每周一次不做飯點外賣時,布蘭迪·約翰遜都守在窗邊從紅色窗簾縫隙朝外張望,等待最愛的外賣到來。看到送餐員轉過拐角把車停到她家公寓前,她趕緊跑上樓看另一扇窗戶,確保餐盒放在前門外。

跟疫情隔離期間很多美國人一樣,約翰遜也訂了很多比薩。

“對我來說,比薩非常完美,不太麻煩,非常方便,冷熱都能吃,而且不用餐具。”約翰遜說。“非常時期,比薩是便利又管飽的一頓。”

頭部比薩連鎖店都因為約翰遜這樣的顧客而獲利頗豐。舉例來說,棒約翰財報顯示,今年二季度北美餐廳銷售額同比增長28%,連續三個月實現兩位數增長,3月至6月間聘請了2萬名額外員工,計劃再招1萬名員工。截至8月初,在經歷數年低迷之后,棒約翰的今年股價已經飆升約55%。

過去幾年百勝集團旗下的必勝客一直面臨銷量下滑問題,今年5月初迎來八年來外賣和外帶銷售業績最好的一周。對于旗下包括塔可鐘和肯德基等品牌的百勝來說,當季全球總銷售額下降15%之際,比薩外賣量上升確實是個亮點。

“二季度必勝客的非堂食業務增長了21%。過去幾年該業務表現不佳,如今的增長表明有特定的行業因素推動比薩板塊股價上漲。”瑞士信貸的分析師勞倫·西爾伯曼表示。

不過,因為美國人胃口大開獲利最多的比薩外賣公司還要數達美樂。

達美樂是全球銷量最大的比薩公司,在美國市場上占份額最高。據彭博行業研究,去年達美樂占據美國比薩總銷量的19%,主要因為在外賣方面的主導地位。2019年達美樂占美國外賣銷售額36%,而其他主要連鎖店的總和為26%。(區域連鎖店和獨立餐廳占38%。)

