在接受我的電話采訪時,卡爾加里市的市長納希德?奈什正驅(qū)車一路向北,前往埃德蒙頓去省議會開會。這段路車程達三小時,一路上我們都在交談。他沿著一段平坦的高速公路前行,背景傳來GPS指路的聲音,他開始介紹城市面臨的挑戰(zhàn)。石油價格跌跌不休,疫情來襲讓情況更糟,卡爾加里財政狀況格外緊張。面臨戲劇性的經(jīng)濟衰退,人們越發(fā)關(guān)注奈什強調(diào)多年的問題,即卡爾加里對石油和天然氣工業(yè)的過度依賴。

48歲的奈什曾經(jīng)在麥肯錫擔任顧問,向來以開朗友好著稱,畢竟他是加拿大人。他是很樂觀,但在直言評價卡爾加里經(jīng)濟狀況時,從聲音中能夠聽出一絲沮喪:“呃,不太好。”

突然,奈什的話停了下來,開始讀路邊一塊廣告牌,上面寫著阿爾伯塔的宣傳語:“實現(xiàn)經(jīng)濟多樣化。”“對。”他冷冷地說。然后他笑著補充道:“說得挺到位。”

這句宣傳語不僅簡單,也很引人注目。奈什指出,這代表著加拿大阿爾伯塔省宣傳的突然轉(zhuǎn)向。“六個月前我可不會看到這種廣告牌。”他說。如今,疫情導(dǎo)致的創(chuàng)傷把全世界最大的石油天然氣中心之一長期爭論的話題迅速改變。

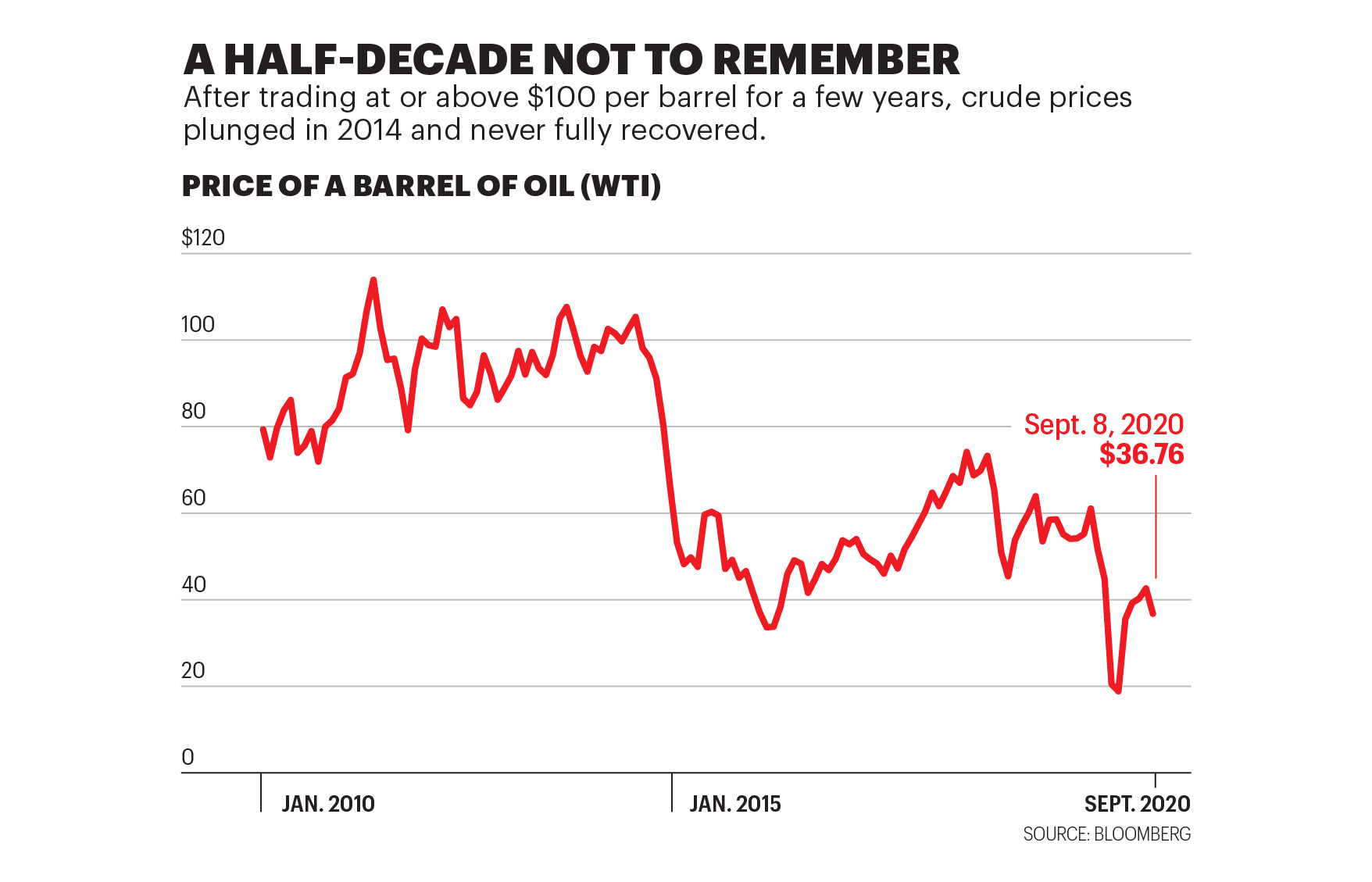

卡爾加里人口有130萬,是加拿大能源行業(yè)企業(yè)和金融中心。2010年奈什當選后,成為北美大城市的首位穆斯林市長。他借助紅藍中間派選民組成的“紫色浪潮”聯(lián)盟贏得競選,宣誓就職時恰逢20年繁榮期臨近結(jié)束。奈什號召通過投資石油天然氣以外的行業(yè)來鞏固卡爾加里的經(jīng)濟實力。過去10年里,油價從每桶超過100美元暴跌到目前的不到40美元,而且一路走低,阿爾伯塔很多人的本能反應(yīng)是靜靜等著下滑趨勢逆轉(zhuǎn)。而環(huán)保主義者的批評聲勢浩大又與日俱增,也讓支持奈什的一些選民更加抗拒。

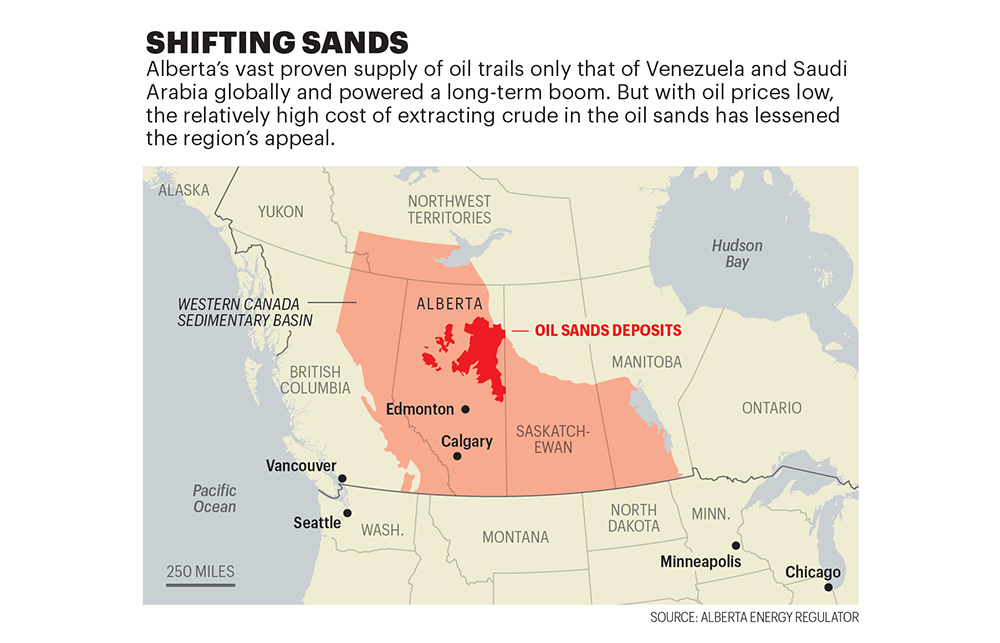

流沙

阿爾伯塔巨大的石油供應(yīng)量在全球僅次于委內(nèi)瑞拉和沙特阿拉伯,推動了長時間的繁榮。但由于油價較低,油砂開采原油的成本相對較高,削弱了該地區(qū)的吸引力。

來源:阿爾伯塔能源監(jiān)管局

阿爾伯塔的能源主要是北部出產(chǎn)的所謂油砂。該地區(qū)的非常規(guī)石油儲量龐大,已探明儲量達1654億桶,位居全球第三,僅次于委內(nèi)瑞拉和沙特阿拉伯。油砂占加拿大石油產(chǎn)量的60%以上。也正因如此,阿爾伯塔成了國際上環(huán)保積極人士的目標。

