本文是《財富》雜志《特別報道:面臨環境危機的商業》組文之一,與普利策危機報道中心合作發表。攝影:塞巴斯蒂安·梅耶

在馬來西亞北部的一處山坡上,一座大型露天廠房矗立在油棕櫚樹和橡膠樹之間。這是生物降解公司BioGreen Frontier設在Bukit Selambau村的再生資源回收工廠,去年11月投產。1月一個驕陽火辣的下午,沙希德·阿里剛剛開始了第一周的工作。他分開雙腳,站在生產線盡頭向下傾斜的傳送帶旁,腳邊的白色濕軟塑料絲深及膝蓋。在他周圍,更多的細絲從傳送帶上落下,像雪片一樣飄散到地面上。

回收過程中,阿里一直在這堆塑料細絲中挑揀著看起來褪色或者臟了的不合格品。雖然這看起來很累,但阿里說這已經比他上一份工作好多了。此前他在附近的一家紡織廠疊床單,工資也比現在低得多。如今,如果吃的節省一點兒,就能存下錢來。他的時薪略高于1美元,每個月可以向父母和六個兄弟姐妹寄250美元,他們住在4300多公里外的巴基斯坦白沙瓦。24歲的阿里,身材矮胖,留著絡腮胡子,戴著眼鏡,臉上露出輕松的微笑。他說:“我聽說這里招工,就趕緊跑來應聘了。”不過,他每天要工作12個小時,每周工作七天。“如果我休息一天,就會少一天的工資。” 阿里說。

在這座廠房中有幾百個大包,堆了差不多有18米高,每個包里都塞滿了幾周前人們丟棄的塑料外包裝和塑料袋。上面的地址標簽清楚地指明了它們的來源地。可以看到加州半月灣一個家庭丟棄的廁紙外包裝,在埃爾帕索打包。還可以看到聚合物薄膜,來自功能飲料廠商紅牛設在圣莫妮卡的總部。

阿里所在的這類工廠是這些廢棄物最終的歸宿,它們飄洋過海,來到1.2萬公里外這個遙遠的角落,這首先說明全球資源回收經濟和人類對塑料依賴之間存在的巨大差距。這個生態系統嚴重失靈,甚至已經瀕臨崩潰。全世界每年都會生產不計其數的塑料,其中約90%最終都沒有得到回收利用,而是被燒掉、埋掉或者扔掉了。

而支持塑料回收利用的消費者越來越多,在數以百萬計的家庭里,把酸奶盒、果汁瓶放進藍色垃圾桶已經成了體現環保信仰的行為。但這種信仰也就到此為止。塑料物品每年都如同潮水般涌進回收行業,而且它們越來越有可能原封不動地被退出來,成為一個癱瘓市場的“受害者”。由于經濟性太差,消費者眼中(而且業界宣稱)的許多“可回收”產品實際上并非如此。隨著石油和天然氣價格接近20年來的最低點(這在很大程度上要歸功于壓裂開采技術革命),出現了所謂的新塑料,也就是一種源于石油原料的產品,其售價和獲取難度要遠低于可回收材料。對于直到現在仍只是勉強生存的資源回收行業來說,這種無法預見的變化無異于毀滅性的打擊。綠色和平組織的全球塑料行動負責人格拉漢姆·福布斯說:“全球廢品貿易實際上已經中斷。我們坐擁大堆塑料,卻無處可送,也無法處理。”

對于如此巨大的超負荷所引發的矛盾,業界和政府再也不能視而不見。這個矛盾源于塑料的盈利能力和用處及其對公眾健康和環境的威脅,而且幾乎沒有什么地方能比馬來西亞更能體現這種矛盾。在這里,超低的工資、便宜的土地以及仍在形成的監管氣候吸引企業主建立了幾百家回收工廠,這是他們為保持盈利的最后一搏。我和攝影師塞巴斯蒂安·梅耶走過了馬來西亞各地,清楚地看到了回收利用塑料的實際經濟和環境成本。我們在10天時間里走訪了10家回收工廠,其中一些,包括BioGreen Frontier的運營都沒有官方備案,所以有停工風險,而他們處理的是一船船來自世界各地的廢品。我們還看到了塑料經濟崩潰后對垃圾場、集裝箱碼頭、家庭以及廣闊海洋的影響。

過去50年塑料的發展呈直線上升態勢,理由很充分,那就是它們便宜、輕便而且基本上不會損壞。在1967年的電影《畢業生》(The Graduate)中,后來的導師對緊張兮兮的年輕人本杰明·布拉多克(達斯汀·霍夫曼飾)說:“塑料非常有前途。”基于這樣的提點來采取行動有可能產生巨大收益。塑料的全球年產量從1970年的2500萬噸飆升至2018年的4億噸以上。

塑料泛濫的背后是巨大的經濟利益——英國數據分析機構Business Research Co.指出,去年全球塑料市場的價值約為1萬億美元。2000年以來塑料需求已經翻了一番,而且到2050年可能再增長一倍。塑料行業組織美國化學理事會的成員包括陶氏化學、杜邦、雪佛龍和埃克森美孚等主要廠商。該組織負責塑料市場的董事總經理基思·克里斯特曼說:“在世界各地,需要提高生活質量的中產階層正在不斷增多。塑料已然成為人們生活的一部分。”大家可以看到,不光是礦泉水瓶和三明治包裝袋用塑料,其他含有塑料的東西不勝枚舉,比如運動衫、濕紙巾、建筑隔音材料和墻板、口香糖和茶包。

關于碳排放的爭論往往會掩蓋人們對塑料的擔心。但這兩個問題緊密相連,因為塑料生產本身就會排放數量可觀的溫室氣體。現在世界已經充分認識到了塑料危機。海龜被塑料吸管噎住,死去鯨魚肚子里塞滿塑料垃圾的圖片早已廣為流傳——它們的背后是每年流入海洋的800萬噸塑料(聯合國環境規劃署估算,到2050年海洋中的塑料數量將超過魚類)。人類不可避免的會受到影響。世界自然基金會資助的研究顯示,每位美國人平均每星期通過食物至少會吃下去一茶匙的塑料,差不多相當于一張信用卡,由此產生的健康問題還無法預測。

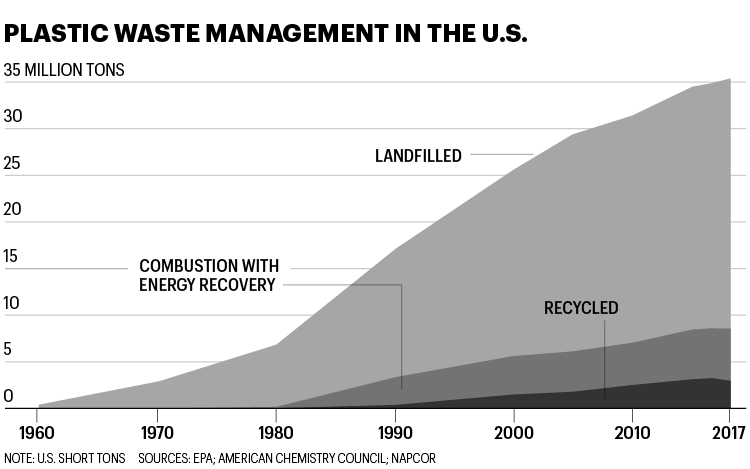

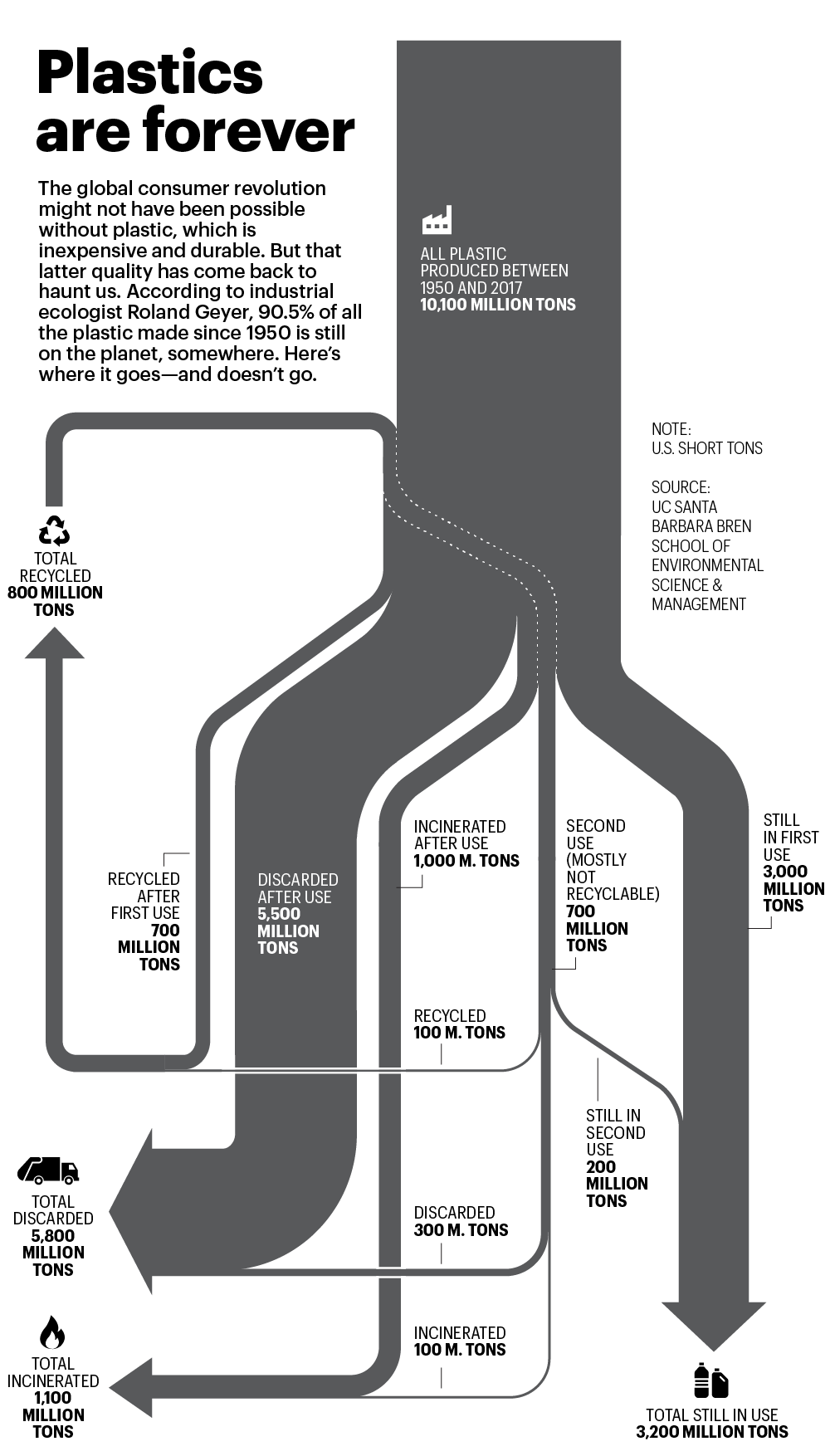

實際情況證明,讓塑料如此有吸引力的耐久性同樣讓塑料成了一枚環境定時炸彈。加州大學圣巴巴拉分校布倫環境科學與管理學院工業生態學教授羅蘭德·耶爾估算,1950年生產的所有塑料中,90.5%目前依然存在。美國環境保護署的數據顯示,2017年美國只有8.4%的廢塑料得到了回收,另有15.8%用于燃燒發電,其他的則都被填埋了起來。在亞洲和非洲的部分地區,塑料的回收利用率甚至更低。就連環保法律嚴格的歐洲,塑料的回收利用率也只有30%左右。