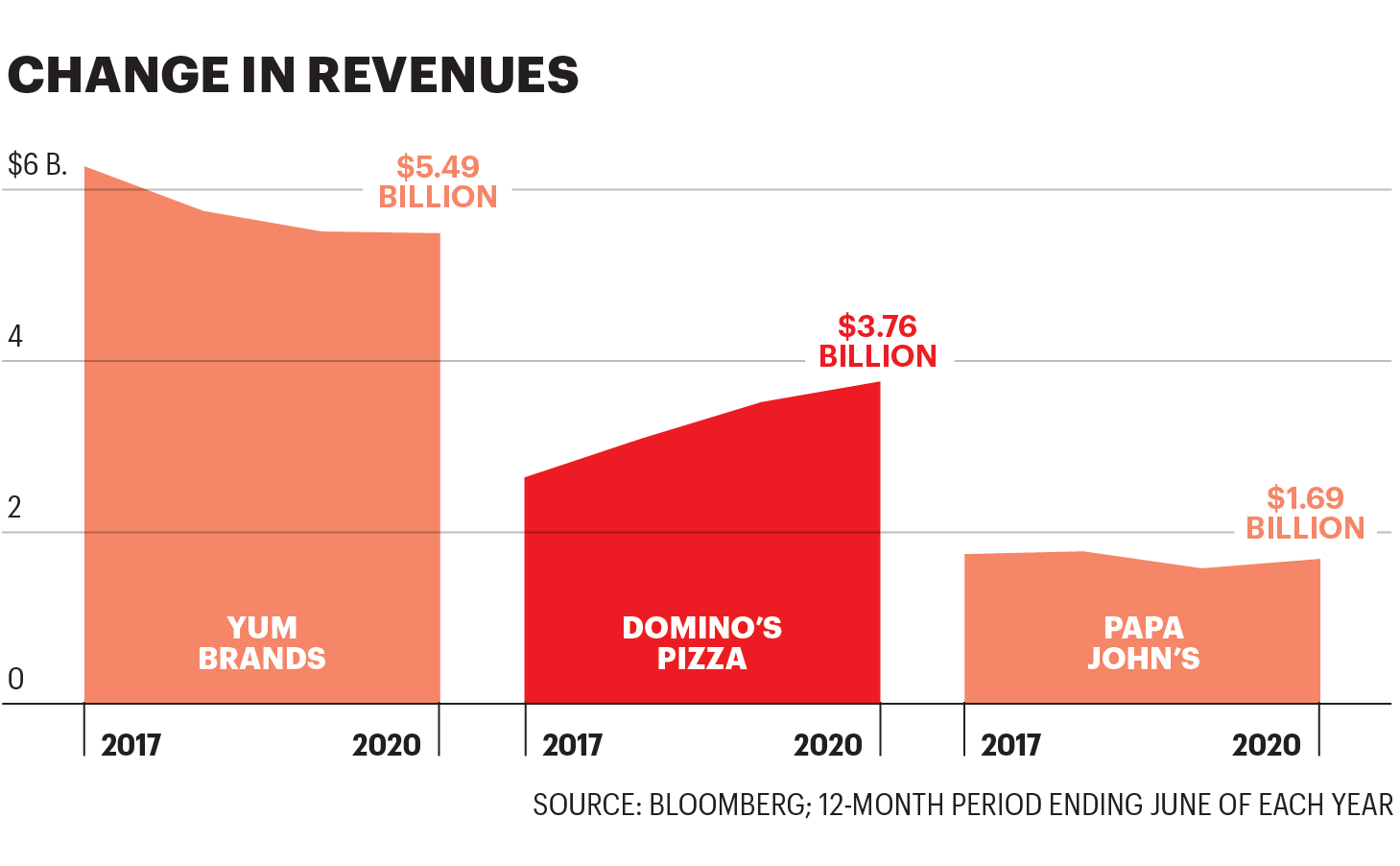

不同比薩店的收入變化。來源:彭博;截至每年6月底的12個月數據

與比薩行業同行一樣,最近幾個月達美樂銷售額猛增。7月,達美樂財報顯示,2020年二季度美國同店銷售額增長了16%,每股收益從去年同期的2.19美元躍升至2.99美元。盡管國際市場增長放緩,但到2020年上半年達美樂凈收入達2.4億美元,同比增長了30%。