油砂煉油必須從含油泥沙中提取和加工,成本高昂且伴隨大量排放,比起傳統(tǒng)鉆探通常更類似露天開采。長期以來,航空拍攝的大量尾礦池,即開采過程中厚厚的油性副產(chǎn)品引發(fā)了環(huán)保人士抵制。近年,環(huán)保人士一直呼吁封閉Keystone XL輸油管道,該管道可以向美國輸送更多油砂原油。盡管特朗普政府努力推動管道項目,然而美國一項法律規(guī)定已經(jīng)叫停建設(shè)。

多年來,油砂提供的稅收收入確保阿爾伯塔的預(yù)算平衡,而且阿爾伯塔一直為聯(lián)邦政府貢獻收入,供其在全國重新分配。

然而,如今阿爾伯塔的會計師們發(fā)現(xiàn)了巨大的漏洞。今年8月,阿爾伯塔政府發(fā)布了本年度修訂后的預(yù)算預(yù)測,赤字比2月的預(yù)測高出128億美元,主要原因是石油天然氣部門的資源收入預(yù)計比之前預(yù)測低30億美元。與此同時,8月阿爾伯塔的失業(yè)率接近12%,在加拿大各省排名第二。預(yù)計今年阿爾伯塔經(jīng)濟將萎縮8.8%。去年,石油天然氣以及采礦業(yè)占了該省GDP的26%,間接影響則更為廣泛。因此,經(jīng)濟放緩讓人很不安。

從許多方面來說,阿爾伯塔充分體現(xiàn)了從美國西得克薩斯州到中東等石油資源豐富地區(qū)的困境。疫情只是徹底揭露了阿爾伯塔在經(jīng)濟上面臨挑戰(zhàn),導(dǎo)致問題更加嚴峻。這也是產(chǎn)油核心地區(qū)面臨的興衰轉(zhuǎn)換難題。當形勢一片大好時,人們沒有動力考慮從利潤豐厚的行業(yè)轉(zhuǎn)移。日子不好過的時候則口袋空空。不過,打破“資源詛咒”很困難,阿爾伯塔的問題尤其麻煩,因為當?shù)厣罹觾?nèi)陸,非常依賴南部的貿(mào)易伙伴美國,目前其96%的出口都是運往美國。同時,在政府和機構(gòu)投資者支持下,越來越多的綠色能源倡導(dǎo)者正在全球范圍推動加快淘汰化石燃料。阿爾伯塔必須順應(yīng)形勢,否則可能在新能源經(jīng)濟中落后。

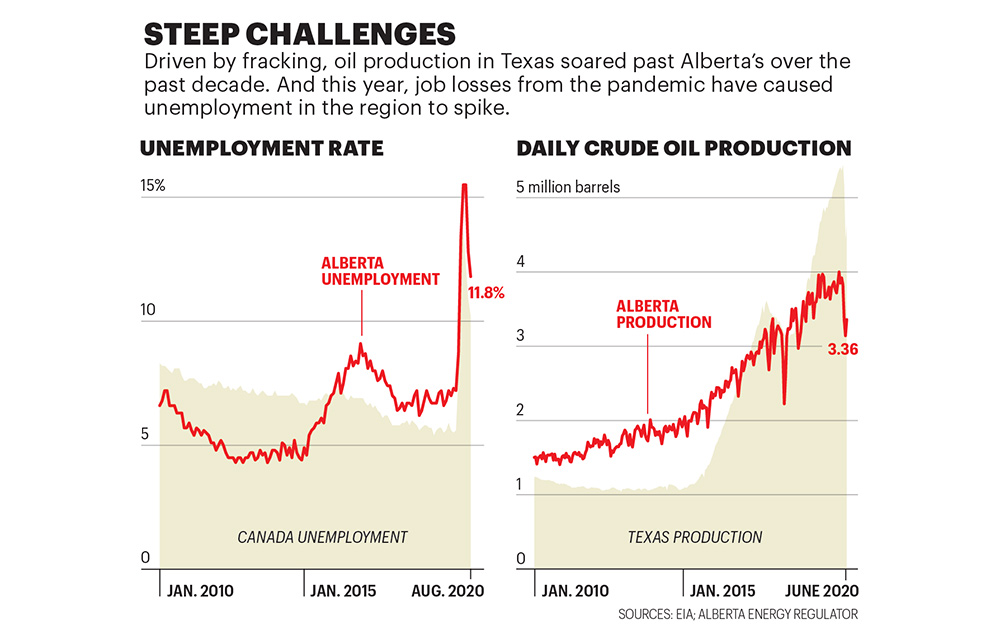

嚴峻的挑戰(zhàn)

在水力壓裂技術(shù)的推動下,過去十年里美國得州石油產(chǎn)量超過了阿爾伯塔。今年,受疫情影響,阿爾伯塔失業(yè)人數(shù)激增。

資料來源:美國能源信息署;阿爾伯塔能源監(jiān)管局

這就是奈什為何認為阿爾伯塔別無選擇,只能迅速改變對未來的看法。卡爾加里要接受發(fā)展清潔能源就業(yè)機會的新運動,也要加快在其他領(lǐng)域投資的步伐。

“有個非常著名的騎車保險杠貼紙。上面寫著:‘上帝啊,再讓我轟隆一次吧,這次一定不會糟蹋了。’”奈什邊說邊開車穿過草原。

他繼續(xù)說:“這段時間我一直在說:‘我們不能糟蹋經(jīng)濟衰退。’我們特別擅長糟蹋繁榮。水平真的很高。我們真的不能浪費經(jīng)濟衰退帶來的機會。”

如果現(xiàn)在卡爾加里還不能改變,還有機會改變嗎?

我出生時恰逢石油危機。1989年11月,我出生在卡爾加里,當天沙特阿拉伯宣布發(fā)現(xiàn)了一處新的大油田。似乎世界上到處都是原油。當時油價僅為每桶20美元。種種因素促成了我的父母在卡爾加里的“銀拖鞋沙龍”酒吧(Silver Slipper Saloon)相識,加入了前些年逐漸衰落的行業(yè)。(我父母一輩子都在能源行業(yè)。)

我開始上學時,出現(xiàn)了油砂擴張驅(qū)動的新一輪繁榮。這波繁榮時間最長,規(guī)模也最大。很快,咖啡連鎖店想招新員工都挺難。郊區(qū)到處鮮花盛開。連十幾歲的男孩都知道,輟學去鉆臺工作很快就能賺大錢。

當前這波下跌始于2014年,幾個月里油價就下跌了超過50%。盡管后來有周期性反彈,但自那以后油價持續(xù)走低。最大原因是采用水力壓裂技術(shù)的美國石油產(chǎn)量令人吃驚地激增。2010年,美國石油日產(chǎn)量約為550萬桶。去年日均產(chǎn)量超過1220萬桶。疫情導(dǎo)致的經(jīng)濟放緩只會加大油價下行壓力。國際能源署的最近估計是,今年全球石油需求預(yù)計為平均每天9190萬桶,比2019年減少810萬桶。

雖然疫情過后油價可能再次攀升,但有跡象表明,類似上一波的繁榮可能永遠不會重現(xiàn)。8月安永一份報告顯示,自動化對阿爾伯塔50%的上游能源就業(yè)崗位造成威脅。卡爾加里經(jīng)濟發(fā)展委員會表示,為推動能源行業(yè)數(shù)字化程度,必須開展大規(guī)模再培訓,主要針對卡爾加里多出的石油工程師和地球物理學家能再就業(yè)的工作崗位。在奈什領(lǐng)導(dǎo)下,卡爾加里一直努力推動經(jīng)濟發(fā)展。2018年,卡爾加里設(shè)立了1億美元基金,向承諾創(chuàng)造就業(yè)機會的科技創(chuàng)業(yè)公司和非石油天然氣行業(yè)的當?shù)仄髽I(yè)提供資助。但在疫情和油價暴跌的夾擊下,一些能夠創(chuàng)造就業(yè)機會的來源受到重創(chuàng),比如曾經(jīng)爆發(fā)式增長的餐館和釀酒廠,以及落基山脈附近的旅游業(yè)。

阿爾伯塔跟一些石油資源豐富的經(jīng)濟體不同,多年來并沒做到未雨綢繆。這方面最突出的是多年來靠著石油財富已積累1萬億美元主權(quán)財富基金的挪威。當?shù)赜?30億美元的阿爾伯塔儲蓄信托基金(Alberta Heritage Savings Trust Fund),規(guī)模根本不足以填補缺口。雖然1976年基金成立以來,政府收入大幅增加,但基金市值卻基本上未變。阿爾伯塔的財富主要投向建立全球一流的公共醫(yī)療和教育,稅收也是全國最低。

