留意這款新“生態友好型”加密貨幣奇亞幣(Chia)的不光只有加密貨幣的擁躉。

奇亞幣使用硬盤上額外的存儲空間來驗證區塊鏈交易,而不是像比特幣(Bitcoin)那樣采用耗能的“工作量證明”模式,因此自奇亞幣面世之后,像西部數據公司(Western Digital)這樣的硬盤制造商便經歷了硬盤和盤片需求的不斷增長。自今年5月初開始交易的奇亞幣由BitTorrent的創始人布拉姆?科恩于2017年在Chia Network上創建,并將成為比特幣的“綠色”替代選項。

即便在奇亞幣開始交易之前,有報道稱,由于礦主為了迎接奇亞幣的發布,東南亞出現了硬盤短缺現象。

美國銀行(Bank of America)的分析師在5月20日的一篇報道中稱:“在最近幾周,高容量硬盤[硬盤又稱機械硬盤]的需求和定價出現了激增……而且企業級硬盤[固態硬盤或SSD]價格也有所增長。”美國銀行稱,需求不斷增長的“主要推手”就是奇亞幣。

這些力量均提振了西部數據的股價,該公司是機械硬盤的主要生產商之一。在過去數周,其股價增幅超過了8%,而且上周初再次大漲。Wedbush的分析師馬修?布萊森對《財富》雜志說:“我確實認為,奇亞幣是西部數據近期良好發展態勢的主要功臣,尤其是眼下,硬盤需求的增長導致高容量硬盤出現了短缺現象。”

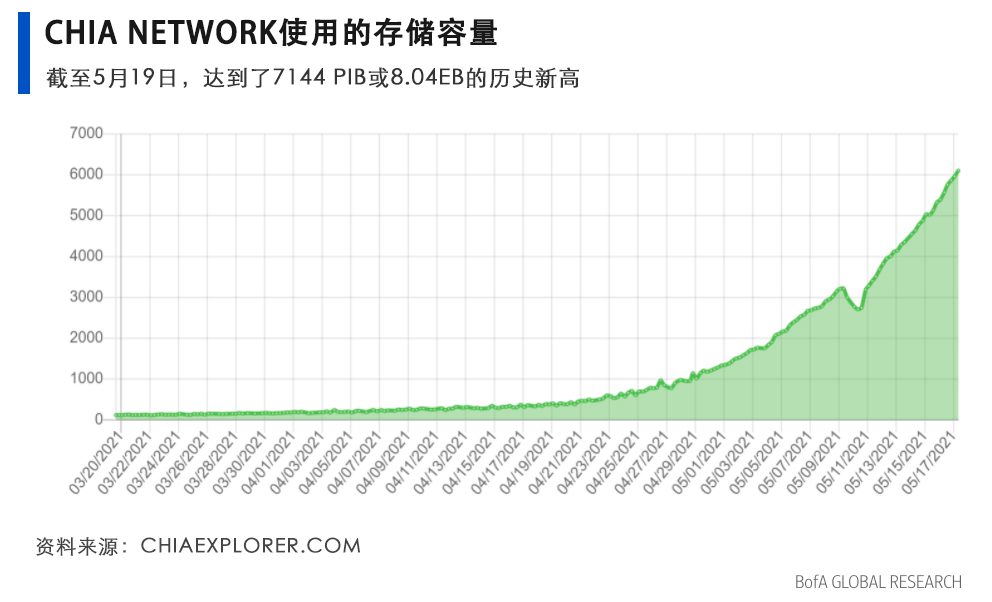

確實,Chia Network在最近幾周使用的存儲量越來越多,當前已經超過了8艾字節,較4月增長了2000%(詳見下圖美國銀行表格)。像布萊森這樣的分析師將關注“艾字節的增速動向,以及多快的增速能夠帶來什么樣的需求。如今,其需求一直在不斷增長”,他說。美國銀行稱,與此同時,某些西部數據產品的價格在過去一個月中一直在快速增長。

當然,一個重要問題在于,這股奇亞幣熱潮能夠持續多久。美國銀行的分析師指出,“從長期來看,奇亞幣熱潮軌跡的可持續性依然不是很明確,”但同時也認為“我們看到[西部數據]受益于需求的增長。”這也是為什么銀行將其股票的目標價從80美元調高至90美元的原因(較5月19日的收盤價增長了約26%)。