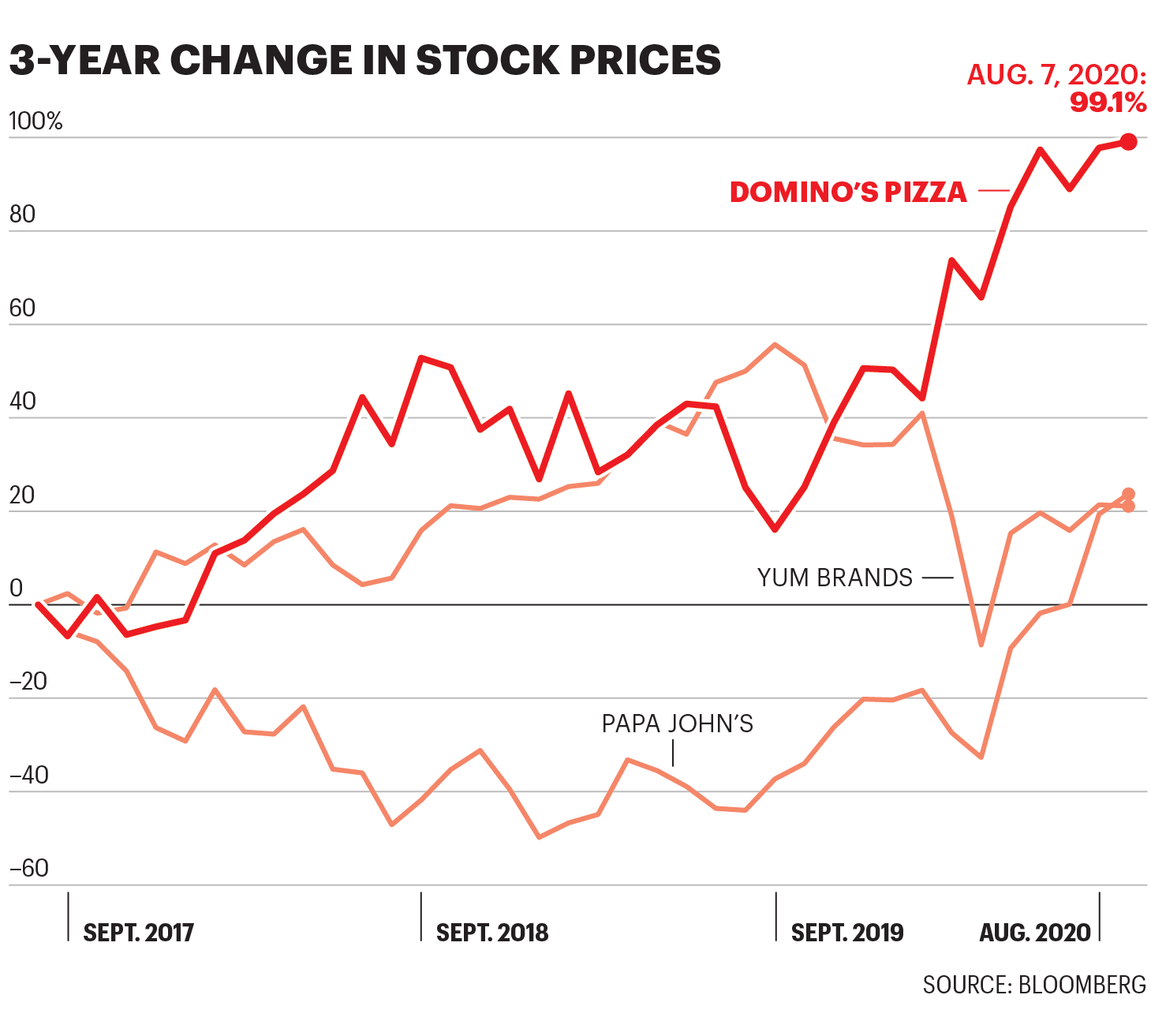

達美樂的股東獲得了不錯回報。截至8月第一周,2020年其股價上漲了24%。這還是多年回報強勁的基礎上。過去三年里,達美樂股價上漲了99%,輕松超過了比薩同行。??

分析人士表示,過去幾年達美樂致力于創新,準確滿足了消費者對意大利香腸和奶酪口味方便食品日益增長的需求。

“過去十年里達美樂的表現超過全行業,主要因為其執行力強大,從規模較小的競爭對手和必勝客手里搶奪了不少份額。”西爾伯曼說。“達美樂的數字和外賣基礎設施在業界領先,我們認為這是公司最強大的資產。”

達美樂公司在提升送貨能力和重塑公眾形象方面的長期投資獲得了巨大回報。2010年,達美樂公司的前首席執行官帕特里克·多伊爾從公司國內零售業務總裁升職時,公司股價為每股9美元左右,顧客抱怨說面餅嘗起來像硬紙板。醬汁?跟番茄醬一樣。于是達美樂努力提高聲譽,還在多伊爾領導下改善配送流程。當2018年多伊爾卸職時,達美樂的股價已經漲到250美元以上,市值也增加了驚人的112億美元。

“看看比薩行業三大巨頭,都非常擅長配送,因為比薩外賣模式已經實踐數十年。”巴魯克學院Zicklin商學院的教授李珊(音譯)表示。“但達美樂是唯一一家堅持自營配送的公司,并不與第三方(如Seamless或Uber Eats)合作。”

如今,達美樂的技術領先于其他公司。2018年,顧客不一定非要在特定地址就能取餐, 因為達美樂推出熱點位置,從海灘到體育場停車場,人們可以在任何地方下單。總部位于安娜堡的達美樂同年還推出了晚餐鈴聲功能。如果下載了移動應用程序,顧客可以創建朋友和家人群組,訂單配送時應用程序會自動“響鈴”。

跟競爭對手相比,達美樂送貨方式還有另一個根本性區別,由此實現利潤最大化。雖然不少必勝客和棒約翰店同樣自行配送,但也跟第三方配送服務合作以觸達更多顧客。2019年,棒約翰與DoorDash合作,而必勝客則選擇了Grubhub。本地比薩連鎖店尤其依賴第三方,相比之下,達美樂完全依賴自營配送。