當然,即便油價不出現(xiàn)大幅反彈,預(yù)計油氣行業(yè)也不會很快消失。雖然有可能積極推進綠色經(jīng)濟轉(zhuǎn)型,預(yù)計到2050年仍然會保留一些石油生產(chǎn),問題只是從何處開采。挪威能源咨詢公司Rystad energy預(yù)計,未來10年加拿大西部地區(qū)石油產(chǎn)量年增長率將接近2%,因為墨西哥和受危機重創(chuàng)的委內(nèi)瑞拉產(chǎn)量下降,而阿爾伯塔對重質(zhì)原油仍然有大量需求。但不少分析師表示,現(xiàn)在不會有油砂方面的新投資。一些國際石油公司,如法國道達爾公司已經(jīng)完全撤出該地區(qū)。

石油行業(yè)從阿爾伯塔撤出,部分原因在于政治不確定性,即Keystone及其他石油運輸管道能否獲批。但最大的問題是在油砂煉油成本。Rystad Energy和總部位于愛丁堡的能源咨詢公司W(wǎng)ood Mackenzie都將油砂煉油盈虧價格定在每桶45美元左右,一些項目成本能夠維持在20至30美元之間。不過,另一些成本高得多。

油砂項目需要龐大的基礎(chǔ)設(shè)施投入,通常需要40至50年才能夠啟動。哪怕是最高效的開發(fā)項目也要有非常密集的資本。2019年阿爾伯塔政府估計,最貴的礦業(yè)項目初始盈虧平衡價格高達每桶75美元或85美元。這個門檻相當高,尤其是當前銀行和其他投資集團又面臨著收緊化石燃料融資的壓力。

奈什和政府同僚必須接受的另一個現(xiàn)實是,基本上不可能通過政策來實現(xiàn)油價上漲帶動經(jīng)濟繁榮。阿爾伯塔大學的能源經(jīng)濟學家安德魯?利奇表示,加拿大其他地區(qū),尤其是大西洋沿岸省份,在鱈魚捕撈和伐木業(yè)都已經(jīng)歷前所未有的蕭條,可以說比阿爾伯塔更需要幫助。目前并未出現(xiàn)一鳴驚人的解決方案。阿爾伯塔經(jīng)濟繁榮的一大諷刺是,雇用的很多員工都是因為大西洋沿岸經(jīng)濟蕭條才不得不另覓生路。“不管政府怎么推政策,也無法每年自動吸引數(shù)十億美元的外國直接投資。”利奇說。

在阿爾伯塔,石油天然氣工人普遍受過高等教育,專業(yè)化程度高,工資也很高。雖然科技行業(yè)蒸蒸日上,也無法保證新工作崗位能夠達到相應(yīng)標準。但也有阿爾伯塔人在默默努力。

利亞姆?希爾德布蘭德曾經(jīng)想利用在油田當焊工時學到的技能來推動綠色能源轉(zhuǎn)型,但根本找不到工作。他說,有人認為石油天然氣工人并不愿意從事可再生能源工作。事實并非如此。如果連工作機會都沒有,怎么指望人們投身建設(shè)綠色的未來。

20歲時,希爾德布蘭德在石油行業(yè)找到第一份工作。2010年,他回到大學攻讀地理學位,主要關(guān)注綠色能源事業(yè),但找不到工作。于是他又回到油砂礦當了六年焊工。“從一天開始,我的外號就是綠色和平。”他笑著說。盡管身邊不少同事都有合理懷疑,但很多人承認內(nèi)心很擔心氣候變化,也承受著行業(yè)繁榮蕭條的壓力。

2015年,隨著油價暴跌,工作午餐時的談話變得越發(fā)緊迫。“我們不是在討論假設(shè)的情況了。”他說,“明天就可能失業(yè)。該怎么辦?”

那一年,如今35歲的希爾德布蘭德和石油行業(yè)的同事成立了“鐵與地球”(Iron & Earth)非營利組織,倡導(dǎo)可持續(xù)能源投資。他們認為,全面能源轉(zhuǎn)型將推動巨大的基礎(chǔ)設(shè)施建設(shè)熱潮,不僅包括風能和太陽能,也包括生物能、地熱能和氫能發(fā)電廠。

愿景雄心勃勃,可惜與現(xiàn)實相去甚遠。進展倒是有一些。今年,伯克希爾-哈撒韋能源公司加拿大子公司新投資的風電場將為阿爾伯塔東南部提供相當于7.9萬戶家庭用量的電力。2019年,可再生能源發(fā)電量不到總發(fā)電量的10%。但據(jù)加拿大風能協(xié)會統(tǒng)計,目前阿爾伯塔已經(jīng)是全國第三大風能市場,裝機容量達1685兆瓦。2017年,加拿大清潔能源部估計,清潔能源就業(yè)崗位有26358個,整體行業(yè)約占阿爾伯塔GDP的1%。6月,位于阿爾伯塔的環(huán)境非政府組織Pembina Institute表示,綠色能源轉(zhuǎn)型過程中,預(yù)計到2030年將在阿爾伯塔創(chuàng)造6.7萬個就業(yè)崗位,相當于能源部門現(xiàn)有員工的67%。

希爾德布蘭德目前已經(jīng)辭去石油行業(yè)的工作,全職經(jīng)營“鐵與地球”,他相信阿爾伯塔人已經(jīng)準備好迎接大變革。“工人們都已經(jīng)覺醒。”他說。

然而,并非每個阿爾伯塔人都對綠色能源的概念持開放態(tài)度。近年來,阿爾伯塔政治兩極分化愈演愈烈,導(dǎo)致可持續(xù)性相關(guān)對話愈加困難。2020年3月加拿大廣播公司CBC主持了一項民意調(diào)查,詢問阿爾伯塔如何才能讓經(jīng)濟重回正軌。調(diào)查顯示,近40%的受訪者提到要控制疫情或政府支持,還有約30%的受訪者表示“需要經(jīng)濟多元化”,29%的受訪者表示“加大石油投資”。此類指標與受訪者的投票密切相關(guān)。2018年3月以來,自稱政治上偏左派或右派的人有所增加,而自稱保持中立的人減少了9%。

很多阿爾伯塔人對反對化石燃料的論點持懷疑態(tài)度。2018年P(guān)embina Institute采取了一項判斷人們對可持續(xù)能源態(tài)度的調(diào)查,叫“阿爾伯塔故事項目”,發(fā)現(xiàn)約半數(shù)參與者要么堅決拒絕氣候變化的概念,要么懷疑氣候變化到底是不是由人類行為造成。

企業(yè)界的觀點不一。之前我采訪的多名能源經(jīng)濟學家和專家表示,該地區(qū)最大規(guī)模的石油天然氣公司高管極度懷疑氣候變化,普遍支持現(xiàn)有的碳排放稅。總部位于卡爾加里的石油天然氣公司森科爾和塞諾佛斯都表示,2030年每桶油的碳排放可以降低30%。

不堪回首的五年

原油價格保持每桶100美元以上數(shù)年之后,2014年出現(xiàn)暴跌,且未能反彈到之前水平。

來源:彭博社

近年來,科學家將越來越多的自然災(zāi)害與氣候變化聯(lián)系起來。2013年,洪水淹沒了卡爾加里市的市中心,導(dǎo)致曲棍球場的看臺升高。2016年,規(guī)模龐大綽號“野獸”的大火摧毀了麥克默里堡郊區(qū)一大片房屋,當?shù)厥怯蜕暗V企業(yè)生活區(qū)。

盡管有種種讓人體會到切身之痛的案例,但要明確提出應(yīng)對氣候變化的緊迫性以及與阿爾伯塔石油業(yè)務(wù)的聯(lián)系,往往容易遭遇強烈的阻力。石油行業(yè)總喜歡提出,阿爾伯塔的油砂已經(jīng)大幅降低了每桶石油的排放量,之前排放量一直為全球最高。加拿大石油生產(chǎn)商協(xié)會表示,1990年以來每桶油砂原油的排放量下降了32%。能源經(jīng)濟學家說,通過研究和開發(fā)確實減少了多個項目的排放量,其中有些降幅還很大。但油砂密集開采意味著,平均而言阿爾伯塔的石油產(chǎn)品仍比其他大多數(shù)原油更加偏能源密集。此外,今天產(chǎn)量增加也意味著同一時期內(nèi)全行業(yè)絕對排放量增加。

各種爭論中要理清頭緒并不容易。45歲的迪安娜?伯加特以親身經(jīng)歷出發(fā),展示了如何在忠于行業(yè)和關(guān)注氣候之間搭建橋梁。她的經(jīng)驗都來自實打?qū)嵉挠H身經(jīng)歷。當年伯加特35歲,在油砂礦區(qū)擔任工程師期間與生母聯(lián)系上,她的生母是經(jīng)常抗議油砂的原住民女性。兩人交流起來并不容易。“我學會了從愛和尊重出發(fā),進行艱難的兩極分化對話。”她說。