幾十年來,塑料生產商及其主要客戶,比如可口可樂、雀巢、百事和寶潔等消費品巨頭一直在說,提高回收利用水平是解決塑料廢品危機的辦法。這些公司認為這是一個行為問題,而且源于我們的行為。美國塑料工業協會的總裁兼首席執行官托尼·拉多斯澤維斯基說:“說問題在于塑料就像是膝跳反射。罪魁禍首是沒有正確處置塑料產品的消費者。”

塑料回收率確實很低。但僅將此歸咎于消費者也著實不妥。更大的問題在于能源市場的巨大變化。10年來石油和天然氣價格直線下滑,從而造成石化公司的新塑料生產成本遠低于塑料廠商的可回收塑料。在有大量利潤可圖的情況下,這些公司的新塑料產量猛增,進一步壓低了價格。二手塑料回收是勞動力密集型活動,因此成本很高,而且世界上很大一部分地區目前的經濟形勢變化也不利于塑料回收。

2018年,中國停止了幾乎所有塑料廢品的進口,理由是中國自己的資源回收行業正在危害環境,這個生態系統因此再遭重擊。此項決定讓我們這個世界的塑料復興經濟陷入混亂。舉例來說,2018年以前,美國一直將70%左右的廢塑料送到中國。而現在,紐約州Smithtown的固體廢物協調員麥克·恩格爾曼說:“回收利用行業就像用上了生命維持系統的病人。” Smithtown在長島郊區,有12萬居民。恩格爾曼表示:“希望情況將出現好轉。但我不能肯定會怎樣好轉。”

改善的途徑之一是限制新塑料的生產和使用,但考慮到石化和能源行業的政治影響力,這種方法存在很大的不確定性。實際上,繁榮的塑料市場對能源行業的長期健康而言已經變得舉足輕重。國際能源機構認為,隨著汽車廠商轉向電動汽車以及可再生能源的騰飛,塑料將成為石油天然氣行業的新增長引擎。該機構估算,石化原料占全球石油總需求的比重將從目前的12%升至2040年的22%,屆時石化原料有可能成為油氣行業唯一增長的領域,而石化原料中有很大一部分都用于制造塑料。

這樣看,大公司在回應消費者顧慮時未強調供給側就不奇怪了。今年1月,陶氏化學、杜邦、雪佛龍和寶潔等大型企業成立了清除塑料廢棄物行動聯盟。寶潔的首席執行官戴懷德對記者表示,塑料危機“需要我們所有人立即采取行動”。

但“立即采取行動”并不包括減產。相反,這些公司承諾將在今后五年內為廢棄物回收利用項目投入15億美元。美國化學理事會的董事總經理克里斯特曼以Renew Oceans項目為例,后者的目標是清理印度恒河中的塑料廢物。他說上述聯盟的目標是到2030年使塑料包裝物“100%可回收”,到2040年確保所有塑料包裝物都得到回收。但當我問他回收如此之多的塑料產生的巨大成本由誰承擔時,他遲疑了一下,然后說:“會有融資措施。部分資金將來自相關行業,部分來自政府。”

環保人士指出,塑料持久的壽命降低了上述說法的可信度。此外,就像耶爾研究顯示的那樣,大多數已經回收過一次的塑料無法再次回收。換句話說就是,我們給地球添加的幾乎所有塑料都很有可能留存下來,而且是和以前的幾乎所有塑料一起。

在一個蒸籠般的下午,塑料貿易商史蒂夫·黃坐在馬來西亞中部城市怡保的一家路邊小餐館中。他正和一位老客戶、當地資源回收公司AZ Plastikar的首席執行官賽基·楊會面。在嗡嗡作響的電扇下,兩人吃著辣餃子和鹵肉卷,喝著茉莉花茶,談起生意來。他們用的就是塑料桌子,坐的黃色椅子也是塑料的。

黃拿出幾個袋子,把其中裝的東西擺在楊面前。其中一個袋子里裝的是來自巴黎多家時裝店的衣架。另一個袋子里是一卷塑料繩,這是一張聚丙烯漁網剩下的一部分,是黃在荷蘭買的。兩人弓著身體,在桌上把漁網扯開來查看其中的聚合物,他們還用打火機燎了燎扯下來的繩頭,目的是聞聞味道,以便判斷它的化學成分。黃對楊說:“看,這很好,我們可以回收這些,這樣的有很多,漁民通常只會把它們扔到海里。”

黃是卜高通美有限公司的首席執行官,在塑料行業德高望重, 1984年在香港成立了卜高通美。他看上去就像一位精力充沛的上門推銷員,從某種意義上講,也的確是這樣。為了給廢塑料中的幾百種不同聚合物找到適于加工的工廠,他很大一部分時間都在美國、歐洲和亞洲之間奔波。5美元的午餐加上無數壺茶,重大回收生意就是在這樣的場合談成的,而不是光鮮的董事會會議室(在另一個下午的另一次會面中,一家華人工廠的老板敬了黃很多自釀米酒。在他的妻子為我們準備一大桌中國菜肴的時候,他和黃用不太結實的烤箱測試了塑料樣品)。

在怡保,楊同意每個月購買大約600噸聚丙烯,價值22.8萬美元左右。但他擔心不斷貶值的貨砸在手里,近來這種情況很普遍。楊說:“生產新塑料比回收便宜太多了。這對我們來說是個大問題。”

在馬來西亞各個地方的工廠里,我們都聽到了類似的情況。YB Enterprise董事總經理、59歲的葉冠發用手比了一把槍,對著自己的腦袋說:“如果你現在來要我開這家公司,那還不如殺了我。”葉的回收工廠占地10英畝(約40460平方米),位于他的家鄉巴東色海的油棕櫚樹林里。葉從17歲開始在巴東色海做資源回收利用,現在每個月回收約1000噸塑料。但在過去6個月時間里,他的產品價格下降了20%,來自中國的訂單也減少了一半。

塑料公司Fizlestari的工廠設在吉隆坡以南的汝來,在那里,裝著澳大利亞、美國和英國礦泉水瓶、飲料瓶的大包一直堆到了房頂。這家工廠去年的收入約為1000萬美元,但成品銷量比2017年,也就是該廠開業的第一年少了25%。首席執行官賽瑟爾·陳告訴我:“價格下跌了非常、非常、非常多,而且我覺得它不會很快回升。”

62歲的黃早就聽到過這樣的話,也感受到了經濟上的影響。他在香港為父親的小回收作坊收廢品時還是個小孩。黃說:“我那時還在上小學,連10歲還不到。”最終,他把小作坊發展成了盈利的企業,并于2000年和夫人以及六個子女移居到了加州Diamond Park。當時他在全球范圍內經營著20多家工廠,包括德國、英國、南非和澳大利亞。他說大多數時間里,光是香港的業務每年就能賺1000萬美元。和大多數回收商一樣,他最大的市場是中國。

這一切都在2018年毀于一旦,中國展開了“國門利劍”行動,禁止進口塑料廢棄物。此前很長一段時間里中國一直允許大量進口廢塑料。但興旺的廢塑料加工行業卻導致了環境污染。如今中國只允許進口幾乎不含污染物的廢品,而最多也只有1%的廢品能達到這一標準。佐治亞大學工程學院預計,今后10年全世界將有約1.11億噸廢塑料需要另尋出路。

中國政府的措施切斷了黃的財富來源。他估算,“國門利劍”行動以來,自己的生意萎縮了90%以上,工廠也關的只剩下了5家。現在他的主要賺錢途徑是當中間人,把廢品介紹給中國大幅調整政策后出現的那幾千家回收工廠。有許多回收廠是從中國遷到泰國、越南和馬來西亞的,吸引它們的是便宜的土地和甚至更低的勞動力成本,或者說來自孟加拉國、巴基斯坦和緬甸的打工者。

走進黃的客戶的工廠才會發現這種工作的勞動力密集度會有多高,以及為什么人們可能不想讓這些工廠開在自己家旁邊。

在工廠里,工人們梳理塞滿集裝箱的廢塑料。他們把二手塑料分類,挑揀出PET(聚對苯二甲酸乙二醇酯,廣泛用于飲料瓶和包裝)和LDPE(低密度聚乙烯,用于制造一次性購物袋)等材料。這些聚合物有幾百種,每一種都需要專門的加工方法。分揀完畢后,這些廢塑料將在機器中清洗,再加工成紗線那樣的細絲。然后把這些細絲放進磨床,磨成米粒大小,成為人們所說的塑料顆粒。回收商再把這些顆粒打包,作為原材料賣給制造商。很大一部分顆粒都送到了中國的工廠,在這里它們會重新進入消費體系的“血液循環”之中,成為汽車零部件、玩具、礦泉水瓶,以及數千種其他產品的原料。

這個過程很了不起,但它的效率絕不是100%。許多廠商想要回收的聚合物都達不到制造業需要的等級。污損的塑料通常都無法重新利用。同時,大量涌現的新塑料帶來的價格壓力只會讓情況變得更糟。澳大利亞公司ResourceCo Asia駐怡保的運營主管穆拉林德蘭·科溫達薩米說:“目前回收這些沒有經濟價值。”他買下了一些馬來西亞工廠無法使用的塑料,然后把這些塑料賣給了水泥公司,作為鋪設道路的材料。其他大多數回收廠只會燒掉或掩埋這些塑料。他指出:“執行情況很不好,把它們扔到填埋場里比較省錢。”

當我問她馬來西亞的廢塑料貿易增長的有多快時,時任馬來西亞環境部長楊美盈看起來很苦惱。在布城聯邦政府行政中心的頂層辦公室里,楊美盈估算此項貿易每年對經濟的貢獻只有10億美元,而且她認為正在全力以赴地對付廢塑料回收企業。后者需要拿到19張環保許可證才能開工。同時,僅去年楊美盈就關閉了200多家回收廠,原因是證照不全。她說,如果需要,馬來西亞政府應該“斷電、斷水,切斷所有可以切斷的東西。他們就像一幫土匪。”

楊美盈發起的戰斗正在等待新的將領——接受我采訪幾周后,她和馬來西亞政府其他成員在議會危機中全體辭職。但無論誰接替她,都會有健康專家和普通民眾作為同盟,而且原因再明顯不過了。

我們在馬來西亞的第一個上午,塞巴斯蒂安·梅耶和我爬上了雙溪大年中心一座約15米高的塑料山。這座小城在檳城附近,有大約20萬居民。廢品山由附近各家工廠認為不能回收的塑料堆積而成。這是塑料供應鏈的最末端。接下來唯一的辦法似乎就是把它燒掉,而且有些人就是這么做的。雙溪大年Metro醫院負責人、內科醫生Tneoh Shen Jen說工廠反復非法燃燒廢塑料已經使當地居民出現了呼吸問題。他表示:他們“在大多數晚上都聞到了燒塑料的味道”。

在附近的社區中,40歲的Tei Jean和她六歲的女兒坐在家中。她們的窗戶是封死的,家里也沒有玩具、毯子和窗簾。為了防止女兒的呼吸系統感染,Tei竭盡了全力。她說,去年她們家附近的塑料回收廠開工后不久,女兒就患上了呼吸系統疾病。從那時起,這位小女孩已經三次住院,去年在家待了六個月,沒有去上學。Tei說:“她的情況一直在惡化。每次出門她的眼睛就會發紅。”現在,她的女兒就待在安靜、昏暗的客廳里,靠在粉紅色小桌子上畫畫來打發時光。

雙溪大年的活動人士進行抗議后,工廠主從去年秋天開始不再焚燒塑料。但雙方仍相互敵視。去年4月有人趁著夜晚在兩家回收廠縱火。工廠主說這是環保組織所為。我們去看那座垃圾山時,一位保安用手機拍下了我們的照片,然后發給馬來西亞所有的回收廠,讓他們警惕我們的到來。幾天后,工廠主用懷疑的眼光看著我們,問道:“你們是跟那些環保主義者一起的嗎?”