第三方送貨服務是可以幫比薩店擴大配送范圍,但要付出成本。例如,Uber Eats按照訂單金額30%向餐廳收取配送費。因此,小作坊比薩店一方面可能獲得更多訂單,另一方面利潤并不一定能同步增長。很多小餐廳面臨維持營業和進店顧客減少的困境,只希望收支平衡。根據金融服務公司BTIG的數據,達美樂連鎖店每筆在線訂單要支付0.25美元配送成本,小餐廳向第三方配送服務支付的費用為每筆訂單2美元或3美元。

佛羅里達州印第安港海灘的尼克森一家就點了不少比薩。兩個月前26歲的卡羅琳搬回家跟父母一起住后,每周至少要點三次比薩,而且都是找距離3英里內的餐館。

“我們壓力都很大,所以容易想到點比薩。”卡羅琳·尼克森說。“正常情況下,我們不會點那么多比薩。我們會出門去餐館吃飯,也會住在不同的地方。”

尼克森原本打算搬到費城找工作,發現機會渺茫之后,她決定搬回家。巴魯克學院的李珊教授說,隨著冠狀病毒流行,不少千禧一代被迫回到家,很多家庭也不得不兼顧工作和育兒,于是開始選擇更快速成本也更低的比薩。

“從預算方面來看,疫情爆發后很多消費者發現預算減少。”李珊說,她主要點加州比薩廚房(California Pizza Kitchen)的泰式比薩。“從某種意義上說,比薩是很多人以較低成本養家的最佳選擇之一。”

隨著需求激增,比薩連鎖店也要想辦法留住新顧客。今年2月,棒約翰推出了新款薄脆三明治Papadias。7月達美樂推出了采用新配方和調料的雞翅。分析師西爾伯曼表示,比薩公司最賺錢的通常還是比薩。但是,巧妙增加菜單選項,尤其是多提供配菜可以提升平均支出,從而帶來更多利潤。

雖然專家并不確定疫情催生的比薩熱潮能持續多久,但李珊說,很長一段時間內消費者行為都會因為擔心疫情而轉變。例如,Brick Meets Click和Mercatus的一項調查顯示,過去20年網上購物增長都非常緩慢,然而過去幾個月里突然出現猛增。李珊說,人們已經適應新的點餐方式,也會堅持使用Instacart等平臺的新習慣。

“人們的生活習慣不會一夜之間返回疫情之前。”她說。“我認為消費者行為的轉變以及疫情的影響將長期且深遠。”

或許,還有比薩的助力。(財富中文網)

譯者:Feb

每周一次不做飯點外賣時,布蘭迪·約翰遜都守在窗邊從紅色窗簾縫隙朝外張望,等待最愛的外賣到來。看到送餐員轉過拐角把車停到她家公寓前,她趕緊跑上樓看另一扇窗戶,確保餐盒放在前門外。

跟疫情隔離期間很多美國人一樣,約翰遜也訂了很多比薩。

“對我來說,比薩非常完美,不太麻煩,非常方便,冷熱都能吃,而且不用餐具。”約翰遜說。“非常時期,比薩是便利又管飽的一頓。”

頭部比薩連鎖店都因為約翰遜這樣的顧客而獲利頗豐。舉例來說,棒約翰財報顯示,今年二季度北美餐廳銷售額同比增長28%,連續三個月實現兩位數增長,3月至6月間聘請了2萬名額外員工,計劃再招1萬名員工。截至8月初,在經歷數年低迷之后,棒約翰的今年股價已經飆升約55%。

過去幾年百勝集團旗下的必勝客一直面臨銷量下滑問題,今年5月初迎來八年來外賣和外帶銷售業績最好的一周。對于旗下包括塔可鐘和肯德基等品牌的百勝來說,當季全球總銷售額下降15%之際,比薩外賣量上升確實是個亮點。

“二季度必勝客的非堂食業務增長了21%。過去幾年該業務表現不佳,如今的增長表明有特定的行業因素推動比薩板塊股價上漲。”瑞士信貸的分析師勞倫·西爾伯曼表示。

不過,因為美國人胃口大開獲利最多的比薩外賣公司還要數達美樂。

達美樂是全球銷量最大的比薩公司,在美國市場上占份額最高。據彭博行業研究,去年達美樂占據美國比薩總銷量的19%,主要因為在外賣方面的主導地位。2019年達美樂占美國外賣銷售額36%,而其他主要連鎖店的總和為26%。(區域連鎖店和獨立餐廳占38%。)