伯加特接受了自己的雙重身份。她年輕時就在石油領(lǐng)域獲得成功,后來才知道自己跟母親一樣屬于原住民德恩和克里族。她想辦法將種種觀點加以融合。如今,伯加特是卡爾加里大學的教授,努力將原住民知識融入工程課程,盡量在項目早期階段參考原住民意見。她還是咨詢公司Indigenous Engineering Inclusion的創(chuàng)始人,與石油公司和原住民團體合作,處理從環(huán)境影響到創(chuàng)造就業(yè)機會等各方面事務(wù)。她說,選擇離開石油行業(yè)投身創(chuàng)業(yè),也是為了“融合”自身身份。她說,她盡最大的努力傾聽每個人的心聲,而且持續(xù)交談,這也是她與母親剛開始談話時學到的策略。

1884年,阿爾弗雷德?歐內(nèi)斯特?克羅斯于從蒙特利爾來到阿爾伯塔,兩年后在卡爾加里以西建立了歷史悠久的A7牧場。后來他成為阿爾伯塔上層,擁有牧場,支持石油天然氣工業(yè),從政,還躋身“四大”,即資助第一屆卡爾加里牛仔節(jié)的四大贊助農(nóng)場主之一,牛仔節(jié)是當?shù)刂呐W懈偧急硌荩掷m(xù)十天。

克羅斯的農(nóng)場成立約100年后,傳給了孫子約翰。約翰?克羅斯決定打破慣例采用整體方式管理牧場,與天然草原的生態(tài)系統(tǒng)合作,不用化肥提高產(chǎn)量。他承認,在20世紀80年代,這一決定“確實不常見,也頗具爭議”。這不是他唯一的奇怪決定。上世紀90年代,他建造了完全“脫離電網(wǎng)”的房子,主要依靠風能和太陽能發(fā)電。(20年后他宣布放棄,用回傳統(tǒng)電力。他承認,完全依賴可再生能源“讓人頭疼”,尤其是冬天。)

今天,約翰?克羅斯相信,新能源轉(zhuǎn)型過程中這塊地可以發(fā)揮作用。他主張通過補償對阿爾伯塔的生態(tài)系統(tǒng)進行再投資,也理解自然的碳匯功能。“所以我認為阿爾伯塔的石油、天然氣和土地產(chǎn)權(quán)能夠互惠互利。”他說。

說回高速公路,正在開車的市長奈什說,受到了新想法的鼓舞,希望阿爾伯塔人都能夠做好準備,找到必要的共同出發(fā)點來踐行廣告牌上迫切的宣傳語。

“你也看到了,最近政府已經(jīng)從‘全押’石油天然氣轉(zhuǎn)向更加平衡。”奈什說,他正穿過大草原前往埃德蒙頓。“人人都想要工作。人人都想要可持續(xù)的經(jīng)濟。這些都應(yīng)該超越黨派偏見。”是時候像廣告牌說的一樣,通過采取實際行動來實現(xiàn)多元化了。

通過數(shù)據(jù)看石油區(qū)

26%

去年,阿爾伯塔GDP當中有26%與石油天然氣行業(yè)有關(guān),也包括采礦業(yè)。該行業(yè)對阿爾伯塔經(jīng)濟的間接影響更大

30億美元

今年阿爾伯塔修訂后預(yù)算中預(yù)計的資源收入缺口,主要因為油價下跌

67000個

據(jù)非營利組織Pembina Institute估計,到2030年,阿爾伯塔轉(zhuǎn)型綠色能源可創(chuàng)造的崗位數(shù)量

96%

阿爾伯塔出口到美國的石油比例。

每桶45美元

業(yè)內(nèi)咨詢公司稱,大多數(shù)油砂原油實現(xiàn)盈虧平衡的油價。某些項目中,盈虧平衡價格可能高達85美元。(財富中文網(wǎng))

本文另一版本登載于《財富》雜志2020年10月刊,標題為《石油熱潮過去之后》。

譯者:馮豐

審校:夏林

加拿大石油天然氣之都阿爾伯塔卡爾加里市中心附近公園里,一只狗在奔跑。

在接受我的電話采訪時,卡爾加里市的市長納希德?奈什正驅(qū)車一路向北,前往埃德蒙頓去省議會開會。這段路車程達三小時,一路上我們都在交談。他沿著一段平坦的高速公路前行,背景傳來GPS指路的聲音,他開始介紹城市面臨的挑戰(zhàn)。石油價格跌跌不休,疫情來襲讓情況更糟,卡爾加里財政狀況格外緊張。面臨戲劇性的經(jīng)濟衰退,人們越發(fā)關(guān)注奈什強調(diào)多年的問題,即卡爾加里對石油和天然氣工業(yè)的過度依賴。

48歲的奈什曾經(jīng)在麥肯錫擔任顧問,向來以開朗友好著稱,畢竟他是加拿大人。他是很樂觀,但在直言評價卡爾加里經(jīng)濟狀況時,從聲音中能夠聽出一絲沮喪:“呃,不太好。”

突然,奈什的話停了下來,開始讀路邊一塊廣告牌,上面寫著阿爾伯塔的宣傳語:“實現(xiàn)經(jīng)濟多樣化。”“對。”他冷冷地說。然后他笑著補充道:“說得挺到位。”

這句宣傳語不僅簡單,也很引人注目。奈什指出,這代表著加拿大阿爾伯塔省宣傳的突然轉(zhuǎn)向。“六個月前我可不會看到這種廣告牌。”他說。如今,疫情導(dǎo)致的創(chuàng)傷把全世界最大的石油天然氣中心之一長期爭論的話題迅速改變。

卡爾加里人口有130萬,是加拿大能源行業(yè)企業(yè)和金融中心。2010年奈什當選后,成為北美大城市的首位穆斯林市長。他借助紅藍中間派選民組成的“紫色浪潮”聯(lián)盟贏得競選,宣誓就職時恰逢20年繁榮期臨近結(jié)束。奈什號召通過投資石油天然氣以外的行業(yè)來鞏固卡爾加里的經(jīng)濟實力。過去10年里,油價從每桶超過100美元暴跌到目前的不到40美元,而且一路走低,阿爾伯塔很多人的本能反應(yīng)是靜靜等著下滑趨勢逆轉(zhuǎn)。而環(huán)保主義者的批評聲勢浩大又與日俱增,也讓支持奈什的一些選民更加抗拒。

流沙

阿爾伯塔巨大的石油供應(yīng)量在全球僅次于委內(nèi)瑞拉和沙特阿拉伯,推動了長時間的繁榮。但由于油價較低,油砂開采原油的成本相對較高,削弱了該地區(qū)的吸引力。

來源:阿爾伯塔能源監(jiān)管局

阿爾伯塔的能源主要是北部出產(chǎn)的所謂油砂。該地區(qū)的非常規(guī)石油儲量龐大,已探明儲量達1654億桶,位居全球第三,僅次于委內(nèi)瑞拉和沙特阿拉伯。油砂占加拿大石油產(chǎn)量的60%以上。也正因如此,阿爾伯塔成了國際上環(huán)保積極人士的目標。

油砂煉油必須從含油泥沙中提取和加工,成本高昂且伴隨大量排放,比起傳統(tǒng)鉆探通常更類似露天開采。長期以來,航空拍攝的大量尾礦池,即開采過程中厚厚的油性副產(chǎn)品引發(fā)了環(huán)保人士抵制。近年,環(huán)保人士一直呼吁封閉Keystone XL輸油管道,該管道可以向美國輸送更多油砂原油。盡管特朗普政府努力推動管道項目,然而美國一項法律規(guī)定已經(jīng)叫停建設(shè)。

從油砂中煉油伴隨著大量排放。

多年來,油砂提供的稅收收入確保阿爾伯塔的預(yù)算平衡,而且阿爾伯塔一直為聯(lián)邦政府貢獻收入,供其在全國重新分配。

然而,如今阿爾伯塔的會計師們發(fā)現(xiàn)了巨大的漏洞。今年8月,阿爾伯塔政府發(fā)布了本年度修訂后的預(yù)算預(yù)測,赤字比2月的預(yù)測高出128億美元,主要原因是石油天然氣部門的資源收入預(yù)計比之前預(yù)測低30億美元。與此同時,8月阿爾伯塔的失業(yè)率接近12%,在加拿大各省排名第二。預(yù)計今年阿爾伯塔經(jīng)濟將萎縮8.8%。去年,石油天然氣以及采礦業(yè)占了該省GDP的26%,間接影響則更為廣泛。因此,經(jīng)濟放緩讓人很不安。