其他人,像Wedbush的布萊森,則將西部數據的NAND業務(類似于閃存)看作“真正推動其模式發展”的動力;布萊森認為奇亞幣在長期內并不會成為該領域里的“顛覆者”,但他認為“從短期來看,由于存在上述產量方面的限制,因此奇亞幣,外加其他領域的強勁需求……足以讓其供應鏈在未來幾個季度中保持趨緊態勢。”

然而,一些評論家已經在擔心,奇亞幣耕種的增加會導致硬件需求的不斷增長,這一現象最終可能會侵蝕它應有的“綠色”屬性,因為更多的設備意味著更多的能耗。Ava Labs的總裁約翰?吳(音譯)最近向《財富》雜志透露:“我確實擔心,當硬件需求增長時,這種空間和時間證明方法基本上等同于比特幣這樣的工作量證明,而且其模式就是:人們最終必須購買更多的設備才可以賺取奇亞幣。”Ava Labs經營著自己的區塊鏈平臺。

然而目前,此類設備不斷增長的需求和價格對西部數據這樣的公司來說應該是一個好消息。(財富中文網)

譯者:馮豐

審校:夏林

留意這款新“生態友好型”加密貨幣奇亞幣(Chia)的不光只有加密貨幣的擁躉。

奇亞幣使用硬盤上額外的存儲空間來驗證區塊鏈交易,而不是像比特幣(Bitcoin)那樣采用耗能的“工作量證明”模式,因此自奇亞幣面世之后,像西部數據公司(Western Digital)這樣的硬盤制造商便經歷了硬盤和盤片需求的不斷增長。自今年5月初開始交易的奇亞幣由BitTorrent的創始人布拉姆?科恩于2017年在Chia Network上創建,并將成為比特幣的“綠色”替代選項。

即便在奇亞幣開始交易之前,有報道稱,由于礦主為了迎接奇亞幣的發布,東南亞出現了硬盤短缺現象。

美國銀行(Bank of America)的分析師在5月20日的一篇報道中稱:“在最近幾周,高容量硬盤[硬盤又稱機械硬盤]的需求和定價出現了激增……而且企業級硬盤[固態硬盤或SSD]價格也有所增長。”美國銀行稱,需求不斷增長的“主要推手”就是奇亞幣。

這些力量均提振了西部數據的股價,該公司是機械硬盤的主要生產商之一。在過去數周,其股價增幅超過了8%,而且上周初再次大漲。Wedbush的分析師馬修?布萊森對《財富》雜志說:“我確實認為,奇亞幣是西部數據近期良好發展態勢的主要功臣,尤其是眼下,硬盤需求的增長導致高容量硬盤出現了短缺現象。”

確實,Chia Network在最近幾周使用的存儲量越來越多,當前已經超過了8艾字節,較4月增長了2000%(詳見下圖美國銀行表格)。像布萊森這樣的分析師將關注“艾字節的增速動向,以及多快的增速能夠帶來什么樣的需求。如今,其需求一直在不斷增長”,他說。美國銀行稱,與此同時,某些西部數據產品的價格在過去一個月中一直在快速增長。

公司的分析師表示,“奇亞幣的走紅將推高機械硬盤和固態硬盤的價格,因為機械硬盤主要被用于儲存數據填充文件,而固態硬盤被用于數據填充,因為后者擁有更高的容量和性能,可以處理大量的數據”,他們寫道。數據填充文件和數據填充指的是奇亞幣的“空間和時間證明”模式,后者涉及“農民”(而不是“挖礦者”)播種和劃分硬盤,是奇亞幣解鎖流程的一部分。

當然,一個重要問題在于,這股奇亞幣熱潮能夠持續多久。美國銀行的分析師指出,“從長期來看,奇亞幣熱潮軌跡的可持續性依然不是很明確,”但同時也認為“我們看到[西部數據]受益于需求的增長。”這也是為什么銀行將其股票的目標價從80美元調高至90美元的原因(較5月19日的收盤價增長了約26%)。