有一次我們是在一起。一天,在雙溪大年附近,兩位活動人士帶著我們沿著慕達河旁的土路走了一遭。這條河是當地農場的水源。在那里,離一所幼兒園不遠就有一座巨大的無證廢品堆。桔黃色的水塘散發出難聞的化學品氣味,其中充斥著西方消費者一眼就能認出來的塑料物品——汰漬洗衣液瓶子、Poland Spring礦泉水瓶、Green Giant冷凍豆子包裝袋。當地人說回收工廠把不想要的東西都堆在了這里,這是違反馬來西亞法律的。一位自卸卡車司機看到我們后就趕緊離開了(兩天后,這堆廢棄物被燒掉了,在當地報紙刊登的照片上能看到樹叢后冒出的黑色濃煙)。

馬來西亞人希望在針對危險廢物的巴塞爾公約幫助下讓自己免受這樣的不良影響,該公約將于明年1月生效,它禁止運輸任何有毒的塑料廢品,而且已經得到世界上幾乎所有國家簽字認可,但美國除外。

馬來西亞官員已經開始阻攔他們懷疑違反規定的集裝箱。在一個狂風大作的周日下午,海關官員帶我們巡視了檳城的集裝箱碼頭,向我們展示了做好標記,將遣返美國、法國和英國的集裝箱船,而且成本由運輸方承擔。不過,這些遣返行動很快就會在官僚主義迷宮里泥足深陷。一艘來自奧克蘭的集裝箱船被打上了遣返標記,但它從2018年6月就一直停靠在檳城的集裝箱碼頭。

前環境部長楊美盈相信,嚴格執行巴塞爾公約前應當限制廢塑料進口,而且不光是馬來西亞,菲律賓和印尼等周邊資源回收樞紐也應如此。人們對廢塑料貿易越發不滿。她問我:“我們國家為什么要成為你們的垃圾場?因為這樣對你們來說更方便嗎?這不公平!”

實際上,幾乎沒有人哪怕短暫地思考一下他們的垃圾去往何方。大多數人都假設當他們把垃圾桶推到路邊后,一個運轉良好的回收系統就會接手。

1月的一個凌晨,我們追蹤了Smithtown的垃圾車,后者證明了上述假設錯的有多離譜。2020年的第一個回收日,這些卡車在一個垃圾中轉站卸下了103噸塑料,而這個中轉站曾經是一個功能齊全的資源回收點。2014年,Smithtown通過向迫不及待的回收公司出售廢品賺了87.8萬美元。現在,他們每年要向垃圾處理公司支付近8萬美元才能將垃圾脫手。

Smithtown的困難是美國整體情況的典型體現,而且這些困難在中國發布禁令前就出現了。隨著石油和天然氣價格暴跌,消納Smithtown二手塑料的市場消失了,而且新塑料就是比前者更便宜。因此,這個Smithtown大幅削減了回收規模,目前只接受質量較高的聚合物,也就是“1類”和“2類”,這是三角形回收標志中的數字。等級較低的塑料,即“3類”到“7類”,再也賣不出去了。在美國,數百個小鎮都做出了類似的決定,而且有幾十個小鎮干脆徹底終止了路邊回收。

現在,卡車公司會把在Smithtown收的廢塑料送到布魯克林的Sims市政回收中心。由于Smithtown所在的長島禁止填埋固體廢物,許多低等級塑料最終都在亨廷頓附近的一家垃圾焚燒發電廠燒掉了。Smithtown衛生監督員尼爾·席安說,真正的塑料回收幾乎已經不可能了:“把它送到世界上其他地方的成本仍然較低,然后它會以其他形式回到這里。”

如果目前的趨勢繼續下去,這種局面就不大可能出現改變。油氣公司正在為今后新塑料的繁榮投入大量資金。跨國巨頭殼牌正在匹茲堡附近修建大型綜合設施,而匹茲堡是美國的油氣壓裂開采中心之一。該綜合設施每年將生產大約35億磅(約157.5萬噸)聚乙烯塑料(賓夕法尼亞州議會已決定為該廠減稅25年,估算減稅額16億美元)。今年1月,臺塑集團獲準在路易斯安那州修建價值94億美元的綜合設施,該集團稱該設施將創造1200個就業機會。

這些工廠本身就存在環境問題。游說組織國際環境法中心指出,石化行業的擴張可能給“地區氣候帶來巨大而且不斷增長的威脅”。該組織預計,到2050年生產塑料排放的溫室氣體將相當于大約615個新建燃煤發電廠的排放量。加州大學圣巴巴拉分校的耶爾教授估算,到那時全世界的新塑料年產量將超過11億噸。

像雙溪大年這樣的垃圾堆已經激怒了周邊居民和監管部門。圖片來源:PHOTOGRAPH BY SEBASTIAN MEYER

像雙溪大年這樣的垃圾堆已經激怒了周邊居民和監管部門。圖片來源:PHOTOGRAPH BY SEBASTIAN MEYER耶爾說經過多年來對行業數據的研究,他得出了一個結論:“最困難的是阻止新塑料生產規模的繼續上升,但我們必須去做。”

塑料生產商阻撓此事的能力就像不可消滅的塑料廢品一樣強,特別是在美國。典型事例就是對塑料袋和其他“一次性”塑料頒布的禁令。從2021年開始,歐盟27國將嚴格限制一次性塑料,中國各主要城市也將禁止使用塑料袋。在美國,石化公司基本上已經讓這樣的提議擱淺,只有八個州對一次性塑料下了禁令。在國家層面,兩位民主黨參議員在2月提出的措施會讓企業分擔回收成本并暫緩新塑料的增長。但美國塑料工業協會的首席執行官拉多斯澤維斯基說第二項措施“沒有成功的希望”。

拉多斯澤維斯基指出,塑料禁令只是政客發出的“高尚信號”,而且玻璃、金屬和紙張在使用壽命中制造的污染更大。該協會的游說成員堅持不懈地向議員們傳遞類似的信息。協會在3月25日召開全國大會的通知中告訴成員單位:“不要讓否定者主導塑料的故事。把我們已經知道的告訴國會山上的那些人,那就是塑料有助于改善人們的生活。”

盡管言辭激烈,但有跡象表明部分企業正在重新考慮塑料問題,部分原因是來自消費者施加的壓力。

一些服裝公司已經證明,回收塑料可以產生奢侈品溢價。2017年,阿迪達斯開始銷售用馬爾代夫海域中撈起的廢塑料制造的高端運動鞋。這款標價200美元的運動鞋一直供不應求,而且去年阿迪達斯生產了1100萬雙這樣的產品。該公司表明目前它計劃將新塑料徹底從生產活動中剔除。耐克也已經在設計以回收聚酯纖維為原料的運動服,并計劃推廣此項措施。

包裝食品領域的行為變化甚至有可能帶來更大的影響。聯合利華的首席執行官艾倫·喬普于去年10月表示,該公司將“從根本上重新考慮”自家產品的包裝,并在2025年之前將新塑料使用量降低一半。聯合利華的年塑料消耗量已經超過70萬噸。

回收利用方面的進步也讓人看到了希望。聯合利華已經和沙特阿美旗下的SABIC合作,旨在創造使用化學回收方法的包裝。他們表示,這個過程將二手塑料分解轉化后生成的材料和新塑料一樣好。去年,IBM稱它已經創造出吞噬PET并將其變為塑料顆粒的化學工藝,和我們在馬來西亞的收廠里看到的艱辛清洗和分揀工作相比,此項工藝的效率和可擴展性要高得多。

馬來西亞一些回收廠的所有者在這些舉措中看到了曙光,或者說他們的塑料顆粒再次成為受青睞商品的一絲希望。臺灣資源回收公司Grey Matter Industries的運營長吳度泓說:“耐克和阿迪達斯想告訴消費者他們關心地球,而且將使用100%回收的塑料。”他指出,最近的這些公告或許預示著轉折點的到來,“我們也想參與其中”。

在BioGreen Frontier,56歲的公司主管黃永文說他也希望跨國公司行為的改變能幫他拿下大生意。但同時,他對短期問題感到擔心。黃永文仍在等待政府給他的工廠頒發批文,也面臨著工廠關閉的風險。1月底,和很大一部分全球經濟一樣,BioGreen Frontier等回收公司受到了新冠疫情的沉重打擊。中國在幾周內關閉了工廠和港口,并且取消了回收塑料顆粒訂單,這給回收公司帶來了巨大的困難。2月中旬,黃永文在電話里告訴我,他已經開始在倉庫里堆放塑料顆粒了,同時正在尋找新的客戶。他說:“我不想把工人趕回家。”

這些工人來自世界上一些最貧窮的國家,他們繼續涌進馬來西亞,急于回收那些來自世界上一些最富裕國家的廢品。對他們來說,盡管廢塑料行業陷入了困境,但仍是收入階梯上的一大進步。“我已經在這里工作兩個月了。”站在BioGreen Frontier生產線上的Aung Aung有 25歲,來自緬甸仰光。他說塑料回收的工資遠高于此前他在檳城餐館的工作,“我得考慮我的家庭。”

與此同時,沙希德·阿里制定了遠大的計劃。他說自己會在BioGreen Frontier再工作兩年,然后返還白沙瓦。“接下來我就會結婚。”他站在濕漉漉的、經過清洗的塑料中說,“我有一個心儀的女孩。”在那之前,他愿意每星期在回收線上工作84個小時——可以這樣說,他正在廢塑料上構建自己的家庭。

抵制塑料

我們對塑料的需求幾乎沒有止境,而地球消化塑料的能力有限。全世界只有9%的二手塑料得到回收,而每年傾倒進海洋的塑料約有800萬噸。廢塑料引發的公眾憤慨日益高漲,從而推動企業采取大膽措施來解決這個問題。以下三種方法正越來越受歡迎。

1. 化學回收

塑料行業很看好這項解決全球塑料泛濫的策略。這種方法將通常要填埋或焚燒的塑料分解成最初的化學成分,這包括塑料包裝袋、薄膜和咖啡膠囊。然后將這些化學成分和新樹脂混合,從而做出跟新塑料一樣堅固的材料。但它存在下行風險,比如說,這個過程會產生大量的碳,從而限制了它對氣候的整體貢獻。

2. 生物塑料

和石油原料制造的傳統塑料不同,生物塑料的制造方法是從玉米或甘蔗中提煉出糖,然后將其轉化為聚乳酸或聚羥基脂肪酸酯。這些材料的外觀和觸感非常像碳基塑料,但不消耗石化燃料。批評人士認為,用于制作生物材料的農作物需要噴灑殺蟲劑,而且會占用本可種植糧食作物的土地。同時,回收生物塑料需要堆肥廠中的高熱量,從而增加了二手生物塑料物品被填埋的風險。