從許多方面來說,阿爾伯塔充分體現(xiàn)了從美國西得克薩斯州到中東等石油資源豐富地區(qū)的困境。疫情只是徹底揭露了阿爾伯塔在經(jīng)濟上面臨挑戰(zhàn),導(dǎo)致問題更加嚴峻。這也是產(chǎn)油核心地區(qū)面臨的興衰轉(zhuǎn)換難題。當形勢一片大好時,人們沒有動力考慮從利潤豐厚的行業(yè)轉(zhuǎn)移。日子不好過的時候則口袋空空。不過,打破“資源詛咒”很困難,阿爾伯塔的問題尤其麻煩,因為當?shù)厣罹觾?nèi)陸,非常依賴南部的貿(mào)易伙伴美國,目前其96%的出口都是運往美國。同時,在政府和機構(gòu)投資者支持下,越來越多的綠色能源倡導(dǎo)者正在全球范圍推動加快淘汰化石燃料。阿爾伯塔必須順應(yīng)形勢,否則可能在新能源經(jīng)濟中落后。

嚴峻的挑戰(zhàn)

在水力壓裂技術(shù)的推動下,過去十年里美國得州石油產(chǎn)量超過了阿爾伯塔。今年,受疫情影響,阿爾伯塔失業(yè)人數(shù)激增。

資料來源:美國能源信息署;阿爾伯塔能源監(jiān)管局

這就是奈什為何認為阿爾伯塔別無選擇,只能迅速改變對未來的看法。卡爾加里要接受發(fā)展清潔能源就業(yè)機會的新運動,也要加快在其他領(lǐng)域投資的步伐。

“有個非常著名的騎車保險杠貼紙。上面寫著:‘上帝啊,再讓我轟隆一次吧,這次一定不會糟蹋了。’”奈什邊說邊開車穿過草原。

他繼續(xù)說:“這段時間我一直在說:‘我們不能糟蹋經(jīng)濟衰退。’我們特別擅長糟蹋繁榮。水平真的很高。我們真的不能浪費經(jīng)濟衰退帶來的機會。”

如果現(xiàn)在卡爾加里還不能改變,還有機會改變嗎?

我出生時恰逢石油危機。1989年11月,我出生在卡爾加里,當天沙特阿拉伯宣布發(fā)現(xiàn)了一處新的大油田。似乎世界上到處都是原油。當時油價僅為每桶20美元。種種因素促成了我的父母在卡爾加里的“銀拖鞋沙龍”酒吧(Silver Slipper Saloon)相識,加入了前些年逐漸衰落的行業(yè)。(我父母一輩子都在能源行業(yè)。)

我開始上學時,出現(xiàn)了油砂擴張驅(qū)動的新一輪繁榮。這波繁榮時間最長,規(guī)模也最大。很快,咖啡連鎖店想招新員工都挺難。郊區(qū)到處鮮花盛開。連十幾歲的男孩都知道,輟學去鉆臺工作很快就能賺大錢。

當前這波下跌始于2014年,幾個月里油價就下跌了超過50%。盡管后來有周期性反彈,但自那以后油價持續(xù)走低。最大原因是采用水力壓裂技術(shù)的美國石油產(chǎn)量令人吃驚地激增。2010年,美國石油日產(chǎn)量約為550萬桶。去年日均產(chǎn)量超過1220萬桶。疫情導(dǎo)致的經(jīng)濟放緩只會加大油價下行壓力。國際能源署的最近估計是,今年全球石油需求預(yù)計為平均每天9190萬桶,比2019年減少810萬桶。

雖然疫情過后油價可能再次攀升,但有跡象表明,類似上一波的繁榮可能永遠不會重現(xiàn)。8月安永一份報告顯示,自動化對阿爾伯塔50%的上游能源就業(yè)崗位造成威脅。卡爾加里經(jīng)濟發(fā)展委員會表示,為推動能源行業(yè)數(shù)字化程度,必須開展大規(guī)模再培訓,主要針對卡爾加里多出的石油工程師和地球物理學家能再就業(yè)的工作崗位。在奈什領(lǐng)導(dǎo)下,卡爾加里一直努力推動經(jīng)濟發(fā)展。2018年,卡爾加里設(shè)立了1億美元基金,向承諾創(chuàng)造就業(yè)機會的科技創(chuàng)業(yè)公司和非石油天然氣行業(yè)的當?shù)仄髽I(yè)提供資助。但在疫情和油價暴跌的夾擊下,一些能夠創(chuàng)造就業(yè)機會的來源受到重創(chuàng),比如曾經(jīng)爆發(fā)式增長的餐館和釀酒廠,以及落基山脈附近的旅游業(yè)。

阿爾伯塔跟一些石油資源豐富的經(jīng)濟體不同,多年來并沒做到未雨綢繆。這方面最突出的是多年來靠著石油財富已積累1萬億美元主權(quán)財富基金的挪威。當?shù)赜?30億美元的阿爾伯塔儲蓄信托基金(Alberta Heritage Savings Trust Fund),規(guī)模根本不足以填補缺口。雖然1976年基金成立以來,政府收入大幅增加,但基金市值卻基本上未變。阿爾伯塔的財富主要投向建立全球一流的公共醫(yī)療和教育,稅收也是全國最低。

當然,即便油價不出現(xiàn)大幅反彈,預(yù)計油氣行業(yè)也不會很快消失。雖然有可能積極推進綠色經(jīng)濟轉(zhuǎn)型,預(yù)計到2050年仍然會保留一些石油生產(chǎn),問題只是從何處開采。挪威能源咨詢公司Rystad energy預(yù)計,未來10年加拿大西部地區(qū)石油產(chǎn)量年增長率將接近2%,因為墨西哥和受危機重創(chuàng)的委內(nèi)瑞拉產(chǎn)量下降,而阿爾伯塔對重質(zhì)原油仍然有大量需求。但不少分析師表示,現(xiàn)在不會有油砂方面的新投資。一些國際石油公司,如法國道達爾公司已經(jīng)完全撤出該地區(qū)。

石油行業(yè)從阿爾伯塔撤出,部分原因在于政治不確定性,即Keystone及其他石油運輸管道能否獲批。但最大的問題是在油砂煉油成本。Rystad Energy和總部位于愛丁堡的能源咨詢公司W(wǎng)ood Mackenzie都將油砂煉油盈虧價格定在每桶45美元左右,一些項目成本能夠維持在20至30美元之間。不過,另一些成本高得多。

油砂項目需要龐大的基礎(chǔ)設(shè)施投入,通常需要40至50年才能夠啟動。哪怕是最高效的開發(fā)項目也要有非常密集的資本。2019年阿爾伯塔政府估計,最貴的礦業(yè)項目初始盈虧平衡價格高達每桶75美元或85美元。這個門檻相當高,尤其是當前銀行和其他投資集團又面臨著收緊化石燃料融資的壓力。

奈什和政府同僚必須接受的另一個現(xiàn)實是,基本上不可能通過政策來實現(xiàn)油價上漲帶動經(jīng)濟繁榮。阿爾伯塔大學的能源經(jīng)濟學家安德魯?利奇表示,加拿大其他地區(qū),尤其是大西洋沿岸省份,在鱈魚捕撈和伐木業(yè)都已經(jīng)歷前所未有的蕭條,可以說比阿爾伯塔更需要幫助。目前并未出現(xiàn)一鳴驚人的解決方案。阿爾伯塔經(jīng)濟繁榮的一大諷刺是,雇用的很多員工都是因為大西洋沿岸經(jīng)濟蕭條才不得不另覓生路。“不管政府怎么推政策,也無法每年自動吸引數(shù)十億美元的外國直接投資。”利奇說。

在阿爾伯塔,石油天然氣工人普遍受過高等教育,專業(yè)化程度高,工資也很高。雖然科技行業(yè)蒸蒸日上,也無法保證新工作崗位能夠達到相應(yīng)標準。但也有阿爾伯塔人在默默努力。

利亞姆?希爾德布蘭德曾經(jīng)想利用在油田當焊工時學到的技能來推動綠色能源轉(zhuǎn)型,但根本找不到工作。他說,有人認為石油天然氣工人并不愿意從事可再生能源工作。事實并非如此。如果連工作機會都沒有,怎么指望人們投身建設(shè)綠色的未來。

20歲時,希爾德布蘭德在石油行業(yè)找到第一份工作。2010年,他回到大學攻讀地理學位,主要關(guān)注綠色能源事業(yè),但找不到工作。于是他又回到油砂礦當了六年焊工。“從一天開始,我的外號就是綠色和平。”他笑著說。盡管身邊不少同事都有合理懷疑,但很多人承認內(nèi)心很擔心氣候變化,也承受著行業(yè)繁榮蕭條的壓力。

希德布拉姆在石油行業(yè)工作多年。如今他負責一家非營利組織,倡導(dǎo)投資可持續(xù)能源。

2015年,隨著油價暴跌,工作午餐時的談話變得越發(fā)緊迫。“我們不是在討論假設(shè)的情況了。”他說,“明天就可能失業(yè)。該怎么辦?”

