股市是否知道民意調(diào)查機(jī)構(gòu)不知道的一些事情?

這便是LPL Financial的首席市場策略師萊恩?德特里克想要介紹的內(nèi)容。他一直在密切地關(guān)注股市以及美元的整體動向。

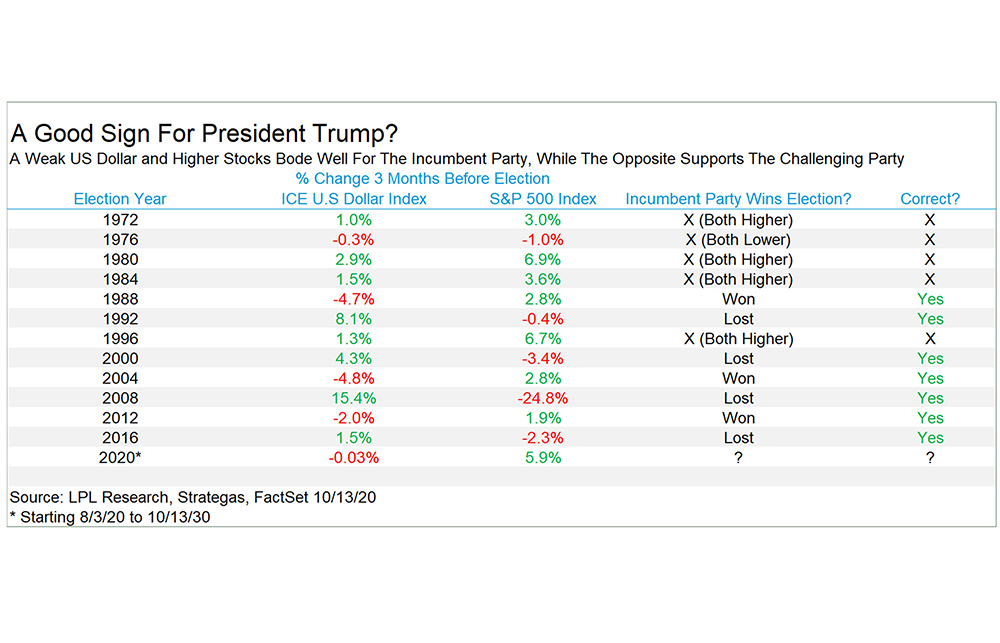

他在10月16日寫道:“我們此前就注意到,從歷史上來看,大選之前股市上揚(yáng)則是支持現(xiàn)任總統(tǒng),而股價走低則是支持新領(lǐng)導(dǎo)層入主白宮。”德特里克還表示,美元是另一個值得關(guān)注的指標(biāo)。“事實上,如果大選前股市上揚(yáng)美元下降,或股市下降美元上揚(yáng),那么大選結(jié)果就會精確地如上述預(yù)測的那樣,過去7年一直都是如此。有鑒于當(dāng)前股市有所上升,美元略有下降,這可能意味著,即將到來的大選將比任何人預(yù)計的都要更加焦灼。”

確實,盡管喬?拜登在全國民調(diào)中遙遙領(lǐng)先,但有跡象表明,人們低估了外界對特朗普的支持。《財富》雜志的杰瑞米?卡恩在上周寫道,曾經(jīng)預(yù)測了脫歐的人工智能工具認(rèn)為二位候選人的差距非常接近。卡恩解釋說,Expert.ai公司“使用了名為‘情緒分析’的人工智能技術(shù)來了解社交媒體貼文中表達(dá)的情緒。該公司的分析顯示,民主黨候選人拜登以50.2%的支持率超出了特朗普總統(tǒng)的47.3%,這個差距要比最近全美民調(diào)中拜登支持率領(lǐng)先特朗普兩位數(shù)的差距要小得多。”

其他人們常用的華爾街大選指標(biāo)則給出了喜憂參半的結(jié)果。《財富》雜志的雷?瑪莎耶吉寫道,《FiveThirtyEight》欄目的內(nèi)特?斯?fàn)柧S認(rèn)為,ISM制造業(yè)指數(shù)(ISM Manufacturing Index)是預(yù)測大選結(jié)果的最好指標(biāo)。就這一點(diǎn)而言,“如果ISM在這一時期的平均水平高于50(意味著制造業(yè)的擴(kuò)張),那么執(zhí)政黨有望獲勝,如果低于50(意味著制造業(yè)的萎縮),那么通常意味著新黨將入主白宮。”然而,該指數(shù)今年前9個月的平均值為50.3,這個數(shù)字告訴我們,大選異常焦灼,結(jié)果難以預(yù)料。(財富中文網(wǎng))

譯者:馮豐

審校:夏林

股市是否知道民意調(diào)查機(jī)構(gòu)不知道的一些事情?