3. 按包裝付費

應對回收市場癱瘓的措施之一是要求企業向市政府付費,以便回收他們的塑料包裝。大多數歐盟國家和一些亞洲國家已經制定了這樣的法律。在美國,緬因州議會正在考慮類似的提案。塑料制造商表示他們更愿意提高回收率,而不是分擔回收成本。但在歐洲,這樣的法律已經開始促使企業減少包裝并重新考慮對塑料的使用。(財富中文網)

Selvanaban Mariappen和塞巴斯蒂安·梅耶也為本篇報道做出了貢獻

本文另一版本登載于《財富》雜志2020年4月刊,標題為《惡性循環》。

譯者: MS

本文是《財富》雜志《特別報道:面臨環境危機的商業》組文之一,與普利策危機報道中心合作發表。攝影:塞巴斯蒂安·梅耶

在馬來西亞北部的一處山坡上,一座大型露天廠房矗立在油棕櫚樹和橡膠樹之間。這是生物降解公司BioGreen Frontier設在Bukit Selambau村的再生資源回收工廠,去年11月投產。1月一個驕陽火辣的下午,沙希德·阿里剛剛開始了第一周的工作。他分開雙腳,站在生產線盡頭向下傾斜的傳送帶旁,腳邊的白色濕軟塑料絲深及膝蓋。在他周圍,更多的細絲從傳送帶上落下,像雪片一樣飄散到地面上。

回收過程中,阿里一直在這堆塑料細絲中挑揀著看起來褪色或者臟了的不合格品。雖然這看起來很累,但阿里說這已經比他上一份工作好多了。此前他在附近的一家紡織廠疊床單,工資也比現在低得多。如今,如果吃的節省一點兒,就能存下錢來。他的時薪略高于1美元,每個月可以向父母和六個兄弟姐妹寄250美元,他們住在4300多公里外的巴基斯坦白沙瓦。24歲的阿里,身材矮胖,留著絡腮胡子,戴著眼鏡,臉上露出輕松的微笑。他說:“我聽說這里招工,就趕緊跑來應聘了。”不過,他每天要工作12個小時,每周工作七天。“如果我休息一天,就會少一天的工資。” 阿里說。

在這座廠房中有幾百個大包,堆了差不多有18米高,每個包里都塞滿了幾周前人們丟棄的塑料外包裝和塑料袋。上面的地址標簽清楚地指明了它們的來源地。可以看到加州半月灣一個家庭丟棄的廁紙外包裝,在埃爾帕索打包。還可以看到聚合物薄膜,來自功能飲料廠商紅牛設在圣莫妮卡的總部。

阿里所在的這類工廠是這些廢棄物最終的歸宿,它們飄洋過海,來到1.2萬公里外這個遙遠的角落,這首先說明全球資源回收經濟和人類對塑料依賴之間存在的巨大差距。這個生態系統嚴重失靈,甚至已經瀕臨崩潰。全世界每年都會生產不計其數的塑料,其中約90%最終都沒有得到回收利用,而是被燒掉、埋掉或者扔掉了。

而支持塑料回收利用的消費者越來越多,在數以百萬計的家庭里,把酸奶盒、果汁瓶放進藍色垃圾桶已經成了體現環保信仰的行為。但這種信仰也就到此為止。塑料物品每年都如同潮水般涌進回收行業,而且它們越來越有可能原封不動地被退出來,成為一個癱瘓市場的“受害者”。由于經濟性太差,消費者眼中(而且業界宣稱)的許多“可回收”產品實際上并非如此。隨著石油和天然氣價格接近20年來的最低點(這在很大程度上要歸功于壓裂開采技術革命),出現了所謂的新塑料,也就是一種源于石油原料的產品,其售價和獲取難度要遠低于可回收材料。對于直到現在仍只是勉強生存的資源回收行業來說,這種無法預見的變化無異于毀滅性的打擊。綠色和平組織的全球塑料行動負責人格拉漢姆·福布斯說:“全球廢品貿易實際上已經中斷。我們坐擁大堆塑料,卻無處可送,也無法處理。”

對于如此巨大的超負荷所引發的矛盾,業界和政府再也不能視而不見。這個矛盾源于塑料的盈利能力和用處及其對公眾健康和環境的威脅,而且幾乎沒有什么地方能比馬來西亞更能體現這種矛盾。在這里,超低的工資、便宜的土地以及仍在形成的監管氣候吸引企業主建立了幾百家回收工廠,這是他們為保持盈利的最后一搏。我和攝影師塞巴斯蒂安·梅耶走過了馬來西亞各地,清楚地看到了回收利用塑料的實際經濟和環境成本。我們在10天時間里走訪了10家回收工廠,其中一些,包括BioGreen Frontier的運營都沒有官方備案,所以有停工風險,而他們處理的是一船船來自世界各地的廢品。我們還看到了塑料經濟崩潰后對垃圾場、集裝箱碼頭、家庭以及廣闊海洋的影響。

過去50年塑料的發展呈直線上升態勢,理由很充分,那就是它們便宜、輕便而且基本上不會損壞。在1967年的電影《畢業生》(The Graduate)中,后來的導師對緊張兮兮的年輕人本杰明·布拉多克(達斯汀·霍夫曼飾)說:“塑料非常有前途。”基于這樣的提點來采取行動有可能產生巨大收益。塑料的全球年產量從1970年的2500萬噸飆升至2018年的4億噸以上。

塑料泛濫的背后是巨大的經濟利益——英國數據分析機構Business Research Co.指出,去年全球塑料市場的價值約為1萬億美元。2000年以來塑料需求已經翻了一番,而且到2050年可能再增長一倍。塑料行業組織美國化學理事會的成員包括陶氏化學、杜邦、雪佛龍和埃克森美孚等主要廠商。該組織負責塑料市場的董事總經理基思·克里斯特曼說:“在世界各地,需要提高生活質量的中產階層正在不斷增多。塑料已然成為人們生活的一部分。”大家可以看到,不光是礦泉水瓶和三明治包裝袋用塑料,其他含有塑料的東西不勝枚舉,比如運動衫、濕紙巾、建筑隔音材料和墻板、口香糖和茶包。

關于碳排放的爭論往往會掩蓋人們對塑料的擔心。但這兩個問題緊密相連,因為塑料生產本身就會排放數量可觀的溫室氣體。現在世界已經充分認識到了塑料危機。海龜被塑料吸管噎住,死去鯨魚肚子里塞滿塑料垃圾的圖片早已廣為流傳——它們的背后是每年流入海洋的800萬噸塑料(聯合國環境規劃署估算,到2050年海洋中的塑料數量將超過魚類)。人類不可避免的會受到影響。世界自然基金會資助的研究顯示,每位美國人平均每星期通過食物至少會吃下去一茶匙的塑料,差不多相當于一張信用卡,由此產生的健康問題還無法預測。

實際情況證明,讓塑料如此有吸引力的耐久性同樣讓塑料成了一枚環境定時炸彈。加州大學圣巴巴拉分校布倫環境科學與管理學院工業生態學教授羅蘭德·耶爾估算,1950年生產的所有塑料中,90.5%目前依然存在。美國環境保護署的數據顯示,2017年美國只有8.4%的廢塑料得到了回收,另有15.8%用于燃燒發電,其他的則都被填埋了起來。在亞洲和非洲的部分地區,塑料的回收利用率甚至更低。就連環保法律嚴格的歐洲,塑料的回收利用率也只有30%左右。

幾十年來,塑料生產商及其主要客戶,比如可口可樂、雀巢、百事和寶潔等消費品巨頭一直在說,提高回收利用水平是解決塑料廢品危機的辦法。這些公司認為這是一個行為問題,而且源于我們的行為。美國塑料工業協會的總裁兼首席執行官托尼·拉多斯澤維斯基說:“說問題在于塑料就像是膝跳反射。罪魁禍首是沒有正確處置塑料產品的消費者。”

塑料回收率確實很低。但僅將此歸咎于消費者也著實不妥。更大的問題在于能源市場的巨大變化。10年來石油和天然氣價格直線下滑,從而造成石化公司的新塑料生產成本遠低于塑料廠商的可回收塑料。在有大量利潤可圖的情況下,這些公司的新塑料產量猛增,進一步壓低了價格。二手塑料回收是勞動力密集型活動,因此成本很高,而且世界上很大一部分地區目前的經濟形勢變化也不利于塑料回收。

2018年,中國停止了幾乎所有塑料廢品的進口,理由是中國自己的資源回收行業正在危害環境,這個生態系統因此再遭重擊。此項決定讓我們這個世界的塑料復興經濟陷入混亂。舉例來說,2018年以前,美國一直將70%左右的廢塑料送到中國。而現在,紐約州Smithtown的固體廢物協調員麥克·恩格爾曼說:“回收利用行業就像用上了生命維持系統的病人。” Smithtown在長島郊區,有12萬居民。恩格爾曼表示:“希望情況將出現好轉。但我不能肯定會怎樣好轉。”

改善的途徑之一是限制新塑料的生產和使用,但考慮到石化和能源行業的政治影響力,這種方法存在很大的不確定性。實際上,繁榮的塑料市場對能源行業的長期健康而言已經變得舉足輕重。國際能源機構認為,隨著汽車廠商轉向電動汽車以及可再生能源的騰飛,塑料將成為石油天然氣行業的新增長引擎。該機構估算,石化原料占全球石油總需求的比重將從目前的12%升至2040年的22%,屆時石化原料有可能成為油氣行業唯一增長的領域,而石化原料中有很大一部分都用于制造塑料。

這樣看,大公司在回應消費者顧慮時未強調供給側就不奇怪了。今年1月,陶氏化學、杜邦、雪佛龍和寶潔等大型企業成立了清除塑料廢棄物行動聯盟。寶潔的首席執行官戴懷德對記者表示,塑料危機“需要我們所有人立即采取行動”。

但“立即采取行動”并不包括減產。相反,這些公司承諾將在今后五年內為廢棄物回收利用項目投入15億美元。美國化學理事會的董事總經理克里斯特曼以Renew Oceans項目為例,后者的目標是清理印度恒河中的塑料廢物。他說上述聯盟的目標是到2030年使塑料包裝物“100%可回收”,到2040年確保所有塑料包裝物都得到回收。但當我問他回收如此之多的塑料產生的巨大成本由誰承擔時,他遲疑了一下,然后說:“會有融資措施。部分資金將來自相關行業,部分來自政府。”

環保人士指出,塑料持久的壽命降低了上述說法的可信度。此外,就像耶爾研究顯示的那樣,大多數已經回收過一次的塑料無法再次回收。換句話說就是,我們給地球添加的幾乎所有塑料都很有可能留存下來,而且是和以前的幾乎所有塑料一起。

在一個蒸籠般的下午,塑料貿易商史蒂夫·黃坐在馬來西亞中部城市怡保的一家路邊小餐館中。他正和一位老客戶、當地資源回收公司AZ Plastikar的首席執行官賽基·楊會面。在嗡嗡作響的電扇下,兩人吃著辣餃子和鹵肉卷,喝著茉莉花茶,談起生意來。他們用的就是塑料桌子,坐的黃色椅子也是塑料的。