那一年,如今35歲的希爾德布蘭德和石油行業(yè)的同事成立了“鐵與地球”(Iron & Earth)非營利組織,倡導(dǎo)可持續(xù)能源投資。他們認為,全面能源轉(zhuǎn)型將推動巨大的基礎(chǔ)設(shè)施建設(shè)熱潮,不僅包括風能和太陽能,也包括生物能、地熱能和氫能發(fā)電廠。

愿景雄心勃勃,可惜與現(xiàn)實相去甚遠。進展倒是有一些。今年,伯克希爾-哈撒韋能源公司加拿大子公司新投資的風電場將為阿爾伯塔東南部提供相當于7.9萬戶家庭用量的電力。2019年,可再生能源發(fā)電量不到總發(fā)電量的10%。但據(jù)加拿大風能協(xié)會統(tǒng)計,目前阿爾伯塔已經(jīng)是全國第三大風能市場,裝機容量達1685兆瓦。2017年,加拿大清潔能源部估計,清潔能源就業(yè)崗位有26358個,整體行業(yè)約占阿爾伯塔GDP的1%。6月,位于阿爾伯塔的環(huán)境非政府組織Pembina Institute表示,綠色能源轉(zhuǎn)型過程中,預(yù)計到2030年將在阿爾伯塔創(chuàng)造6.7萬個就業(yè)崗位,相當于能源部門現(xiàn)有員工的67%。

希爾德布蘭德目前已經(jīng)辭去石油行業(yè)的工作,全職經(jīng)營“鐵與地球”,他相信阿爾伯塔人已經(jīng)準備好迎接大變革。“工人們都已經(jīng)覺醒。”他說。

然而,并非每個阿爾伯塔人都對綠色能源的概念持開放態(tài)度。近年來,阿爾伯塔政治兩極分化愈演愈烈,導(dǎo)致可持續(xù)性相關(guān)對話愈加困難。2020年3月加拿大廣播公司CBC主持了一項民意調(diào)查,詢問阿爾伯塔如何才能讓經(jīng)濟重回正軌。調(diào)查顯示,近40%的受訪者提到要控制疫情或政府支持,還有約30%的受訪者表示“需要經(jīng)濟多元化”,29%的受訪者表示“加大石油投資”。此類指標與受訪者的投票密切相關(guān)。2018年3月以來,自稱政治上偏左派或右派的人有所增加,而自稱保持中立的人減少了9%。

很多阿爾伯塔人對反對化石燃料的論點持懷疑態(tài)度。2018年P(guān)embina Institute采取了一項判斷人們對可持續(xù)能源態(tài)度的調(diào)查,叫“阿爾伯塔故事項目”,發(fā)現(xiàn)約半數(shù)參與者要么堅決拒絕氣候變化的概念,要么懷疑氣候變化到底是不是由人類行為造成。

企業(yè)界的觀點不一。之前我采訪的多名能源經(jīng)濟學家和專家表示,該地區(qū)最大規(guī)模的石油天然氣公司高管極度懷疑氣候變化,普遍支持現(xiàn)有的碳排放稅。總部位于卡爾加里的石油天然氣公司森科爾和塞諾佛斯都表示,2030年每桶油的碳排放可以降低30%。

不堪回首的五年

原油價格保持每桶100美元以上數(shù)年之后,2014年出現(xiàn)暴跌,且未能反彈到之前水平。

來源:彭博社

近年來,科學家將越來越多的自然災(zāi)害與氣候變化聯(lián)系起來。2013年,洪水淹沒了卡爾加里市的市中心,導(dǎo)致曲棍球場的看臺升高。2016年,規(guī)模龐大綽號“野獸”的大火摧毀了麥克默里堡郊區(qū)一大片房屋,當?shù)厥怯蜕暗V企業(yè)生活區(qū)。

盡管有種種讓人體會到切身之痛的案例,但要明確提出應(yīng)對氣候變化的緊迫性以及與阿爾伯塔石油業(yè)務(wù)的聯(lián)系,往往容易遭遇強烈的阻力。石油行業(yè)總喜歡提出,阿爾伯塔的油砂已經(jīng)大幅降低了每桶石油的排放量,之前排放量一直為全球最高。加拿大石油生產(chǎn)商協(xié)會表示,1990年以來每桶油砂原油的排放量下降了32%。能源經(jīng)濟學家說,通過研究和開發(fā)確實減少了多個項目的排放量,其中有些降幅還很大。但油砂密集開采意味著,平均而言阿爾伯塔的石油產(chǎn)品仍比其他大多數(shù)原油更加偏能源密集。此外,今天產(chǎn)量增加也意味著同一時期內(nèi)全行業(yè)絕對排放量增加。

身為長期從事石油天然氣行業(yè)的資深人士,同時也是原住民女性,迪安娜?伯加特努力將行業(yè)評論家和支持者的觀點結(jié)合起來。

各種爭論中要理清頭緒并不容易。45歲的迪安娜?伯加特以親身經(jīng)歷出發(fā),展示了如何在忠于行業(yè)和關(guān)注氣候之間搭建橋梁。她的經(jīng)驗都來自實打?qū)嵉挠H身經(jīng)歷。當年伯加特35歲,在油砂礦區(qū)擔任工程師期間與生母聯(lián)系上,她的生母是經(jīng)常抗議油砂的原住民女性。兩人交流起來并不容易。“我學會了從愛和尊重出發(fā),進行艱難的兩極分化對話。”她說。

伯加特接受了自己的雙重身份。她年輕時就在石油領(lǐng)域獲得成功,后來才知道自己跟母親一樣屬于原住民德恩和克里族。她想辦法將種種觀點加以融合。如今,伯加特是卡爾加里大學的教授,努力將原住民知識融入工程課程,盡量在項目早期階段參考原住民意見。她還是咨詢公司Indigenous Engineering Inclusion的創(chuàng)始人,與石油公司和原住民團體合作,處理從環(huán)境影響到創(chuàng)造就業(yè)機會等各方面事務(wù)。她說,選擇離開石油行業(yè)投身創(chuàng)業(yè),也是為了“融合”自身身份。她說,她盡最大的努力傾聽每個人的心聲,而且持續(xù)交談,這也是她與母親剛開始談話時學到的策略。

1884年,阿爾弗雷德?歐內(nèi)斯特?克羅斯于從蒙特利爾來到阿爾伯塔,兩年后在卡爾加里以西建立了歷史悠久的A7牧場。后來他成為阿爾伯塔上層,擁有牧場,支持石油天然氣工業(yè),從政,還躋身“四大”,即資助第一屆卡爾加里牛仔節(jié)的四大贊助農(nóng)場主之一,牛仔節(jié)是當?shù)刂呐W懈偧急硌荩掷m(xù)十天。

克羅斯的農(nóng)場成立約100年后,傳給了孫子約翰。約翰?克羅斯決定打破慣例采用整體方式管理牧場,與天然草原的生態(tài)系統(tǒng)合作,不用化肥提高產(chǎn)量。他承認,在20世紀80年代,這一決定“確實不常見,也頗具爭議”。這不是他唯一的奇怪決定。上世紀90年代,他建造了完全“脫離電網(wǎng)”的房子,主要依靠風能和太陽能發(fā)電。(20年后他宣布放棄,用回傳統(tǒng)電力。他承認,完全依賴可再生能源“讓人頭疼”,尤其是冬天。)

農(nóng)場主約翰?克羅斯在阿爾伯塔南頓附近歷史悠久的A7牧場上。

今天,約翰?克羅斯相信,新能源轉(zhuǎn)型過程中這塊地可以發(fā)揮作用。他主張通過補償對阿爾伯塔的生態(tài)系統(tǒng)進行再投資,也理解自然的碳匯功能。“所以我認為阿爾伯塔的石油、天然氣和土地產(chǎn)權(quán)能夠互惠互利。”他說。

說回高速公路,正在開車的市長奈什說,受到了新想法的鼓舞,希望阿爾伯塔人都能夠做好準備,找到必要的共同出發(fā)點來踐行廣告牌上迫切的宣傳語。

“你也看到了,最近政府已經(jīng)從‘全押’石油天然氣轉(zhuǎn)向更加平衡。”奈什說,他正穿過大草原前往埃德蒙頓。“人人都想要工作。人人都想要可持續(xù)的經(jīng)濟。這些都應(yīng)該超越黨派偏見。”是時候像廣告牌說的一樣,通過采取實際行動來實現(xiàn)多元化了。

通過數(shù)據(jù)看石油區(qū)

26%

去年,阿爾伯塔GDP當中有26%與石油天然氣行業(yè)有關(guān),也包括采礦業(yè)。該行業(yè)對阿爾伯塔經(jīng)濟的間接影響更大

30億美元

今年阿爾伯塔修訂后預(yù)算中預(yù)計的資源收入缺口,主要因為油價下跌

67000個

據(jù)非營利組織Pembina Institute估計,到2030年,阿爾伯塔轉(zhuǎn)型綠色能源可創(chuàng)造的崗位數(shù)量

96%

阿爾伯塔出口到美國的石油比例。

每桶45美元

業(yè)內(nèi)咨詢公司稱,大多數(shù)油砂原油實現(xiàn)盈虧平衡的油價。某些項目中,盈虧平衡價格可能高達85美元。(財富中文網(wǎng))

本文另一版本登載于《財富》雜志2020年10月刊,標題為《石油熱潮過去之后》。

譯者:馮豐

審校:夏林

The Mayor of Calgary is driving north. Naheed Nenshi is making the three-hour trip to a meeting of the provincial legislature in Edmonton, and I’m along for the ride via speakerphone. As he heads down a flat stretch of highway, the GPS bleating instructions in the background, Nenshi begins laying out the challenges that his city is facing. A prolonged slump in oil prices, made worse by the pandemic, has severely strained Calgary’s finances. And the dramatic downturn has put a new spotlight on a problem that Nenshi has been talking about for years: the region’s unhealthy overdependence on the oil and gas industry.