其他人,像Wedbush的布萊森,則將西部數據的NAND業務(類似于閃存)看作“真正推動其模式發展”的動力;布萊森認為奇亞幣在長期內并不會成為該領域里的“顛覆者”,但他認為“從短期來看,由于存在上述產量方面的限制,因此奇亞幣,外加其他領域的強勁需求……足以讓其供應鏈在未來幾個季度中保持趨緊態勢。”

然而,一些評論家已經在擔心,奇亞幣耕種的增加會導致硬件需求的不斷增長,這一現象最終可能會侵蝕它應有的“綠色”屬性,因為更多的設備意味著更多的能耗。Ava Labs的總裁約翰?吳(音譯)最近向《財富》雜志透露:“我確實擔心,當硬件需求增長時,這種空間和時間證明方法基本上等同于比特幣這樣的工作量證明,而且其模式就是:人們最終必須購買更多的設備才可以賺取奇亞幣。”Ava Labs經營著自己的區塊鏈平臺。

然而目前,此類設備不斷增長的需求和價格對西部數據這樣的公司來說應該是一個好消息。(財富中文網)

譯者:馮豐

審校:夏林

It's not only crypto enthusiasts that are taking note of the new "eco-friendly" cryptocurrency chia.

Hard-disk drive makers like Western Digital have seen growing demand for their hard drives and disks ever since chia—which uses spare storage space on hard drives to verify blockchain transactions instead of using the energy-intensive "proof of work" model employed by the likes of Bitcoin—launched in the crypto world. The coin, which started trading in early May, was created in 2017 by BitTorrent founder Bram Cohen on the Chia Network, and claims to be a 'green' alternative to Bitcoin.

Even before the coin began trading, there were reports of hard drive shortages in areas like Southeast Asia as miners prepared for chia's launch.

"In recent weeks the demand and pricing for high capacity [hard disk drives, or HDDs] has seen a material step higher ... and enterprise [solid state drive, or SSD] prices have also moved higher," analysts at Bank of America wrote in a May 20 report. The "primary upside driver" for that rising demand, according to BofA: chia.

These forces have all boosted the stock of Western Digital, a dominant seller of HDDs, as shares are up over 8% over the past couple weeks after seeing a big rally earlier last week. Wedbush analyst Matthew Bryson tells Fortune, "I certainly think that chia is a primary contributor to what's going on with ...Western Digital, particularly in the sense that the incremental demand on the hard drive side has created a shortfall in availability of high capacity drives."

Indeed, the Chia Network is using up more and more storage in recent weeks—presently, over 8 exabytes, an over 2,000% increase from April (see BofA's chart below). Analysts like Bryson are going to be watching "what happens with exabyte growth, which kind of tells you what demand has looked like. Right now it's been constantly increasing," he notes. Prices for some of Western Digital's products, meanwhile, have also been rising at a rapid clip within the past month, per BofA.

The firm's analysts note that "the rise in popularity of Chia would increase the price of both HDD and SSD, since HDD is primarily used to store the plots, while SSD is used for plotting due to higher capacity and performance to handle large amount of data," they wrote. The plots and plotting refer to chia's "proof of space and time" model, which involves "farmers" (instead of "miners") seeding and plotting hard drives as part of its process of unlocking coins.

The big question, of course, is how long the chia tailwind might last. The BofA analysts note that the "sustainability of this trajectory of Chia's popularity remains unclear" for the long term, but argue "we see [Western Digital] benefiting from the increased demand." That's why the bank is upping its price target for the stock from $80 per share to $90 per share (some 26% upside from its May 19 close price).

Others like Wedbush's Bryson view the company's NAND business (think flash memory) as what "really drives their model"; Bryson doesn't think that chia will be "transformational" for the space long term. But he believes "from a near term perspective, because you have these constraints around production, that chia, plus strong demand in other areas, … [is] enough to keep a tight supply chain over the next couple quarters," he says.

Still, some critics are already fretting that the growing amount of hardware used to farm more chia could eventually erode how "green" it actually is, as more equipment would mean more energy consumption. "I do worry that when they do grow, this proof of space and time has kind of the same methodology [as] proof of work, like Bitcoin, and their model is: you ultimately have to buy more equipment to get paid," John Wu, president of Ava Labs, which has its own blockchain platform, recently told Fortune.

But for now, the rising demand and prices for such equipment should likely be a boon for the likes of Western Digital.