黃拿出幾個袋子,把其中裝的東西擺在楊面前。其中一個袋子里裝的是來自巴黎多家時裝店的衣架。另一個袋子里是一卷塑料繩,這是一張聚丙烯漁網剩下的一部分,是黃在荷蘭買的。兩人弓著身體,在桌上把漁網扯開來查看其中的聚合物,他們還用打火機燎了燎扯下來的繩頭,目的是聞聞味道,以便判斷它的化學成分。黃對楊說:“看,這很好,我們可以回收這些,這樣的有很多,漁民通常只會把它們扔到海里。”

黃是卜高通美有限公司的首席執行官,在塑料行業德高望重, 1984年在香港成立了卜高通美。他看上去就像一位精力充沛的上門推銷員,從某種意義上講,也的確是這樣。為了給廢塑料中的幾百種不同聚合物找到適于加工的工廠,他很大一部分時間都在美國、歐洲和亞洲之間奔波。5美元的午餐加上無數壺茶,重大回收生意就是在這樣的場合談成的,而不是光鮮的董事會會議室(在另一個下午的另一次會面中,一家華人工廠的老板敬了黃很多自釀米酒。在他的妻子為我們準備一大桌中國菜肴的時候,他和黃用不太結實的烤箱測試了塑料樣品)。

在怡保,楊同意每個月購買大約600噸聚丙烯,價值22.8萬美元左右。但他擔心不斷貶值的貨砸在手里,近來這種情況很普遍。楊說:“生產新塑料比回收便宜太多了。這對我們來說是個大問題。”

在馬來西亞各個地方的工廠里,我們都聽到了類似的情況。YB Enterprise董事總經理、59歲的葉冠發用手比了一把槍,對著自己的腦袋說:“如果你現在來要我開這家公司,那還不如殺了我。”葉的回收工廠占地10英畝(約40460平方米),位于他的家鄉巴東色海的油棕櫚樹林里。葉從17歲開始在巴東色海做資源回收利用,現在每個月回收約1000噸塑料。但在過去6個月時間里,他的產品價格下降了20%,來自中國的訂單也減少了一半。

塑料公司Fizlestari的工廠設在吉隆坡以南的汝來,在那里,裝著澳大利亞、美國和英國礦泉水瓶、飲料瓶的大包一直堆到了房頂。這家工廠去年的收入約為1000萬美元,但成品銷量比2017年,也就是該廠開業的第一年少了25%。首席執行官賽瑟爾·陳告訴我:“價格下跌了非常、非常、非常多,而且我覺得它不會很快回升。”

62歲的黃早就聽到過這樣的話,也感受到了經濟上的影響。他在香港為父親的小回收作坊收廢品時還是個小孩。黃說:“我那時還在上小學,連10歲還不到。”最終,他把小作坊發展成了盈利的企業,并于2000年和夫人以及六個子女移居到了加州Diamond Park。當時他在全球范圍內經營著20多家工廠,包括德國、英國、南非和澳大利亞。他說大多數時間里,光是香港的業務每年就能賺1000萬美元。和大多數回收商一樣,他最大的市場是中國。

這一切都在2018年毀于一旦,中國展開了“國門利劍”行動,禁止進口塑料廢棄物。此前很長一段時間里中國一直允許大量進口廢塑料。但興旺的廢塑料加工行業卻導致了環境污染。如今中國只允許進口幾乎不含污染物的廢品,而最多也只有1%的廢品能達到這一標準。佐治亞大學工程學院預計,今后10年全世界將有約1.11億噸廢塑料需要另尋出路。

中國政府的措施切斷了黃的財富來源。他估算,“國門利劍”行動以來,自己的生意萎縮了90%以上,工廠也關的只剩下了5家。現在他的主要賺錢途徑是當中間人,把廢品介紹給中國大幅調整政策后出現的那幾千家回收工廠。有許多回收廠是從中國遷到泰國、越南和馬來西亞的,吸引它們的是便宜的土地和甚至更低的勞動力成本,或者說來自孟加拉國、巴基斯坦和緬甸的打工者。

走進黃的客戶的工廠才會發現這種工作的勞動力密集度會有多高,以及為什么人們可能不想讓這些工廠開在自己家旁邊。

在工廠里,工人們梳理塞滿集裝箱的廢塑料。他們把二手塑料分類,挑揀出PET(聚對苯二甲酸乙二醇酯,廣泛用于飲料瓶和包裝)和LDPE(低密度聚乙烯,用于制造一次性購物袋)等材料。這些聚合物有幾百種,每一種都需要專門的加工方法。分揀完畢后,這些廢塑料將在機器中清洗,再加工成紗線那樣的細絲。然后把這些細絲放進磨床,磨成米粒大小,成為人們所說的塑料顆粒。回收商再把這些顆粒打包,作為原材料賣給制造商。很大一部分顆粒都送到了中國的工廠,在這里它們會重新進入消費體系的“血液循環”之中,成為汽車零部件、玩具、礦泉水瓶,以及數千種其他產品的原料。

這個過程很了不起,但它的效率絕不是100%。許多廠商想要回收的聚合物都達不到制造業需要的等級。污損的塑料通常都無法重新利用。同時,大量涌現的新塑料帶來的價格壓力只會讓情況變得更糟。澳大利亞公司ResourceCo Asia駐怡保的運營主管穆拉林德蘭·科溫達薩米說:“目前回收這些沒有經濟價值。”他買下了一些馬來西亞工廠無法使用的塑料,然后把這些塑料賣給了水泥公司,作為鋪設道路的材料。其他大多數回收廠只會燒掉或掩埋這些塑料。他指出:“執行情況很不好,把它們扔到填埋場里比較省錢。”

當我問她馬來西亞的廢塑料貿易增長的有多快時,時任馬來西亞環境部長楊美盈看起來很苦惱。在布城聯邦政府行政中心的頂層辦公室里,楊美盈估算此項貿易每年對經濟的貢獻只有10億美元,而且她認為正在全力以赴地對付廢塑料回收企業。后者需要拿到19張環保許可證才能開工。同時,僅去年楊美盈就關閉了200多家回收廠,原因是證照不全。她說,如果需要,馬來西亞政府應該“斷電、斷水,切斷所有可以切斷的東西。他們就像一幫土匪。”

楊美盈發起的戰斗正在等待新的將領——接受我采訪幾周后,她和馬來西亞政府其他成員在議會危機中全體辭職。但無論誰接替她,都會有健康專家和普通民眾作為同盟,而且原因再明顯不過了。

我們在馬來西亞的第一個上午,塞巴斯蒂安·梅耶和我爬上了雙溪大年中心一座約15米高的塑料山。這座小城在檳城附近,有大約20萬居民。廢品山由附近各家工廠認為不能回收的塑料堆積而成。這是塑料供應鏈的最末端。接下來唯一的辦法似乎就是把它燒掉,而且有些人就是這么做的。雙溪大年Metro醫院負責人、內科醫生Tneoh Shen Jen說工廠反復非法燃燒廢塑料已經使當地居民出現了呼吸問題。他表示:他們“在大多數晚上都聞到了燒塑料的味道”。

在附近的社區中,40歲的Tei Jean和她六歲的女兒坐在家中。她們的窗戶是封死的,家里也沒有玩具、毯子和窗簾。為了防止女兒的呼吸系統感染,Tei竭盡了全力。她說,去年她們家附近的塑料回收廠開工后不久,女兒就患上了呼吸系統疾病。從那時起,這位小女孩已經三次住院,去年在家待了六個月,沒有去上學。Tei說:“她的情況一直在惡化。每次出門她的眼睛就會發紅。”現在,她的女兒就待在安靜、昏暗的客廳里,靠在粉紅色小桌子上畫畫來打發時光。

雙溪大年的活動人士進行抗議后,工廠主從去年秋天開始不再焚燒塑料。但雙方仍相互敵視。去年4月有人趁著夜晚在兩家回收廠縱火。工廠主說這是環保組織所為。我們去看那座垃圾山時,一位保安用手機拍下了我們的照片,然后發給馬來西亞所有的回收廠,讓他們警惕我們的到來。幾天后,工廠主用懷疑的眼光看著我們,問道:“你們是跟那些環保主義者一起的嗎?”

有一次我們是在一起。一天,在雙溪大年附近,兩位活動人士帶著我們沿著慕達河旁的土路走了一遭。這條河是當地農場的水源。在那里,離一所幼兒園不遠就有一座巨大的無證廢品堆。桔黃色的水塘散發出難聞的化學品氣味,其中充斥著西方消費者一眼就能認出來的塑料物品——汰漬洗衣液瓶子、Poland Spring礦泉水瓶、Green Giant冷凍豆子包裝袋。當地人說回收工廠把不想要的東西都堆在了這里,這是違反馬來西亞法律的。一位自卸卡車司機看到我們后就趕緊離開了(兩天后,這堆廢棄物被燒掉了,在當地報紙刊登的照片上能看到樹叢后冒出的黑色濃煙)。

馬來西亞人希望在針對危險廢物的巴塞爾公約幫助下讓自己免受這樣的不良影響,該公約將于明年1月生效,它禁止運輸任何有毒的塑料廢品,而且已經得到世界上幾乎所有國家簽字認可,但美國除外。

馬來西亞官員已經開始阻攔他們懷疑違反規定的集裝箱。在一個狂風大作的周日下午,海關官員帶我們巡視了檳城的集裝箱碼頭,向我們展示了做好標記,將遣返美國、法國和英國的集裝箱船,而且成本由運輸方承擔。不過,這些遣返行動很快就會在官僚主義迷宮里泥足深陷。一艘來自奧克蘭的集裝箱船被打上了遣返標記,但它從2018年6月就一直停靠在檳城的集裝箱碼頭。

前環境部長楊美盈相信,嚴格執行巴塞爾公約前應當限制廢塑料進口,而且不光是馬來西亞,菲律賓和印尼等周邊資源回收樞紐也應如此。人們對廢塑料貿易越發不滿。她問我:“我們國家為什么要成為你們的垃圾場?因為這樣對你們來說更方便嗎?這不公平!”

