各大企業在疫情伊始的裁員速度可謂創美國歷史之最,失業率也從2月的3.5%飆升至4月的14.7%。然而,隨著各州重啟經濟,該數字在6月已經降至11.1%。

盡管失業率的降低意味著經濟的好轉,但事實也清楚地擺在人們眼前,美國并沒有看到期盼已久的V形恢復軌跡。

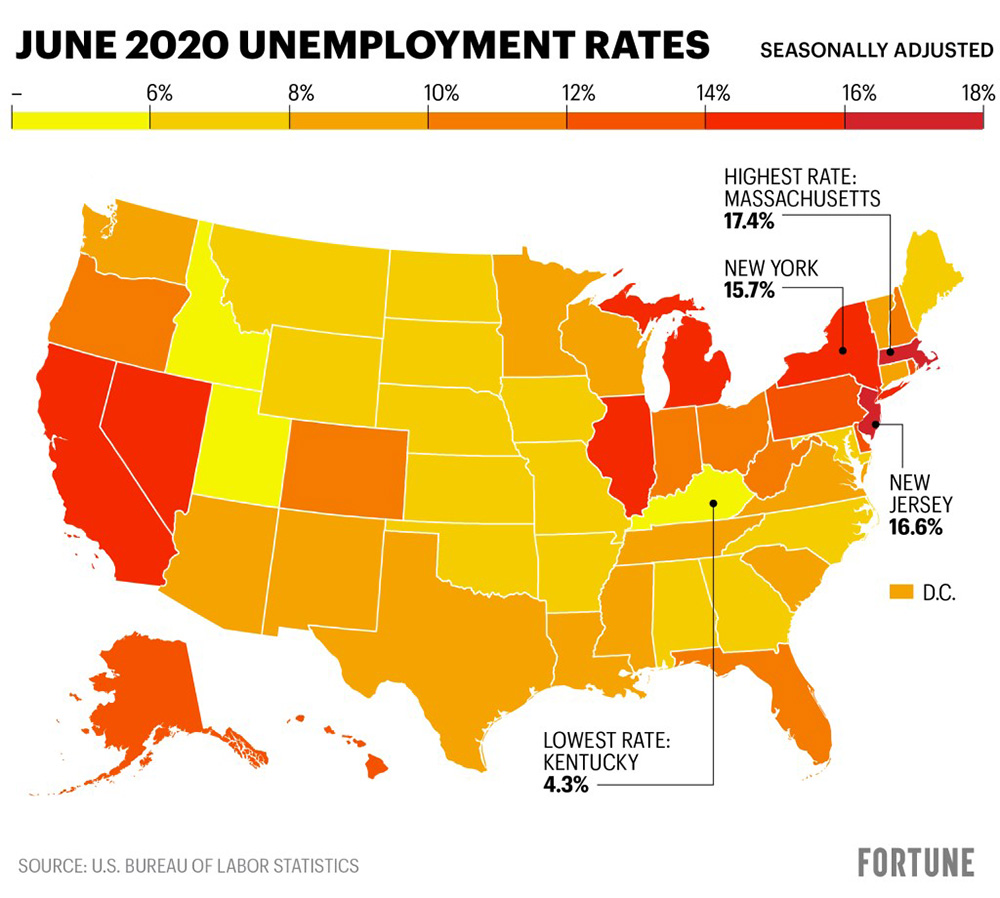

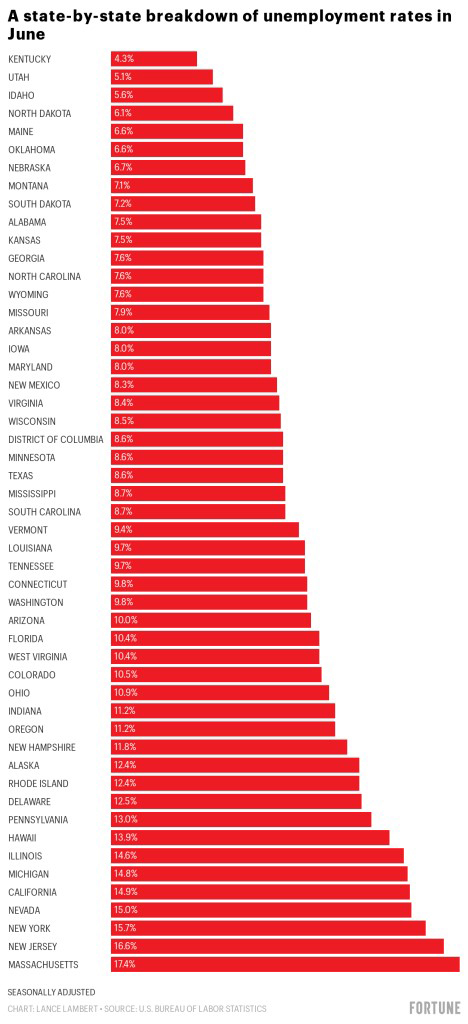

如果我們繼續深挖的話,也會明顯看到,美國各州的恢復水平不盡相同,并且差異很大。美國勞工統計局稱,肯塔基州按季節調整后的失業率從2月的4.2%升至4月的16.6%。但隨著州長安德魯·貝舍爾重啟該州的經濟,其6月的失業率降至4.3%,達到了全國最低的水平,屬于教科書式的V形恢復。

肯塔基州迅速的恢復甚至讓該州官員感到震驚。5月,該州預計會出現4.57億美元的公共基金缺口,然而該州在6月出現了1.775億美元的盈余。部分原因在于肯塔基州對受疫情嚴重影響的休閑和酒店行業的依賴度并不高。

其他一些以農業為主的州,例如猶他州(5.1%)、愛達荷州(5.6%)和北達科他州(6.1%)亦出現了V形經濟恢復模式下才有的失業率。

然而,有一些州鮮有恢復甚至是沒有恢復。新澤西州和馬薩諸塞州4月的失業率則分別達到了16.3%和16.2%。6月,這兩個州的失業率分別為16.6%和17.4%,是全美失業率最高的兩個州。紐約州6月的失業率為15.7%,排名第三。上述失業率水平與上個世紀30年代的經濟大蕭條時期相當,當時,全美平均失業率達到了17%。

