。在新冠疫情爆發前,木材價格一直在每千板尺350美元到500美元之間波動。

“在未來幾周,木材價格還會繼續下探,然后逐漸趨穩。買家需要在未來幾周填補庫存。”古德曼告訴《財富》雜志。他認為,高企的價格可能會持續數年。“一般來說,一切都會回歸均值,但我們認為,未來一至三年的均值將高于過去10至15年的均值。這是因為除通脹因素之外,我們預計需求將維持高位。”

《財富》雜志在過去幾周采訪的業內人士一致認為,木材價格可能在今年年底前跌至每千板尺600美元。隨著木材的現貨或批發價格下跌,這些折扣需要一段時間才能夠體現在諸如家得寶(Home Depot)這類大賣場的價格標簽上。不過,即使木材價格有所緩解,你家新圍欄或露臺的建造成本仍然會比危機前高很多。

為什么價格不太可能很快回歸到新冠疫情爆發前的水平呢?盡管建造房屋和自己動手修繕房屋的熱潮有所消退,但仍然十分火爆。5月,新屋開工量比2019年1月的水平高出26%。與此同時,家裝銷量在同一時期增長了23%。

正如《財富》雜志此前報道的那樣,這場歷史性木材短缺是新冠疫情掀起的完美風暴造成的。疫情在2020年春天爆發時,正值鋸木廠因為擔心房地產市場崩潰而削減產量并清理庫存之際。房地產市場并未崩潰——相反的一幕發生了。美國人競相涌入家得寶和勞氏(Lowe 's)購買自建項目所需的材料,而經濟衰退引發的低利率也刺激了房地產市場的繁榮。與此同時,大批千禧一代開始進入購房高峰期,讓原本就熱火朝天的房地產市場變得如火如荼。這波景氣導致住房庫存枯竭,促使買家爭先尋找新房源。家庭裝修和建造新房需要大量的木材,但鋸木廠無法跟上井噴的市場需求。(財富中文網)

譯者:任文科

After climbing to historic heights this spring, lumber prices are headed back down—fast. Last week the cash price per thousand board feet of lumber fell $211 to $1,113, according to industry trade publication Random Lengths. That's down 27% from its $1,515 all-time high on May 28.

"We are in a free fall," Andy Goodman, CEO of Sherwood Lumber, told Fortune. In the lumber futures market, prices are down even more— dropping 47% since going above $1,700 on May 10.

Why are lumber prices finally correcting? The exorbitant price of lumber finally has some homebuilders and DIYers backing off. New home construction in May is down 8.8% from the 14-year high set in March. While home improvement sales are down 8.1% since setting an all-time high in March. Incentivized by record-high prices, sawmills and loggers rushed to tick up production. Of course, rising supply and falling demand is a perfect recipe for a price correction.

Stinson Dean, CEO of Deacon Lumber, agreed that buyers balking at sky-high prices are helping to alleviate the problem. But, he said, it's also down because the dynamic that led to the historic lumber squeeze in the spring has already played out—and won't happen again.

"The spring short squeeze to $1,700 wasn't really felt by the builders as much as it was [by] their vendors. The builders locked in their price with the vendors in the winter and the vendors had to cover it at high prices...now vendors aren't offering forward price locks so they don't get squeezed again," Stinson told Fortune. "The short squeeze dynamics are not there today like they were in the spring."

The price of lumber may be crashing—but we're still far above pre-pandemic levels. The cash price is still up 211% from spring 2020. Prior to the pandemic, lumber prices fluctuated between $350 to $500 per thousand board feet.

"Prices will continue to decline for the next few weeks and gradually stabilize. Buyers will need to fill inventories in the coming weeks," Goodman told Fortune. He believes elevated prices could last years: "In general everything reverts back to the mean, however we believe that the mean for the next one to three years will be higher than the past 10 to 15-year mean. This is due to the high demand we expect on top of inflation."

The consensus among industry insiders Fortune has interviewed over the past few weeks is that prices could drop to $600 per thousand board feet before the end of the year. As the cash, or wholesale, lumber price falls it will take time for those discounts to be reflected in big box stores like Home Depot. But even with this lumber price relief, your new fence or deck is still going to cost a lot more than it would have pre-crisis.

Why are prices unlikely to reach pre-pandemic levels anytime soon? Even though homebuilding and DIY are slowing a bit, they're still running hot. In May, new home construction was 26% above Jan. 2019 levels. Meanwhile, home improvement sales are up 23% during the same period.

As Fortune has previously reported, this historic lumber shortage was spurred by a perfect storm of factors set off during the pandemic. When COVID-19 broke out in spring 2020, sawmills cut production and unloaded inventory in fears of a looming housing crash. The crash didn't happen—instead, the opposite occurred. Americans rushed to Home Depot and Lowe’s to buy up materials for do-it-yourself projects, while recession-induced interest rates helped spur a housing boom. That boom, which was exacerbated by a large cohort of millennials starting to hit their peak homebuying years, dried up housing inventory and sent buyers in search of new construction. Home improvements and construction require a lot of lumber, and mills couldn't keep up.