實際上,幾乎沒有人哪怕短暫地思考一下他們的垃圾去往何方。大多數人都假設當他們把垃圾桶推到路邊后,一個運轉良好的回收系統就會接手。

1月的一個凌晨,我們追蹤了Smithtown的垃圾車,后者證明了上述假設錯的有多離譜。2020年的第一個回收日,這些卡車在一個垃圾中轉站卸下了103噸塑料,而這個中轉站曾經是一個功能齊全的資源回收點。2014年,Smithtown通過向迫不及待的回收公司出售廢品賺了87.8萬美元。現在,他們每年要向垃圾處理公司支付近8萬美元才能將垃圾脫手。

Smithtown的困難是美國整體情況的典型體現,而且這些困難在中國發布禁令前就出現了。隨著石油和天然氣價格暴跌,消納Smithtown二手塑料的市場消失了,而且新塑料就是比前者更便宜。因此,這個Smithtown大幅削減了回收規模,目前只接受質量較高的聚合物,也就是“1類”和“2類”,這是三角形回收標志中的數字。等級較低的塑料,即“3類”到“7類”,再也賣不出去了。在美國,數百個小鎮都做出了類似的決定,而且有幾十個小鎮干脆徹底終止了路邊回收。

現在,卡車公司會把在Smithtown收的廢塑料送到布魯克林的Sims市政回收中心。由于Smithtown所在的長島禁止填埋固體廢物,許多低等級塑料最終都在亨廷頓附近的一家垃圾焚燒發電廠燒掉了。Smithtown衛生監督員尼爾·席安說,真正的塑料回收幾乎已經不可能了:“把它送到世界上其他地方的成本仍然較低,然后它會以其他形式回到這里。”

如果目前的趨勢繼續下去,這種局面就不大可能出現改變。油氣公司正在為今后新塑料的繁榮投入大量資金。跨國巨頭殼牌正在匹茲堡附近修建大型綜合設施,而匹茲堡是美國的油氣壓裂開采中心之一。該綜合設施每年將生產大約35億磅(約157.5萬噸)聚乙烯塑料(賓夕法尼亞州議會已決定為該廠減稅25年,估算減稅額16億美元)。今年1月,臺塑集團獲準在路易斯安那州修建價值94億美元的綜合設施,該集團稱該設施將創造1200個就業機會。

這些工廠本身就存在環境問題。游說組織國際環境法中心指出,石化行業的擴張可能給“地區氣候帶來巨大而且不斷增長的威脅”。該組織預計,到2050年生產塑料排放的溫室氣體將相當于大約615個新建燃煤發電廠的排放量。加州大學圣巴巴拉分校的耶爾教授估算,到那時全世界的新塑料年產量將超過11億噸。

耶爾說經過多年來對行業數據的研究,他得出了一個結論:“最困難的是阻止新塑料生產規模的繼續上升,但我們必須去做。”

塑料生產商阻撓此事的能力就像不可消滅的塑料廢品一樣強,特別是在美國。典型事例就是對塑料袋和其他“一次性”塑料頒布的禁令。從2021年開始,歐盟27國將嚴格限制一次性塑料,中國各主要城市也將禁止使用塑料袋。在美國,石化公司基本上已經讓這樣的提議擱淺,只有八個州對一次性塑料下了禁令。在國家層面,兩位民主黨參議員在2月提出的措施會讓企業分擔回收成本并暫緩新塑料的增長。但美國塑料工業協會的首席執行官拉多斯澤維斯基說第二項措施“沒有成功的希望”。

拉多斯澤維斯基指出,塑料禁令只是政客發出的“高尚信號”,而且玻璃、金屬和紙張在使用壽命中制造的污染更大。該協會的游說成員堅持不懈地向議員們傳遞類似的信息。協會在3月25日召開全國大會的通知中告訴成員單位:“不要讓否定者主導塑料的故事。把我們已經知道的告訴國會山上的那些人,那就是塑料有助于改善人們的生活。”

盡管言辭激烈,但有跡象表明部分企業正在重新考慮塑料問題,部分原因是來自消費者施加的壓力。

一些服裝公司已經證明,回收塑料可以產生奢侈品溢價。2017年,阿迪達斯開始銷售用馬爾代夫海域中撈起的廢塑料制造的高端運動鞋。這款標價200美元的運動鞋一直供不應求,而且去年阿迪達斯生產了1100萬雙這樣的產品。該公司表明目前它計劃將新塑料徹底從生產活動中剔除。耐克也已經在設計以回收聚酯纖維為原料的運動服,并計劃推廣此項措施。

包裝食品領域的行為變化甚至有可能帶來更大的影響。聯合利華的首席執行官艾倫·喬普于去年10月表示,該公司將“從根本上重新考慮”自家產品的包裝,并在2025年之前將新塑料使用量降低一半。聯合利華的年塑料消耗量已經超過70萬噸。

回收利用方面的進步也讓人看到了希望。聯合利華已經和沙特阿美旗下的SABIC合作,旨在創造使用化學回收方法的包裝。他們表示,這個過程將二手塑料分解轉化后生成的材料和新塑料一樣好。去年,IBM稱它已經創造出吞噬PET并將其變為塑料顆粒的化學工藝,和我們在馬來西亞的收廠里看到的艱辛清洗和分揀工作相比,此項工藝的效率和可擴展性要高得多。

馬來西亞一些回收廠的所有者在這些舉措中看到了曙光,或者說他們的塑料顆粒再次成為受青睞商品的一絲希望。臺灣資源回收公司Grey Matter Industries的運營長吳度泓說:“耐克和阿迪達斯想告訴消費者他們關心地球,而且將使用100%回收的塑料。”他指出,最近的這些公告或許預示著轉折點的到來,“我們也想參與其中”。

在BioGreen Frontier,56歲的公司主管黃永文說他也希望跨國公司行為的改變能幫他拿下大生意。但同時,他對短期問題感到擔心。黃永文仍在等待政府給他的工廠頒發批文,也面臨著工廠關閉的風險。1月底,和很大一部分全球經濟一樣,BioGreen Frontier等回收公司受到了新冠疫情的沉重打擊。中國在幾周內關閉了工廠和港口,并且取消了回收塑料顆粒訂單,這給回收公司帶來了巨大的困難。2月中旬,黃永文在電話里告訴我,他已經開始在倉庫里堆放塑料顆粒了,同時正在尋找新的客戶。他說:“我不想把工人趕回家。”

這些工人來自世界上一些最貧窮的國家,他們繼續涌進馬來西亞,急于回收那些來自世界上一些最富裕國家的廢品。對他們來說,盡管廢塑料行業陷入了困境,但仍是收入階梯上的一大進步。“我已經在這里工作兩個月了。”站在BioGreen Frontier生產線上的Aung Aung有 25歲,來自緬甸仰光。他說塑料回收的工資遠高于此前他在檳城餐館的工作,“我得考慮我的家庭。”

與此同時,沙希德·阿里制定了遠大的計劃。他說自己會在BioGreen Frontier再工作兩年,然后返還白沙瓦。“接下來我就會結婚。”他站在濕漉漉的、經過清洗的塑料中說,“我有一個心儀的女孩。”在那之前,他愿意每星期在回收線上工作84個小時——可以這樣說,他正在廢塑料上構建自己的家庭。

抵制塑料

我們對塑料的需求幾乎沒有止境,而地球消化塑料的能力有限。全世界只有9%的二手塑料得到回收,而每年傾倒進海洋的塑料約有800萬噸。廢塑料引發的公眾憤慨日益高漲,從而推動企業采取大膽措施來解決這個問題。以下三種方法正越來越受歡迎。

1. 化學回收

塑料行業很看好這項解決全球塑料泛濫的策略。這種方法將通常要填埋或焚燒的塑料分解成最初的化學成分,這包括塑料包裝袋、薄膜和咖啡膠囊。然后將這些化學成分和新樹脂混合,從而做出跟新塑料一樣堅固的材料。但它存在下行風險,比如說,這個過程會產生大量的碳,從而限制了它對氣候的整體貢獻。

2. 生物塑料

和石油原料制造的傳統塑料不同,生物塑料的制造方法是從玉米或甘蔗中提煉出糖,然后將其轉化為聚乳酸或聚羥基脂肪酸酯。這些材料的外觀和觸感非常像碳基塑料,但不消耗石化燃料。批評人士認為,用于制作生物材料的農作物需要噴灑殺蟲劑,而且會占用本可種植糧食作物的土地。同時,回收生物塑料需要堆肥廠中的高熱量,從而增加了二手生物塑料物品被填埋的風險。

3. 按包裝付費

應對回收市場癱瘓的措施之一是要求企業向市政府付費,以便回收他們的塑料包裝。大多數歐盟國家和一些亞洲國家已經制定了這樣的法律。在美國,緬因州議會正在考慮類似的提案。塑料制造商表示他們更愿意提高回收率,而不是分擔回收成本。但在歐洲,這樣的法律已經開始促使企業減少包裝并重新考慮對塑料的使用。(財富中文網)

Selvanaban Mariappen和塞巴斯蒂安·梅耶也為本篇報道做出了貢獻

本文另一版本登載于《財富》雜志2020年4月刊,標題為《惡性循環》。

譯者: MS

This article is part of a Fortune Special Report: Business Faces the Climate Crisis. It was published in partnership with the Pulitzer Center on Crisis Reporting. Photography by Sebastian Meyer.

Cut into a hillside in northern Malaysia, amid oil palms and rubber trees, stands a large, open-air warehouse. This is the BioGreen Frontier recycling factory, which opened last November in the village of Bukit Selambau. On a searing-hot afternoon in January, Shahid Ali was working his very first week on the job. With his feet square in front of a chute on the production line, he stood knee-deep in soggy, white bits of plastic. Around him, more bits floated off the conveyor belt and fluttered to the ground like snowflakes.

Hour after hour, Ali sifts through the plastic jumble moving down the belt, picking out pieces that look off-color or soiled—rejects in the recycling process. Though it looks like backbreaking work, Ali says it is a great improvement over his previous job, folding bedsheets in a nearby textile factory, for much lower pay. Now, if he eats frugally, he can save money from his wages of just over $1 an hour and send $250 a month to his parents and six siblings in Peshawar, Pakistan, 2,700 miles away. “As soon as I heard about this work, I asked for a job,” says Ali, 24, a squat, bearded man with glasses and an easy smile. Still, he’s working 12 hours a day, seven days a week. “If I take a day off, I lose a day’s wages,” he says.

In the warehouse, hundreds of bales are stacked more than 60 feet high—each stuffed with plastic wrappers and bags tossed out weeks earlier by their original users. The address labels still stuck inside the bags offer clear clues to their origins. You can see toilet-tissue wrappers from a household in Half Moon Bay, Calif., packaging from El Paso, and polymeric film from energy-drink maker Red Bull’s U.S. headquarters in Santa Monica.

For this detritus, factories like Ali’s are the end of an odyssey of as much as 8,000 miles. The fact that the waste has traveled to this distant corner of the planet in the first place shows how badly the global recycling economy has failed to keep pace with humanity’s plastics addiction. This is an ecosystem that is deeply dysfunctional, if not on the point of collapse: About 90% of the millions of tons of plastic the world produces every year will eventually end up not recycled, but burned, buried, or dumped.

Plastic recycling enjoys ever-wider support among consumers: Putting yogurt containers and juice bottles in a blue bin is an eco-friendly act of faith in millions of households. But faith goes only so far. The tidal wave of plastic items that enters the recycling stream each year is increasingly likely to fall right back out again, casualties of a broken market. Many products that consumers believe (and industries claim) are “recyclable” are in reality not, because of stark economics. With oil and gas prices near 20-year lows—thanks in large part to the fracking revolution—so-called virgin plastic, a product of petroleum feedstocks, is now far cheaper and easier to obtain than recycled material. That unforeseen shift has yanked the financial rug out from under what was until recently a viable recycling industry. “The global waste trade is essentially broken,” says Graham Forbes, head of the global plastics campaign at Greenpeace. “We are sitting on vast amounts of plastic, with nowhere to send it and nothing to do with it.”

This gargantuan overload is creating a conflict that industry and government can no longer ignore—one that pits the profitability and usefulness of plastic against its threat to public health and the environment. There are few places where that conflict is more visible than in Malaysia. Here, rock-bottom wages, cheap land, and a still-evolving regulatory climate have enticed entrepreneurs to build hundreds of factories in a last-ditch bid to stay profitable. The real economic and environmental costs of plastic recycling are on vivid display, as I discovered traveling across the country with photographer Sebastian Meyer. Over the course of 10 days, we visited 10 recycling factories—some of them, including BioGreen Frontier, operating without official registration, under threat of a shutdown—as they grappled with waste shipped by the boatload from across the world. And we saw how the consequences of the broken plastics economy spill over into waste dumps, container dockyards, private homes, and out into the ocean.