這便是LPL Financial的首席市場策略師萊恩?德特里克想要介紹的內(nèi)容。他一直在密切地關(guān)注股市以及美元的整體動向。

他在10月16日寫道:“我們此前就注意到,從歷史上來看,大選之前股市上揚(yáng)則是支持現(xiàn)任總統(tǒng),而股價走低則是支持新領(lǐng)導(dǎo)層入主白宮。”德特里克還表示,美元是另一個值得關(guān)注的指標(biāo)。“事實上,如果大選前股市上揚(yáng)美元下降,或股市下降美元上揚(yáng),那么大選結(jié)果就會精確地如上述預(yù)測的那樣,過去7年一直都是如此。有鑒于當(dāng)前股市有所上升,美元略有下降,這可能意味著,即將到來的大選將比任何人預(yù)計的都要更加焦灼。”

對特朗普總統(tǒng)來說是好消息?(美元的走弱以及股市的啟高對于執(zhí)政黨來說是好消息,而其反向則是對在野黨的支持。)來源:LPL Research, Strategas

確實,盡管喬?拜登在全國民調(diào)中遙遙領(lǐng)先,但有跡象表明,人們低估了外界對特朗普的支持。《財富》雜志的杰瑞米?卡恩在上周寫道,曾經(jīng)預(yù)測了脫歐的人工智能工具認(rèn)為二位候選人的差距非常接近。卡恩解釋說,Expert.ai公司“使用了名為‘情緒分析’的人工智能技術(shù)來了解社交媒體貼文中表達(dá)的情緒。該公司的分析顯示,民主黨候選人拜登以50.2%的支持率超出了特朗普總統(tǒng)的47.3%,這個差距要比最近全美民調(diào)中拜登支持率領(lǐng)先特朗普兩位數(shù)的差距要小得多。”

其他人們常用的華爾街大選指標(biāo)則給出了喜憂參半的結(jié)果。《財富》雜志的雷?瑪莎耶吉寫道,《FiveThirtyEight》欄目的內(nèi)特?斯?fàn)柧S認(rèn)為,ISM制造業(yè)指數(shù)(ISM Manufacturing Index)是預(yù)測大選結(jié)果的最好指標(biāo)。就這一點(diǎn)而言,“如果ISM在這一時期的平均水平高于50(意味著制造業(yè)的擴(kuò)張),那么執(zhí)政黨有望獲勝,如果低于50(意味著制造業(yè)的萎縮),那么通常意味著新黨將入主白宮。”然而,該指數(shù)今年前9個月的平均值為50.3,這個數(shù)字告訴我們,大選異常焦灼,結(jié)果難以預(yù)料。(財富中文網(wǎng))

譯者:馮豐

審校:夏林

Does the stock market know something the pollsters don’t?

That’s the takeaway from Ryan Detrick, chief market strategist for LPL Financial, who has been closely monitoring both the overall stock market’s moves as well as the U.S. dollar.

As he wrote on October 16, “We’ve noted before that stock market gains ahead of the election historically support the incumbent party, while if stocks are lower it tends to support new leadership in the White House.” Detrick adds that the dollar is another indicator worth watching. “In fact, when stocks are up and the U.S. dollar is lower ahead of the election, or if stocks are lower and the U.S. dollar is higher before an election, the results have accurately predicted the last seven times those scenarios took place. Given stocks are up and the U.S. dollar is slightly lower, this could be one clue the upcoming election will be much closer than many are expecting.”

Indeed, despite a commanding lead in national polls, there are indications that support for Trump is somehow being undercounted. As Fortune’s Jeremy Kahn wrote last week, an A.I. tool that correctly predicted Brexit is showing a tight race. Expert.ai, explains Kahn, “uses an A.I. technique called ‘sentiment analysis’ to understand the emotions being expressed in social media posts. The company’s analysis puts Democratic candidate Joseph Biden ahead of President Donald Trump, 50.2% to 47.3%, a margin that is much narrower than the double-digit lead that Biden has over Trump in most national opinion polls.”

Other favorite Wall Street election indicators show a mixed bag. Fortune’s Rey Mashayekhi wrote that FiveThirtyEight’s Nate Silver considers the ISM Manufacturing Index to be the best metric for predicting elections. On that front, “if the ISM averages above 50 during that time (signaling an expanding manufacturing sector), that tends to bode well for the incumbent party, while an ISM average of below 50 (reflecting a contracting manufacturing sector) usually corresponds with a new party taking control of the White House.” With the index at 50.3 through the first nine months of the year, that’s another piece of data that suggests this election is still way too close to call.