與比薩行業同行一樣,最近幾個月達美樂銷售額猛增。7月,達美樂財報顯示,2020年二季度美國同店銷售額增長了16%,每股收益從去年同期的2.19美元躍升至2.99美元。盡管國際市場增長放緩,但到2020年上半年達美樂凈收入達2.4億美元,同比增長了30%。

達美樂的股東獲得了不錯回報。截至8月第一周,2020年其股價上漲了24%。這還是多年回報強勁的基礎上。過去三年里,達美樂股價上漲了99%,輕松超過了比薩同行。

分析人士表示,過去幾年達美樂致力于創新,準確滿足了消費者對意大利香腸和奶酪口味方便食品日益增長的需求。

“過去十年里達美樂的表現超過全行業,主要因為其執行力強大,從規模較小的競爭對手和必勝客手里搶奪了不少份額。”西爾伯曼說。“達美樂的數字和外賣基礎設施在業界領先,我們認為這是公司最強大的資產。”

達美樂公司在提升送貨能力和重塑公眾形象方面的長期投資獲得了巨大回報。2010年,達美樂公司的前首席執行官帕特里克·多伊爾從公司國內零售業務總裁升職時,公司股價為每股9美元左右,顧客抱怨說面餅嘗起來像硬紙板。醬汁?跟番茄醬一樣。于是達美樂努力提高聲譽,還在多伊爾領導下改善配送流程。當2018年多伊爾卸職時,達美樂的股價已經漲到250美元以上,市值也增加了驚人的112億美元。

“看看比薩行業三大巨頭,都非常擅長配送,因為比薩外賣模式已經實踐數十年。”巴魯克學院Zicklin商學院的教授李珊(音譯)表示。“但達美樂是唯一一家堅持自營配送的公司,并不與第三方(如Seamless或Uber Eats)合作。”

如今,達美樂的技術領先于其他公司。2018年,顧客不一定非要在特定地址就能取餐, 因為達美樂推出熱點位置,從海灘到體育場停車場,人們可以在任何地方下單。總部位于安娜堡的達美樂同年還推出了晚餐鈴聲功能。如果下載了移動應用程序,顧客可以創建朋友和家人群組,訂單配送時應用程序會自動“響鈴”。

跟競爭對手相比,達美樂送貨方式還有另一個根本性區別,由此實現利潤最大化。雖然不少必勝客和棒約翰店同樣自行配送,但也跟第三方配送服務合作以觸達更多顧客。2019年,棒約翰與DoorDash合作,而必勝客則選擇了Grubhub。本地比薩連鎖店尤其依賴第三方,相比之下,達美樂完全依賴自營配送。

第三方送貨服務是可以幫比薩店擴大配送范圍,但要付出成本。例如,Uber Eats按照訂單金額30%向餐廳收取配送費。因此,小作坊比薩店一方面可能獲得更多訂單,另一方面利潤并不一定能同步增長。很多小餐廳面臨維持營業和進店顧客減少的困境,只希望收支平衡。根據金融服務公司BTIG的數據,達美樂連鎖店每筆在線訂單要支付0.25美元配送成本,小餐廳向第三方配送服務支付的費用為每筆訂單2美元或3美元。

佛羅里達州印第安港海灘的尼克森一家就點了不少比薩。兩個月前26歲的卡羅琳搬回家跟父母一起住后,每周至少要點三次比薩,而且都是找距離3英里內的餐館。

“我們壓力都很大,所以容易想到點比薩。”卡羅琳·尼克森說。“正常情況下,我們不會點那么多比薩。我們會出門去餐館吃飯,也會住在不同的地方。”

尼克森原本打算搬到費城找工作,發現機會渺茫之后,她決定搬回家。巴魯克學院的李珊教授說,隨著冠狀病毒流行,不少千禧一代被迫回到家,很多家庭也不得不兼顧工作和育兒,于是開始選擇更快速成本也更低的比薩。

“從預算方面來看,疫情爆發后很多消費者發現預算減少。”李珊說,她主要點加州比薩廚房(California Pizza Kitchen)的泰式比薩。“從某種意義上說,比薩是很多人以較低成本養家的最佳選擇之一。”