A onetime McKinsey consultant, Nenshi, 48, is famously cheerful and friendly; he is, after all, Canadian. So he comes across as pretty upbeat. But it’s possible to detect just a touch of frustration in his voice as he offers a blunt assessment of his city’s economic situation: “Uh, not great.”

Suddenly, Nenshi interrupts himself to read a billboard he’s driving past with a message from the government of Alberta: “Diversify Our Economy.” “That’s it,” he says drily. Then he adds, chuckling: “That’s all it says.”

The language is striking for more than its simplicity. Nenshi points out that it represents a sudden shift in messaging from the government of the Canadian province. “I would not have seen that billboard six months ago,” he says. The trauma of the COVID-19 crisis, however, has quickly reshaped a long-running debate in one of the world’s biggest strongholds for the oil and gas business.

Calgary, a city of 1.3 million people, is the corporate and financial headquarters of Canada’s energy industry. When Nenshi was elected in 2010, he became the first Muslim mayor of a major North American city. He rode to victory on a “purple wave” coalition of red and blue centrist voters and took office near the end of a two-decade boom. Nenshi touted plans to build on Calgary’s economic strength by investing in industries outside of oil and gas. But as oil prices have tumbled from above $100 per barrel over the past decade to the current level below $40—falling even lower along the way—the instinct of many of his fellow Albertans has been to hunker down and wait for the slide to reverse. And a loud and growing chorus of criticism from environmentalists has caused some of Nenshi’s constituents to grow even more defiant.

Alberta’s energy wealth is derived primarily from the so-called oil sands located in the region’s north. The area’s vast unconventional petroleum deposits add up to proven reserves of 165.4 billion barrels—the third-largest total in the world after Venezuela and Saudi Arabia. The sands are the source of more than 60% of Canada’s oil production. They have also made Alberta a global target for activists.

Crude from the oil sands must be extracted and processed from a sandy sludge, in a costly and emissions-intensive process that often more closely resembles open-pit mining than conventional drilling. Aerial photos of the vast ponds of tailings—a thick, oily by-product of the extraction process—have long sparked pushback by environmentalists. Blocking the Keystone XL pipeline, which would bring additional oil-sands crude to the U.S., has been a major priority of environmental campaigners in recent years. A legal effort has successfully stopped construction in the U.S. for the time being, despite the Trump administration’s efforts to push the pipeline ahead.

For years, tax revenues from the oil sands helped fund robust and balanced budgets in Alberta. And the province still makes a net contribution to the federal government that is redistributed across the country.

Today, however, the province’s accountants are looking at a gaping hole. In August, the Alberta government released a revised budget forecast for the current year with a deficit that was $12.8 billion larger than projected back in February. Resource revenues, mainly from the oil and gas sector, are expected to be $3 billion below the original projection. The unemployment rate in Alberta, meanwhile, stood at nearly 12% in August, the second-highest of any province in the country. And the province’s economy is expected to contract 8.8% this year. Last year, oil and gas, along with mining, accounted for 26% of Alberta’s GDP, and its indirect impact was even bigger. So the slowdown stings.

In many ways, Alberta is emblematic of the struggle going on in oil-rich areas around the world, from West Texas to the Middle East. The pandemic has merely laid bare and made even starker the economic challenges Alberta was already facing—the essential conundrums of boom and bust at the heart of any oil region. When times are good, there’s little motivation to shift attention away from a lucrative sector. When times are bad, there’s no money. But while breaking the “resource curse” is always hard, the problem is especially vexing in Alberta, which is landlocked and dependent on its trading partner to the south—the U.S. is the destination for 96% of its exports. Meanwhile, green-energy advocates—increasingly with the heft of governments and institutional investors behind them—are gaining new traction globally in the push to accelerate the transition away from fossil fuels. Alberta must adapt, or it could be left behind in the new energy economy.

That’s why Nenshi believes that the region has no choice but to change how it sees its future, and quickly. Calgary must embrace a nascent movement to develop clean-energy jobs, and up the pace of its investment in other areas.

“There is a very famous bumper sticker. And it says, ‘God, grant me another boom, I promise not to piss it away this time,’?” says Nenshi as his car rolls through the prairie.

He continues: “What I’ve been saying for some time is, ‘We can’t piss away the downturn, either.’ We’re exceptionally good at pissing away booms. We’re world-class at it. But we cannot actually afford to piss away a downturn.”

If Calgary can’t change now, can it ever?

*****

My arrival in this world coincided with an oil bust. I was born in Calgary in November 1989, on the same day that Saudi Arabia announced the discovery of a major new oilfield. The world was seemingly awash in crude. And it was trading at just $20 a barrel. All of which meant that the industry that had drawn my parents—who met at a Calgary bar called the Silver Slipper Saloon—to the city earlier that decade was in decline. (Both of my parents have spent their careers in the energy sector.)

By the time I was starting school, a new boom had begun, driven by the expansion of the oil sands. It would be the longest, biggest boom of all. Before long, coffee chains were struggling to find staff; the suburbs were blooming in every direction; and teenage boys knew they could get big money, fast, by dropping out to work on the rigs.

The current reckoning really began in 2014, when oil prices dropped by more than 50% in a matter of months. Despite periodic rallies, oil has remained persistently lower since then. The biggest reason has been the astonishing, fracking-enabled surge in U.S. oil production. In 2010, the U.S. produced some 5.5 million barrels per day of oil. Last year, the average was over 12.2 million barrels per day. Now the coronavirus-driven economic slowdown has only increased the downward pressure on prices. The most recent estimate from the International Energy Agency is that global oil demand is expected to average 91.9 million barrels per day this year—that’s 8.1 million barrels per day less than in 2019.

While it’s possible oil prices could climb again post-pandemic, there are signs that another boom like the last one may never come back. Automation threatens 50% of upstream energy jobs in the province, according to an August report by EY. And Calgary Economic Development, an economic council, says that retraining for jobs in a more digital energy sector—largely for the kinds of jobs that can repurpose Calgary’s surplus of petroleum engineers and geophysicists—must happen on a massive scale. The city of Calgary, led by Nenshi, has been trying to stoke new economic development. In 2018, the city created a $100 million fund to give grants to tech startups and other local businesses outside the oil and gas industry that pledge to create jobs. But the pairing of the pandemic and the oil slump has also hit some alternative sources of job creation—like what was an exploding restaurant and brewery scene, and tourism around the Rockies.

Unlike some oil-rich economies—notably Norway, which socked away its petroleum riches over the years to amass what is now a $1 trillion sovereign wealth fund—Alberta hasn’t saved much for a rainy day. The province’s own Alberta Heritage Savings Trust Fund, with some $13 billion in assets, is simply not large enough to plug the gap. While government revenue has soared since 1976, when the fund was created, its value has essentially remained flat: Alberta’s riches, instead, went to its world-class public health care and education—and toward the lowest taxes in the country.

Of course, the oil and gas sector is not expected to disappear any time soon, even if prices don’t rise dramatically. Even under aggressive forecasts for transitioning to a green economy, some oil production is still expected to be in place by 2050—it’s simply a matter of where it will come from. The Norwegian energy consultancy Rystad Energy still expects oil production across western Canada to grow by close to 2% annually for the next decade, with demand for Alberta’s heavier-style crude bolstered by declining output from Mexico and crisis-wracked Venezuela. But new investment in the oil sands in particular is nonexistent right now, according to a range of analysts. Some international oil companies, such as French giant Total, have pulled out of the region completely.

The industry’s pullback from Alberta can be chalked up in part to political uncertainty over whether or not Keystone and other pipelines to bring more oil out of the region will be approved. But the biggest issue is the cost of producing crude in the oil sands. Both Rystad Energy and Wood Mackenzie, the Edinburgh-based energy consultancy, put the break-even price for existing oil-sands production at around $45 per barrel, with some projects able to keep the lights on in the $20 to $30 range. For some projects, though, the price is much higher.