像紐約州、新澤西州和馬薩諸塞州這類位于美國東北部的州是早期疫情最為集中的地區,因此其經濟的重啟速度要慢得多。不過好消息在于,美國東北部并不像其他地區那樣出現了新冠病例抬頭的跡象。

盡管包括肯塔基州和猶他州在內的一些州出現了V形恢復,而且東北地區各州基本上處于停滯不前的狀態,也有一些州處于兩者之間。附近的內華達州就是個例子,由于其酒店和賭場停業,該州失業率在4月曾經飆升至30.1%。隨著這些設施在今夏的重新開放,該州的失業率在6月降至15%。這個恢復速度很快,但與內華達2月2.6%的失業率相比依然相距甚遠。

但很多專家預計美國的經濟恢復將十分緩慢。世界大型企業聯合會最近對美國首席執行官的調查顯示,有42%預測經濟將出現U形恢復,26%預計將出現可怕的L形, 23%預計將呈W形,也就是雙低谷衰退,僅有9%的美國首席執行官預計其將呈現V形。(財富中文網)

譯者:Feb

各大企業在疫情伊始的裁員速度可謂創美國歷史之最,失業率也從2月的3.5%飆升至4月的14.7%。然而,隨著各州重啟經濟,該數字在6月已經降至11.1%。

盡管失業率的降低意味著經濟的好轉,但事實也清楚地擺在人們眼前,美國并沒有看到期盼已久的V形恢復軌跡。

如果我們繼續深挖的話,也會明顯看到,美國各州的恢復水平不盡相同,并且差異很大。美國勞工統計局稱,肯塔基州按季節調整后的失業率從2月的4.2%升至4月的16.6%。但隨著州長安德魯·貝舍爾重啟該州的經濟,其6月的失業率降至4.3%,達到了全國最低的水平,屬于教科書式的V形恢復。

肯塔基州迅速的恢復甚至讓該州官員感到震驚。5月,該州預計會出現4.57億美元的公共基金缺口,然而該州在6月出現了1.775億美元的盈余。部分原因在于肯塔基州對受疫情嚴重影響的休閑和酒店行業的依賴度并不高。