隨著需求激增,比薩連鎖店也要想辦法留住新顧客。今年2月,棒約翰推出了新款薄脆三明治Papadias。7月達美樂推出了采用新配方和調料的雞翅。分析師西爾伯曼表示,比薩公司最賺錢的通常還是比薩。但是,巧妙增加菜單選項,尤其是多提供配菜可以提升平均支出,從而帶來更多利潤。

雖然專家并不確定疫情催生的比薩熱潮能持續多久,但李珊說,很長一段時間內消費者行為都會因為擔心疫情而轉變。例如,Brick Meets Click和Mercatus的一項調查顯示,過去20年網上購物增長都非常緩慢,然而過去幾個月里突然出現猛增。李珊說,人們已經適應新的點餐方式,也會堅持使用Instacart等平臺的新習慣。

“人們的生活習慣不會一夜之間返回疫情之前。”她說。“我認為消費者行為的轉變以及疫情的影響將長期且深遠。”

或許,還有比薩的助力。(財富中文網)

譯者:Feb

Once a week Brandi Johnson finds herself peeping through her red curtains, on the lookout for her favorite delivery—the one that means she doesn’t have to cook dinner. When the driver pulls around the corner and stops in front of her apartment, she runs upstairs to look out another window, this time to make sure the box is placed outside her front door.

Like many Americans during quarantine, Johnson has been ordering a lot of pizza.

“Pizza is the perfect comfort food for me—not too messy, hard to mess up, good whether it’s hot or cold, and I don’t need silverware,” says Johnson. “It’s just a perfect guaranteed meal to have during such uncertain times.”

Top pizza chains have benefited from the cravings of customers like Johnson. Papa John’s, for instance, reported that sales at its North American restaurants saw a 28% increase in the second quarter compared with the year before, with three straight months of double-digit gains. To keep up with that skyrocketing demand, the company said that it had hired 20,000 additional employees between March and June—and plans on hiring 10,000 more. As of early August, shares of Papa John’s had spiked some 55% this year, after a couple of years of underperforming.

Yum Brands’ Pizza Hut, which has been battling falling sales over the past few years, had its best week for delivery and carry-out sales in eight years in early May. The uptick in pizza delivery was a bright spot for Yum Brands—whose portfolio includes Taco Bell and KFC—in a quarter in which overall sales fell 15% worldwide.

“Pizza Hut’s off-premise business was up 21% in 2Q, and for a business that has underperformed over the last few years, the performance suggests there is a material industry-specific component to the pizza category’s share gains,” says Credit Suisse analyst Lauren Silberman.

But no delivery operator has benefited more from America’s increased appetite than Domino’s Pizza.

The largest pizza company in the world by sales, Domino’s had the biggest slice of the U.S. market coming into the pandemic. According to Bloomberg Intelligence, last year Domino’s captured 19% of total pizza sales in the U.S. thanks to its dominance in delivery. The company gobbled up a whopping 36% of U.S. delivery sales in 2019 versus a combined total of 26% for other major chains. (Regional chains and independent restaurants garnered 38%.)

As with its pizza peers, the company’s sales have spiked in recent months. In July, Domino’s reported that its U.S. same-store sales increased by 16% in the second quarter of 2020 and earnings per share leapt to $2.99 from $2.19 in the same quarter last year. Domino’s generated $240 million in net income through the first half of 2020, a 30% increase over last year, despite slower growth in international markets.

Shareholders of Domino’s have been well rewarded. Through the first week of August, the pizza giant’s stock was up 24% in 2020. And that’s on top of years of strong returns. Over the past three years, Domino’s stock has risen 99%—easily outpacing its pizza peers.

Analysts say that Domino’s was uniquely positioned to meet consumers’ increased demand for pepperoni-and-cheese–topped comfort food thanks to its commitment to innovation over the past several years.

“Domino’s has outperformed the industry over the last decade given its strong execution, which has allowed it to gain share from smaller competitors and Pizza Hut,” Silberman says. “Domino’s has an industry-leading digital and delivery infrastructure, which we view as the most powerful asset it has.”