Oil-sands projects are vast pieces of infrastructure and typically require 40- to 50-year commitments to get off the ground. And even the most efficient developments are hugely capital intensive. The Alberta government estimated in 2019 that the most expensive mining-style projects’ initial break-even price is as steep as $75 or $85 per barrel. That’s a very high bar to meet, especially when banks and other investment groups are under pressure to tighten financing for fossil-fuel projects.

Another reality that Nenshi and his peers in government must accept is that economic prosperity on the scale of an oil boom is basically impossible to manufacture through policy. In fact, other parts of Canada—particularly the Atlantic provinces, which already lived through their own epic busts in the cod fishing and logging industries—arguably need help even more than Alberta, says Andrew Leach, an energy economist at the University of Alberta. And yet there have been few blockbuster solutions. One of the great ironies of the Alberta boom was that it employed so many of the people whose economic futures had been displaced by the busts in Atlantic Canada that came before. “There’s nothing that a government policy can do that’s automatically going to bring in billions of dollars of foreign direct investment every year,” Leach says.

The average oil and gas worker in Alberta is highly educated, specialized, and well-paid. Despite the sparkle of the tech economy, there is no guarantee that the new jobs that might arrive will match that standard. But there are Albertans who are determined to do their best to make it so.

*****

Lliam Hildebrand wanted to use his skills as a welder in the oil patch to assist the green-energy transition—he just couldn’t get a job. There’s an assumption that oil and gas workers don’t want to work in renewable energy, he says. But that’s not the case. The truth is that you can’t expect people to jump on a green future without a job.

Hildebrand took his first job in the oil business at age 20. In 2010, he went back to university to get a degree in geography with an eye toward a career in green energy—but no job offers materialized. So he returned to the oil sands to work as a welder for another six years. “I was nicknamed Greenpeace, like day one,” he says with a laugh. But while many of his colleagues were legitimately skeptical, others admitted that worries over climate change, or the stress of boom and bust, were wearing on them.

By 2015, with oil prices crashing, the conversations over lunch in the work camps gained new urgency. “We weren’t discussing a hypothetical situation,” he says. “We might not have a job tomorrow. What are we going to do about that?”

That year Hildebrand, now 35, and a group of his fellow oil-sector workers, formed a nonprofit called Iron & Earth to advocate for sustainable energy investment. They argue that a full energy transition will produce a vast infrastructure building boom, across not just wind and solar, but biomass, geothermal, and hydrogen plants.

It’s an ambitious vision—and far from the current reality. But there are signs of progress. This year a new wind farm funded by Berkshire Hathaway Energy's Canadian subsidiary will power the equivalent of 79,000 homes in southeast Alberta. Renewables made up less than 10% of the province’s electricity generation in 2019. But Alberta is now the country’s third-largest wind market, with 1,685 megawatts of installed capacity, according to the Canadian Wind Energy association. In 2017, Clean Energy Canada estimated that the province was home to 26,358 jobs in clean energy, with the sector representing about 1% of the province’s GDP. In June, the Pembina Institute, an Alberta-based environmental NGO, said it estimated 67,000 jobs—the equivalent of 67% of the current employees of the resources sector in the province—could be created by 2030 as part of a green-energy transition.

Hildebrand, who left his oil job to run Iron & Earth full-time, believes that Albertans are ready to embrace big changes. There is a “whole awakening among workers,” he says.

*****

Not everyone in the province is so open to the concept of green energy. In recent years, Alberta has become more politically polarized, and that has made conversations about sustainability more difficult. A poll by the Canadian broadcaster CBC in March 2020 asked Albertans what the province needed to get its economy back on track. While nearly 40% mentioned the need to control pandemic or government support, some 30% of respondents said “economic diversification,” while 29% said “double down on oil.” Such markers were closely linked to how respondents vote, the survey noted. And since March 2018, those self-reporting that they are on either the left or the right politically have grown, while those reporting they are in the center shrunk by 9%.

Many Albertans are dubious about the arguments against fossil fuels. A 2018 effort by the Pembina Institute to gauge attitudes about sustainability, called The Alberta Narratives Project, found that about half of the people who participated either rejected the concept of climate change outright or doubted that it is caused by human behavior.

Within the corporate community, views are mixed. Multiple energy economists and experts I spoke with said climate-change doubt is unheard-of among executives at the largest oil and gas companies in the region, and support for an existing carbon tax is widespread. Both Suncor and Cenovus, Calgary-based oil and gas companies, have said they would reduce their per-barrel emissions intensity by 30% by 2030.

There have been plenty of examples in recent years of the damaging natural disasters that scientists are increasingly connecting to climate change. In 2013, flooding engulfed downtown Calgary, rising up the stands at the city’s hockey stadium. And in 2016, a fire so massive it was nicknamed “The Beast” eviscerated swaths of suburban homes in Fort McMurray, the company town that serves the oil sands.

Despite these visceral examples, broaching the urgency of addressing climate change and how it intersects with Alberta’s oil sector tends to come up against stout resistance. One argument the industry likes to make is that Alberta’s oil sands have dramatically reduced their emissions per barrel, which have historically been among the highest in the world. The Canadian Association of Petroleum Producers says that oil-sands emissions per barrel have fallen by 32% since 1990. And energy economists say it’s true that research and development has reduced per-barrel emissions across many of the projects, in some cases dramatically. But the intense extraction process in the oil sands means that, on average, Alberta’s product is still more energy-intensive than most other barrels. Plus, higher production volumes today mean that absolute emissions from the sector have increased over that same period.

Navigating these debates can be tricky. Deanna Burgart, 45, offers herself as an example of how to bridge the gap between loyalty to the industry and concern about the climate. She has learned from her own hard-won experience. Burgart was 35 and working as an engineer in the oil sands when she developed a relationship with her birth mother—an Indigenous woman and regular protester against the oil sands. It wasn’t easy. “I learned how to have these difficult, polarized conversations from a place of love and respect,” she says.

Burgart embraced her dual identities. She had found early success in the oil business. And now she learned that she was a Dene and Cree woman on her mother’s side. She sought a way to combine these perspectives. Today, Burgart is a teaching chair focused on integrating Indigenous knowledge into the engineering curriculum at the University of Calgary, working to bring First Nations perspective into projects at the earliest stages. She is also the founder of Indigenous Engineering Inclusion, a consulting company, where she works with oil companies and First Nations groups to address everything from environmental impact to the prospects for job creation. She describes the choice to quit her job in the sector and start her own business as a choice to “converge” her identities. These days she does her best, she says, to listen to everyone, and just keep talking—a strategy she learned in those early conversations with her mom.

*****

Alfred Ernest Cross first arrived in Alberta from Montréal in 1884, founding the historic A7 Ranche just west of Calgary two years later. He would go on to become Albertan royalty: a ranchman, a proponent of the oil and gas industry, a politician, and one of the “Big Four”—the four ranchers that financed the first Calgary Stampede, the city’s famous 10-day festival and rodeo.

Roughly 100 years after Cross founded his ranch, it passed into the hands of his grandson John. And John Cross decided to buck convention. He decided to adopt a holistic method of managing his ranch, working with the ecosystem of the natural grasslands to increase yields without fertilizer. It was a decision that, in the 1980s, was “really uncommon and quite controversial,” he admits. It wasn’t his only quirky decision. In the 1990s, he built an entirely “off-the-grid” house, powering it largely with wind and solar. (Twenty years later, he gave in and ran electric power. Relying completely on renewables “was a pain in the ass,” he admits, especially in winter.)

Today John Cross believes the land has a place to play in a new energy transition. He advocates using offsets to reinvest in Alberta’s ecosystem, and understanding nature’s role as a carbon sink. “I think that’s where oil and gas and land ownership in Alberta can benefit each other,” he says.

Back on the highway, the mayor says he is buoyed by new ideas emerging, and he’s hopeful that Albertans are ready at last to find the common ground necessary to deliver on the urgent billboard directive.

“I think you’ve seen government shift just very recently from ‘a(chǎn)ll in’ on oil and gas to a more balanced view,” says Nenshi, as he rolls along through the prairie on the road to Edmonton. “Everyone wants jobs. Everyone wants a sustainable economy. And these are the sorts of things that should transcend partisanship.” It’s time to back up the billboard with action.

*****

An oil region by the numbers

26%

Portion of Alberta’s GDP last year connected to the oil and gas industry, including mining. The sector’s indirect impact on the province’s economy is even larger

$3 billion

Projected shortfall in resource revenues in Alberta’s revised budget this year, largely because of lower oil prices

67,000

Estimated number of jobs that could be created in Alberta by 2030 in a green-energy transition according to the nonprofit Pembina Institute

96%

Portion of Alberta’s oil exports that go to the U.S.

$45 per barrel

Price of crude at which most oil-sands production breaks even, according to industry consultants. For some projects, the break-even price can be as high as $85

A version of this article appears in the October 2020 issue of Fortune with the headline “After the oil rush.”