For half a century, plastics have seen rocketing growth, for good reason: They are cheap, lightweight, and virtually indestructible. “There’s a great future in plastics,” a nervous young Benjamin Braddock (played by Dustin Hoffman) is told by a would-be mentor in the 1967 movie The Graduate. Acting on that tip would have yielded spectacular returns. Global production soared from 25 million tons a year in 1970 to more than 400 million tons in 2018.

Behind this polyethylene deluge is an economic colossus: a global plastics market worth about $1 trillion last year, according to U.K. data analysts the Business Research Co. Demand for plastics has doubled since 2000 and could double again by 2050. “We have a growing middle class around the world that needs to improve their quality of life,” says Keith Christman, managing director of plastic markets for the American Chemistry Council, an industry organization whose members include major producers like Dow, DuPont, Chevron, and Exxon Mobil. “Plastic is a part of that.” You can find plastic not just in your water bottles and sandwich bags, but in sweatshirts and wet wipes, home insulation and siding, chewing gum, tea bags, and countless other items.

Concerns about plastic have often been eclipsed by debates over carbon dioxide emissions. But the two are closely interlinked, with plastic production emitting considerable greenhouse gases itself. Now the world has fully awakened to the plastics crisis. Images of turtles choking on drinking straws or dead whales with stomachs engorged with plastic junk have gone viral—signifiers of the 8 million tons of plastic disgorged into oceans every year. (The UN Environment Program estimates that by 2050, the oceans will contain more plastic than fish.) The human toll is equally worrying. According to a study commissioned by the World Wildlife Fund, the average American consumes at least a teaspoon’s worth of plastic a week through food—roughly the amount in a credit card—with unforeseeable health consequences.

The durability that makes plastic so appealing, it turns out, also makes it an environmental time bomb. An estimated 90.5% of all the plastic produced since 1950 is still in existence, according to analysis by Roland Geyer, an industrial ecology professor at the University of California at Santa Barbara’s Bren School of Environmental Science & Management. Only 8.4% of plastic waste in the U.S. was recycled in 2017, according to the Environmental Protection Agency. An additional 15.8% was burned to generate energy; the rest wound up in landfills. Recycling rates are even lower in parts of Asia and Africa. Even Europe, with its stringent environmental laws, recycles only about 30% of plastics.

For decades, plastics producers and their biggest customers—consumer-goods giants like Coca-Cola, Nestlé, PepsiCo, and Procter & Gamble—have argued that improving these recycling numbers is the solution to the plastic-waste crisis. They frame the problem as one of behavior—ours. “It’s a knee-jerk reaction to say the problem is with plastic,” Tony Radoszewski, president and CEO of the Plastics Industry Association, tells me. “The culprit is the consumer who does not dispose of products properly.”

It’s true that recycling rates are low. But to blame that fact on consumers alone is disingenuous. The bigger problem is a huge shift in energy markets. Prices for oil and natural gas have plummeted over the past decade. That in turn has made it far cheaper for petrochemical companies to produce virgin plastics than for factories to create recycled plastic. And with big profits to be made, companies have sharply increased virgin production, further driving down prices. Recycling used plastic is labor-?intensive and therefore expensive—and the shifting economics now work against recycling in much of the world.

In 2018, this ecosystem endured another major blow when China halted the importation of almost all plastic scrap, saying that its own recycling industry was becoming an environmental hazard. The decision has caused chaos in the world’s plastic-resuscitation economy. Up until then, for example, the U.S. had been sending about 70% of its plastic waste to China. Now, “recycling is on life support,” says Mike Engelmann, solid waste coordinator for Smithtown, N.Y., a town of 120,000 people on suburban Long Island. “Hopefully things will turn around. But I am not sure how.”

One turnaround option, curbing the production and use of virgin plastics, faces long odds, given the petrochemical and energy industries’ political clout. Indeed, a thriving plastics market has become pivotal to the energy sector’s long-term health. As automakers transition to electric vehicles, and renewable energy takes off, plastics will pick up the slack in oil-and-gas industry growth, according to the International Energy Agency. It estimates that petrochemical feedstocks, much of which go to make plastics, could rise from 12% of total global oil demand today to 22% in 2040—at which point the agency says feedstocks could be the only segment of the industry that’s growing at all.

It’s no surprise, then, that big companies’ responses to consumer concerns don’t emphasize the supply side. In January, big players like Dow, DuPont, Chevron, P&G, and other major players launched the Alliance to End Plastic Waste. The plastics crisis “demands swift action from all of us,” P&G CEO ?David Taylor told reporters.

But “swift action” did not include cutting production. Instead, companies committed to spending $1.5 billion over five years on projects to reclaim and recycle waste. Christman of the American Chemistry Council cites as one example the Renew Oceans project, which targets plastic pollution in India’s Ganges River. He says the alliance aims to make plastic packaging “100% recyclable” by 2030 and to make sure it all goes into the recycling stream by 2040. But when I ask who will bear the enormous cost of recycling such a mammoth amount, he hesitates, then says, “This will take funding. Part will come from industry, part from governments.”

Environmentalists say the sheer life span of plastics undermines that argument. What’s more, as Geyer’s research points out, most plastic that’s recycled after first use can’t be recycled again. Put another way: Almost every new piece of plastic we add to the planet may well stay here—along with almost all the old ones.

On a steamy afternoon, plastics trader Steve Wong sits at a small sidewalk eatery in the city of Ipoh, in central Malaysia. He’s meeting an old client, Saikey Yeong, CEO of local recycler AZ Plastikar. Under a roaring fan, the two men sit down to business over plates of spicy dumplings and pork rolls, washed down with jasmine tea. Their table is plastic, and so are their yellow chairs.

Wong takes out several bags and lays the contents in front of Yeong. In one are bits of clothing hangers he has collected from Paris fashion houses. In another is a tangle of plastic rope, the remnants of a polypropylene fishing net, which Wong acquired in the Netherlands. Hunched over the table, the men pull apart the net to check the polymers, at one point holding the flame of a plastic lighter up to the strands, to smell the smoke and determine its chemical makeup. “Look, this is good—we can recycle this, and there is a lot of it,” Wong tells Yeong. “The fishermen usually just dump this at the bottom of the sea.”

Wong is CEO of Fukutomi Recycling, a venerable name in the plastics industry, which he founded in 1984 in Hong Kong. He has the rough-and-ready mien of a door-to-door salesman, which, in a sense, he is. He spends much of his time traveling between the U.S., Europe, and Asia, attempting to match the hundreds of different polymers in plastic waste with whichever factories can process them. It is in settings like these—over $5 lunches and endless pots of tea, rather than in sleek corporate boardrooms—that crucial recycling deals are really decided. (On another afternoon, at another meeting, a Chinese factory owner plied Wong with homemade rice wine. As his wife cooked up a spread of Chinese dishes for us, he and Wong tested plastic samples in a rickety toaster oven.)

In Ipoh, Yeong agrees to buy about 600 tons of the polypropylene each month, for about $228,000 a month. But he fears being stuck with depreciating stock—a common experience these days. “Producing new plastic is so much cheaper than recycling,” Yeong says. “It is a very big problem for us.”

In factories across Malaysia, we hear similar tales. “If you came to me now and asked me to start this business, you had better just kill me,” says Yap Koon Fatt, 59, managing director of YB Enterprise, miming a gun to his head. Yap’s 10-acre recycling factory is set among oil palm trees in his hometown of Padang Serai, where he started recycling at 17. He currently recycles about 1,000 tons of plastic a month. But prices for his products have dropped 20% over the past six months, and Chinese orders have dropped by half.

In the Fizlestari factory, in Nilai, south of Kuala Lumpur, enormous bales of used water and juice bottles from Australia, the U.S., and Britain sit stacked to the ceiling. The factory brought in about $10 million in revenue last year, but its finished product sells for 25% less than in 2017, when the factory opened. “Prices have dropped a lot, a lot, a lot,” CEO Cecil Chan tells me. “And I don’t see them going back up anytime soon.”

Wong, 62, has heard it all before, and he too is feeling the economic pain. He began as a boy in Hong Kong—“I was in primary school, not even teenage years,” he says—collecting trash for his father’s small recycling operation. He eventually grew the business into a profitable enterprise, and in 2000 he moved his wife and six children to Diamond Park, Calif. By then Wong operated more than 20 factories across the world, including in Germany, Britain, South Africa, and Australia. He says that most years he made $10 million in profit from his Hong Kong operation alone. Like most recyclers, his biggest market was China.

That all came crashing down in 2018, when China launched the ban it calls Operation National Sword. The country had long allowed enormous quantities of plastic-waste imports. But the vibrant industry that sprang up to process that waste eventually prompted complaints about the pollution it generated. Today, China will accept only waste that’s almost completely uncontaminated—?a threshold barely 1% of items can clear. Globally, about 111 million tons of plastic waste will need to find other destinations within the next decade, according to the University of Georgia College of Engineering.

China’s actions shut the pipeline that had made Wong rich. He estimates his business has plummeted more than 90% since National Sword, and he has closed all but five of his factories. Now he makes most of his livelihood as a middleman, brokering waste to the thousands of recyclers that have opened in response to China’s drastic change. Many have relocated from China to Thailand, Vietnam, and Malaysia, drawn by cheap land—and even cheaper labor, in the form of migrants from Bangladesh, Pakistan, and Myanmar.

Venturing into the factories of Wong’s customers shows just how labor-intensive the work can be and why communities might not want the factories as neighbors.

Inside, workers comb through containerloads of plastic waste. They sort through used plastic, separating materials such as PET (polyethylene terephthalate), which is widely used in drinking bottles and packaging, and LDPE (low-density polyethylene), the plastic in throwaway shopping bags. Each of the hundreds of polymers requires different processing. Once sorted, the waste is machine-washed and turned into yarn-like string. The string is then fed into a grinder, which turns it into pellets the size of grains of rice, known as nurdles. Recyclers pack the pellets into bales and sell them back to manufacturers as raw material. Much of the supply goes to factories in China, where it reenters the consumerism bloodstream as material for car parts, toys, water bottles, and thousands of other products.

The process is remarkable—but it has never been close to 100% efficient. Many polymers that users try to recycle are too low-grade for manufacturing. Soiled and damaged plastics often can’t be repurposed. And the price pressures created by the virgin plastic glut have only disrupted things further. “At the moment, there is no economic value to recycle this,” says Muralindran Kovindasamy, operations director in Ipoh for ResourceCo Asia, an Australian company. He buys some of the plastic Malaysian factories can’t use and sells it to cement companies as material for road paving. Most other recyclers simply burn or bury it. “Enforcement is poor,” he says, “and it’s cheap to dump it in the landfill.”

Yeo Bee Yin, then Malaysia’s environment minister, looked almost pained when I asked her how quickly Malaysia’s plastic-scrap trade has grown. Sitting in her top-floor office in the federal administrative center, Putrajaya, Yeo estimated that the trade contributes only $1 billion a year to the economy. Yet she saw herself as waging an all-out war against the operators. Malaysian recyclers require 19 different environmental permits to operate, and Yeo closed more than 200 factories last year alone, for lack of paperwork. If need be, she said, the government should “cut their electricity, cut their water, cut everything that is possible. They are gangsters.”