Domino’s long-term investment in advancing its delivery capabilities and rehabbing its public image has paid off in a big way. When former Domino’s CEO Patrick Doyle was promoted in 2010 from his role as president of the company’s domestic retail operations, the company’s stock was trading at about $9 a share, and customers complained that the crust tasted like cardboard. The sauce? Like ketchup. Domino’s went on a mission to improve its reputation and, under Doyle’s leadership, to perfect delivery. When Doyle stepped down in 2018, Domino’s price per share had risen to more than $250, and its market value had increased by an astonishing $11.2 billion.

“When you consider the three big players in pizza, they are already an expert in delivery because the pizza industry has been using this model for decades,” says Shan Li, a professor at the Zicklin School of Business at Baruch College. “But Domino’s is the only one to rely on their own capabilities to deliver food to customers instead of working with a third party [such as Seamless or Uber Eats].”

Today, Domino’s technology leads the pack. Customers don’t have to be at a specific address to get their favorite pie—Domino’s rolled out hotspot locations in 2018, which allows people to get their pizza anywhere, from the beach to a stadium parking lot. The Ann Arbor–based company also introduced the dinner bell function in 2018. Using the mobile app, customers can create groups of their friends and family and the app will automatically “ring the bell” when their order is out for delivery.

There is another fundamental difference in how Domino’s does delivery compared to its rivals—one that allows it to maximize profits. While many Pizza Hut and Papa John’s stores deliver their pizzas directly to customers, those chains have also paired up with third-party delivery services in order to reach more customers. In 2019, Papa John’s partnered with DoorDash, while Pizza Hut has a similar arrangement with Grubhub. Local pizza chains are especially reliant on third-party operators. By contrast, Domino’s relies solely on its own delivery infrastructure.

Third-party delivery services allow local pizza places to scale up their delivery volume, but it comes at a cost. Uber Eats, for example, charges restaurants a fee equal to 30% of the order to deliver to their customers. So although mom-and-pop pizzerias may be getting more orders, that doesn’t always lead to a profit increase; with the costs of staying open and few dine-in customers, many small businesses are just hoping to break even. According to financial services firm BTIG, while Domino’s franchisees pay $0.25 per online sale, small businesses are charged $2 or $3 for a similar transaction by third-party operators.

The Nickerson family in Indian Harbour Beach, Fla., has been doing its part to keep their local pizza places busy. Since Caroline, 26, moved back home with her parents two months ago, they’ve been ordering pizza at least three times a week, all from restaurants within a three-mile radius of their home.

“I think we’re all stressed, so it’s also the first thing we think of,” Caroline Nickerson says. “Under normal circumstances, we wouldn’t be ordering so much pizza. We’d go out to eat at different restaurants, and we’d be living in separate houses.”

Nickerson planned to move to Philadelphia for a job, but when the opportunity went remote, she decided to move home. As the coronavirus pandemic drives millennials back home and forces families to juggle work and childcare, many households are turning to pizza for a quick, low-cost option, says Li, the Baruch College professor.

“From the budget perspective, many consumers have found themselves with smaller budget constraints due to the pandemic,” says Li, whose go-to order is California Pizza Kitchen’s Thai pizza. “To some extent, pizza is just one of the best options for many of us to feed a family at a lower cost.”

Riding the spike in demand, pizza chains must now find a way to keep these new customers. Papa John’s answered with its new flatbread sandwich, the Papadias, in February. And Domino’s rolled out a new recipe and sauces for chicken wings in July. Typically the most profitable menu item for a pizza company is still pizza, analyst Silberman says. But smart menu additions and sides, in particular, can help increase the average check and lead to more profit.

While experts don’t know how long the pandemic pizza boom will last, Li says consumer behavior will be altered by pandemic concerns for a long time. For instance, online grocery shopping, which has grown very slowly over the past 20 years, suddenly experienced huge growth over the past few months, according to a survey conducted by Brick Meets Click and Mercatus. People have adjusted to the new ease of ordering, Li says, and will stick to their new habits of using platforms like Instacart.

“People will not go back to their pre-COVID lives overnight,” she says. “I think this shift in consumer behavior and the impact of the pandemic is going be long-lasting and profound.”

And, perhaps, pizza-fueled.