其他一些以農業為主的州,例如猶他州(5.1%)、愛達荷州(5.6%)和北達科他州(6.1%)亦出現了V形經濟恢復模式下才有的失業率。

然而,有一些州鮮有恢復甚至是沒有恢復。新澤西州和馬薩諸塞州4月的失業率則分別達到了16.3%和16.2%。6月,這兩個州的失業率分別為16.6%和17.4%,是全美失業率最高的兩個州。紐約州6月的失業率為15.7%,排名第三。上述失業率水平與上個世紀30年代的經濟大蕭條時期相當,當時,全美平均失業率達到了17%。

像紐約州、新澤西州和馬薩諸塞州這類位于美國東北部的州是早期疫情最為集中的地區,因此其經濟的重啟速度要慢得多。不過好消息在于,美國東北部并不像其他地區那樣出現了新冠病例抬頭的跡象。

盡管包括肯塔基州和猶他州在內的一些州出現了V形恢復,而且東北地區各州基本上處于停滯不前的狀態,也有一些州處于兩者之間。附近的內華達州就是個例子,由于其酒店和賭場停業,該州失業率在4月曾經飆升至30.1%。隨著這些設施在今夏的重新開放,該州的失業率在6月降至15%。這個恢復速度很快,但與內華達2月2.6%的失業率相比依然相距甚遠。

但很多專家預計美國的經濟恢復將十分緩慢。世界大型企業聯合會最近對美國首席執行官的調查顯示,有42%預測經濟將出現U形恢復,26%預計將出現可怕的L形, 23%預計將呈W形,也就是雙低谷衰退,僅有9%的美國首席執行官預計其將呈現V形。(財富中文網)

譯者:Feb

Employers laid off employees at the fastest clip in U.S. history at the onset of the pandemic, with the unemployment rate soaring from 3.5% in February to 14.7% in April. But as states reopen, that rate had fallen to 11.1% by June.

While a dropping jobless rate points to an improving economy, it also makes it clear we aren't seeing the much-hoped-for V-shaped recovery—when an economy recovers nearly as fast as it contracted.

But dig a bit deeper and it's clear that not all recoveries are proceeding equally. They vary immensely by state. In Kentucky, the seasonally adjusted jobless rate soared from 4.2% in February to 16.6% in April, according to the U.S. Bureau of Labor Statistics. But as Gov. Andrew Beshear reopened the Bluegrass State's economy, the jobless rate sunk to 4.3% by June—the lowest in the nation. That's a textbook V-shaped recovery.

The swift recovery in Kentucky even caught its state officials by surprise. In May the state projected a $457 million general fund shortfall; however, it ended the fiscal year in June with a $177.5 million surplus. It helped that Kentucky doesn't rely heavily on industries like leisure and hospitality that were decimated by the pandemic.

Other more rural states like Utah (5.1%), Idaho (5.6%), and North Dakota (6.1%) have jobless rates that also indicate V-shaped recoveries.

Then there are places that have seen little to no recovery. The jobless rate in New Jersey and Massachusetts were at 16.3% and 16.2%, respectively, in April. In June, the jobless rate was 16.6% in New Jersey and 17.4% in Massachusetts—the two highest rates in the nation. New York was the third highest at 15.7% in June. Those rates are on par with the Great Depression era, which saw an average of a 17% jobless rate during the 1930s.

Northeast states like New York, New Jersey, and Massachusetts were among the early epicenters of the virus and are reopening their economies at much slower rates. On the flip side, the Northeast is not seeing COVID-19 cases spike like other regions.

While states like Kentucky and Utah see V-shaped recoveries, and Northeast states barely move, there are other places firmly in the middle. Look no further than Nevada, which saw its jobless rate soar to 30.1% in April as its hotels and casinos shuttered. As it reopened this summer, that jobless rate fell to 15% in June. That is a fast recovery but still a long way to go from Nevada's February jobless rate of 3.6%.

But many experts expect to see the rate of recovery in the U.S. slow. Among U.S. chief executive officers, 42% foresee a U-shaped recovery, 26% expect the dreaded L-shaped recovery, and 23% forecast a W-shaped recovery, or a double-dip recession, according to the Conference Board's most recent survey of CEOs. Only 9% of U.S. CEOs predict a V-shaped recovery.