Yeo’s war awaits a new general: A few weeks after we spoke, she resigned with the rest of Malaysia’s cabinet amid a parliamentary crisis. But whoever succeeds her will have allies among health experts and ordinary citizens, for reasons evident even to the casual observer.

On our first morning in Malaysia, Sebastian Meyer and I climb a plastic mountain 50 feet high in the heart of Sungai Petani, a town of about 200,000 people near the island of Penang. This waste dump comprises plastics that nearby factories have deemed unrecyclable. It is the very end of the plastic supply chain. Burning it seems about the only next step, and someone is doing just that. Tneoh Shen Jen, a physician who directs the city’s Metro Hospital, says residents have experienced breathing problems as factories repeatedly and illegally burn the waste; they “smell burning plastic most nights,” he says.

In a neighborhood nearby, Tei Jean, 40, sits in her living room with her 6-year-old daughter. Their windows are sealed, and the house is stripped of toys, blankets, and curtains. It is a desperate effort by Tei to stop the girl’s respiratory infections, which she says began soon after recycling factories opened in their area last year. The girl has been hospitalized three times since then and last year stayed home from school for six months. “She kept getting worse,” Tei says. “Every time she left the house, her eyes would turn red.” Now the girl spends her days in the quiet, dark living room, drawing at a small pink table.

After protests from activists in Sungai Petani, factory owners stopped burning plastic last fall. But the two sides remain hostile. Last April, arsonists set ablaze two factories overnight. Their owners blame environmental groups. When we visited the town dump, a security guard snapped our photograph with his phone, then texted it to factories across Malaysia, to alert them to our presence. For days after, factory owners eyed us with suspicion, asking, “Are you with the environmentalists?”

On one occasion, we were. One day, near Sungai Petani, two activists guided us down a dirt road that ran alongside the Mudah River, a source of water for local farms. There, a short walk from a kindergarten, a large, unlicensed dump had sprung up. A chemical reek wafted up from pools of orange-colored water, filled with plastics instantly recognizable to Western consumers: Tide laundry soap bottles, Poland Spring water bottles, Green Giant frozen-pea packets. Locals explained that recyclers had discarded unwanted stocks here, in violation of Malaysian law. When a dump-truck driver spotted us, he hurriedly left the area. (Two days later, the site was set alight; local newspapers showed photos of thick black smoke rising over the trees.)

Malaysians hope to defend themselves from some of these depredations with the help of the Basel Convention on hazardous waste, which goes into effect next January. The convention bars the shipment of plastic contaminated with any kind of waste, and it has been signed by almost every country in the world—though not the U.S.

Malaysian officials have already begun blocking containers that they suspect violate the rules. On a blustery Sunday afternoon, customs officials escort us around Penang’s dockyard, showing us which containers are marked for return to the U.S., France, and Britain—at the shippers’ expense. Those returns can quickly get mired in a bureaucratic labyrinth, however. One container from Oakland, marked for repatriation, has sat on the dockside in Penang since June 2018.

Yeo, the former minister, believes plastic waste imports should be limited until the new Basel rules are strictly enforced, not only in Malaysia but also in nearby recycling hubs like the Philippines and Indonesia. People are increasingly rankled by the trade, she says. “Why are we a dumping ground for you? Because it is more convenient for you?” she asks me. “The feeling is there is perhaps injustice in it.”

In truth, few people give even a passing thought to where their trash goes. Most assume that after they wheel their garbage bins to the sidewalk, a well-oiled recycling system takes over.

Early one January morning, we tracked Smithtown’s garbage trucks as they proved how far off the mark that assumption is. On the first recycling day of 2020, the trucks tipped out 103 tons of plastic at a collection center that was once a full-service recycling facility. In 2014, Smithtown earned about $878,000 selling its waste to eager recyclers. Now, they pay nearly $80,000 a year to get disposal companies to take it off their hands.

Smithtown’s difficulties typify what has happened across the U.S.—and they predate China’s ban. As oil and gas prices crashed, the market for the town’s used plastic dried up; virgin plastic was simply cheaper. So it drastically cut its recycling and now accepts only higher-quality polymers, called “ones” and “twos”—the numbers inside the triangle recycling icon. Lower-grade plastics, numbered three to seven, are no longer marketable. Hundreds of towns across the U.S. have made similar decisions, and dozens have simply stopped curbside recycling altogether.

These days, a trucking company collects Smithtown’s plastic waste and delivers it to the Sims Municipal Recycling Center in Brooklyn. Since Long Island, where Smithtown is located, bans solid-waste landfilling, many low-grade plastics wind up being burned for electricity at a plant in nearby Huntington. Actual recycling of the waste is almost out of the question, says Smithtown sanitation supervisor Neal Sheehan. “It is still cheaper to ship it across the world to someplace, to come back as something,” he says.

If current trends continue, that’s unlikely to change. Oil and gas companies are making major investments in a future virgin-plastic boom. Multinational goliath Royal Dutch Shell is building a mammoth complex near Pittsburgh—one of America’s fracking epicenters—that will produce about 3.5 billion pounds a year of polyethylene plastic. (The plant won a 25-year tax break from the Pennsylvania state legislature that’s worth an estimated $1.6 billion.) In January, Taiwan’s Formosa Plastics Group won approval from state lawmakers to build a $9.4 billion plastic-production complex in Louisiana, which it says will create 1,200 jobs.

These plants are an environmental problem in their own right. The Center for International Environmental Law, an advocacy group, argues that the industry’s expansion could pose “a significant and growing threat to the earth’s climate.” It calculates that the greenhouse gases emitted in the production of plastics will equal the output of about 615 new coal plants by 2050. And Geyer, the UC–Santa Barbara professor, estimates that by then, the world will be creating more than 1.1 billion tons of virgin plastic a year.

Geyer says that after years of studying industry data, he has reached one conclusion. “There is one thing we absolutely must do, and it is also the hardest,” he says. “We have to commit ourselves to stop growing the production of virgin plastic.”

Yet plastic producers’ capacity to resist that outcome seems as sturdy as a laundry-soap bottle, especially in the U.S. Bans on bags and other “single use” plastics are a case in point. Beginning in 2021, single-use plastics will be strictly controlled in the European Union’s 27 countries, and plastic bags will be banned in major cities in China. In the U.S., petrochemical companies have largely stymied such proposals. Only eight U.S. states ban single-use plastics. At the national level, a measure introduced in February by two Democratic U.S. senators would make companies share the burden of recycling and impose a moratorium on virgin-plastic growth. But Rado?szewski, CEO of the Plastics Industry Association, calls the second measure “a nonstarter.”

Radoszewski says plastic-ban proposals are simply “virtue signaling” by politicians, and argues that alternatives like glass, metal, and paper are more polluting over their life span. The association lobbies relentlessly to send similar messages to lawmakers. “Don’t let naysayers dictate the story of plastics,” the group told its members in announcing its national conference on March 25. “Educate those on Capitol Hill about what we already know: Plastics help change people’s lives for the better.”

For all the fighting words, there are signs that some businesses are rethinking plastics—in part because of pressure from concerned customers.

Some clothing companies have proved that recycled plastics can command a luxury premium. In 2017, Adidas began selling high-end sneakers made of plastic waste hauled from the ocean off the coast of the Maldives. The $200 shoes have been a sold-out hit, and Adidas made 11 million pairs last year. The company says it now aims to eliminate virgin plastic from its production completely. Nike has also designed sportswear from recycled polyester and plans to expand that effort.

Behavioral changes in the packaged-goods world could have an even bigger impact. Unilever CEO Alan Jope said last October that the company would “fundamentally rethink” its packaging—its plastic footprint exceeds 700,000 tons a year—and halve virgin-plastic use by 2025.

Advances in recycling also show promise. Unilever has partnered with SABIC, a company owned by Saudi Aramco, to create packaging using chemical recycling, a process that breaks down used plastics and converts them into material it says is as good as virgin. And IBM last year said it had created a chemical process to eat through PET and turn it into nurdles—in a process it says is far more efficient and scalable than the painstaking washing and sorting in factories like the ones we visited in Malaysia.

Several owners of those factories see promise in these moves—a glimmer of hope that their nurdles might finally become desirable commodities again. “Nike and Adidas want to tell customers they care about the earth and will use 100% recycled plastics,” says Adu Wu, chief operating officer for Grey Matter Industries, a Taiwanese recycler. The recent announcements might signal a turning point, he says. “We want to be part of that.”

Back at BioGreen Frontier, company director Engboon Ooi, 56, says he too hopes changing behavior among multinationals could help him land big deals. In the meantime, he’s preoccupied with short-term woes. Ooi is still waiting for official permits for his factory and risks being shut down. And in late January, BioGreen and other recyclers, like much of the global economy, were hit with a body blow from the coronavirus. Within weeks, China shut down factories and ports and canceled orders for recycled-plastic pellets, causing havoc for recyclers. By phone in mid-February, Ooi told me he has begun stockpiling nurdles in the warehouse, while hunting for other clients. “I don’t want to send the workers home,” he says.

Those workers continue to flood into Malaysia from some of the world’s poorest countries, eager to recycle the waste from some of its richest. For them, the plastic-waste industry, even in its depressed state, remains a large step up the economic ladder. “I have worked here for two months,” says Aung Aung, 25, from Yangon, Myanmar, as he stands on the BioGreen production line. He says recycling plastic pays far more than his previous restaurant jobs in Penang. “I need to think about my family,” he says.

Shahid Ali, meanwhile, has big plans. He says he will work at BioGreen for two more years before returning to Peshawar. “I will get married then,” he says, standing amid the sodden washed plastic. “I have already chosen a girl.” Until then, he’s willing to spend 84 hours a week on the recycling line—building a home, figuratively speaking, out of plastic scraps.

Pushing Back on Plastic

Our appetite for plastic is almost limitless; the planet’s ability to absorb it is not. Barely 9% of used plastics are recycled worldwide, and about 8 million tons are dumped into the oceans every year. A growing wave of popular anger over plastic waste is pushing companies to take bolder steps to tackle the problem. These three approaches are gaining momentum.

1. Chemical recycling

The plastics industry is bullish on this strategy to address the global glut. The method involves breaking down plastics that are typically landfilled or burned, like plastic wrappers, film, and coffee pods, into their raw chemical ingredients. Those are then mingled with virgin resins to make materials that are just as strong as new plastic. There are downsides, however. The process generates a substantial carbon footprint, for example, limiting its overall benefit to the climate.

2. Bioplastics

Unlike traditional plastic, which is made from petroleum feedstocks, bioplastics are produced by extracting sugar from corn or sugarcane and turning it into polylactic acids or polyhydroxyalkanoates. Those materials look and feel much like carbon-based plastics, without the fossil fuel consumption. Critics note that crops for bioplastics require pesticides and hog land on which food could be grown. And recycling bioplastics requires high heat in composting plants, increasing the risk that used items will be landfilled.

3. Pay-per-package

One way to counteract a broken recycling market: require companies to pay city governments to recycle their plastic packaging. In most of the European Union and some Asian countries, such laws already exist. In the U.S., Maine’s legislature is considering a similar bill. Plastic makers say they would prefer to boost recycling rates rather than shoulder the costs. But in Europe, the laws have helped spur companies to cut packaging and rethink their use of plastic.

With additional reporting by Selvanaban Mariappen and Sebastian Meyer

A version of this article appears in the April 2020 issue of Fortune with the headline “Vicious (Re)cycle.”