在最近兩次股東大會之間,巴菲特都買了哪些好股

|

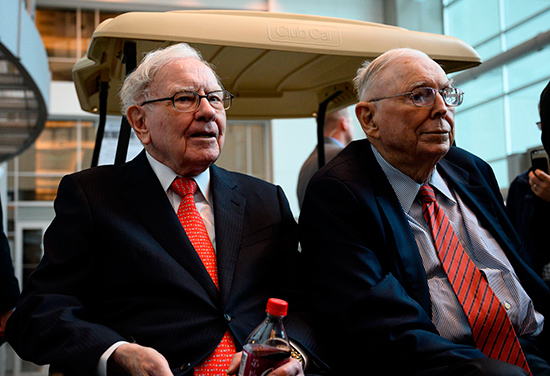

又到了每年的這個時候。上周六,估計有4萬名伯克希爾·哈撒韋投資者相聚內布拉斯加州,聆聽“奧馬哈先知”本人——沃倫·巴菲特總結這家綜合性控股集團的靚麗業績,同時展望未來的情況將會如何。 會前,巴菲特和他的副手查理·芒格已在上周登上了頭條。上周四,巴菲特透露說伯克希爾-哈撒韋已經買進了亞馬遜的股票。長期以來巴菲特一直很欣賞亞馬遜,他因為沒能盡早出手而自責的事也已眾所周知,而今伯克希爾-哈撒韋終于持有了亞馬遜股票。上周五,該消息推動亞馬遜股價上漲3%。 與此同時,接受《華爾街日報》采訪的芒格為富國銀行被趕下臺的前首席執行官蒂姆·斯隆辯護,稱后者為“非常好的銀行負責人”。芒格還說,他“本人會讓斯隆留任,但沒人問過我”。伯克希爾-哈撒韋當然是富國銀行的最大股東,它在這家陷入困境的銀行中持股10%。 雖然去年富國銀行的情況不好,但對伯克希爾-哈撒韋來說這絕對是個好年份。該公司向美國證券交易委員會提交的股票持倉報告(13F)顯示,截至2018年底,這家綜合集團在48家公司持有約35億股股票。 雖然此后的持倉一定會有變化(包括最近對亞馬遜的投資),但《財富》雜志的數據分析結果表明,伯克希爾-哈撒韋去年底所持股票已升值6.7%,此前12個月的總回報率為8.5%。總的來說,截至5月2日,2018年底伯克希爾-哈撒韋手中這48只股票的價值已超過2100億美元;與之相比,該公司2017年底持倉在2018年5月2日的價值在1780億美元以上。 在伯克希爾-哈撒韋持有的主要股票中,蘋果公司繼續一騎絕塵。到去年底,伯克希爾-哈撒韋在蒂姆·庫克領導的這家大型科技企業中持股約2.5億股(或5%以上),而此前12個月蘋果的股價上漲了18.5%,總回報率超過20%。 伯克希爾-哈撒韋持股1.52億股(近18%)的美國運通同樣表現的格外出色——伯克希爾-哈撒韋上次股東大會以來,美國運通的股價上漲了20%,總回報率為22%。可口可樂也是如此——2018年股價上漲15%,總回報率19%。截至2018年底,伯克希爾-哈撒韋持有這家軟飲料巨無霸4億股,持股比例超過9%。 富國銀行一直是伯克希爾-哈撒韋不那么成功的主要持股對象之一。受一系列丑聞影響,過去12個月富國銀行股價下跌了7.5%,回報率為負4.5%。不過,讓伯克希爾-哈撒韋“最受傷”的投資莫過于卡夫亨氏——鑒于那些相當公開化的問題,這家食品飲料巨頭的股價在過去一年中下跌近41%,回報率接近負38%。今年早些時候巴菲特本人承認伯克希爾-哈撒韋“買卡夫買貴了”。 除了主要投資對象,給伯克希爾-哈撒韋帶來最強勁回報的是那些持有量相對較少的股票。以互聯網域名注冊公司威瑞信為例,截至2018年底伯克希爾-哈撒韋持有近1300萬股威瑞信股票,而后者過去12個月的漲幅和總回報率都超過了65%。伯克希爾-哈撒韋對寶潔的投資甚至更少。寶潔過去一年的股價漲幅接近49%,回報率幾乎達到54%,而伯克希爾-哈撒韋的持股量只有31.5萬股。 過去一年股價漲幅和回報率達到兩位數的其他投資包括STORE Capital(總回報率40%)、萬事達卡(34%)、United Continental Holdings(30%)、Visa(28%)、Costco Wholesale(26%)和達美航空(14%)。落后幅度較大的個股則包括美國航空(總回報率為負19%)、森科能源(負14%)和高盛(負11%)。 就像巴菲特自己在年度致股東信中所說,管理如此龐大的投資意味著他“會有代價高昂的主動失誤,也會錯失很多機會。”但整體而言,很難否認奧馬哈先知仍然很成功。(財富中文網) 譯者:Charlie |

It’s that time of the year again. On Saturday, an estimated 40,000 Berkshire Hathaway investors will gather in Nebraska to hear the “Oracle of Omaha” himself, Warren Buffett, recap his holding conglomerate’s successes and cast an eye to what the future may hold. Both Buffett and his deputy, Charlie Munger, have already made headlines this week in advance of the meeting. On Thursday, Buffett revealed that Berkshire Hathaway has purchased shares of Amazon—finally investing in a company that Buffett himself has long admired and has famously kicked himself for not betting on earlier. The news prompted Amazon’s stock to climb 3% on Friday. Munger, meanwhile, gave an interview to the Wall Street Journal in which he defended ousted Wells Fargo CEO Tim Sloan, calling him “a very good bank lender” and saying he would “would have kept Sloan, myself, but nobody asked me.” Berkshire Hathaway, of course, is Wells Fargo’s largest shareholder, owning a nearly 10% stake in the beleaguered bank. While the past year wasn’t a good one for Wells Fargo, it was definitely good for Berkshire Hathaway. Buffett’s conglomerate held roughly 3.5 billion shares in 48 different companies at the end of 2018, according to the most recently available data found in Berkshire Hathaway’s 13F filing with the Securities and Exchange Commission. While the firm’s various positions have certainly changed since then (including its recent Amazon investment), the stocks that were in Berkshire Hathaway’s portfolio at the end of last year have appreciated 6.7% and delivered total returns of 8.5% over the past 12 months, according to a data analysis by Fortune. In total, the company’s year-end position across those 48 stocks is now valued at more than $210 billion as of May 2; by contrast, its various positions at the end of 2017 were value at more than $178 billion at this point last year. Of Berkshire Hathaway’s largest holdings, none other than Apple continues to be a standout. At the end of last year, Buffett’s firm owned around 250 million shares (or a more than 5% stake) in the Tim Cook-led tech giant, whose stock has climbed 18.5% in the last 12 months and delivered a total return of more than 20%. American Express, in which it held 152 million shares (a nearly 18% stake), has also performed exceptionally well—with its stock up 20% and a total return of 22% since Berkshire Hathaway’s last annual meeting. The same goes for Coca-Cola, which has seen its shares rise 15% in the last year and a total return of 19%; Buffett’s firm owned 400 million shares, or more than 9%, in the soft drink behemoth at the end of 2018. Less successful among Berkshire Hathaway’s big bets has been Wells Fargo, which in the midst of an array of scandals has seen shares fall 7.5% in the last 12 months with a negative return of -4.5%. Yet no investment has hurt more than its position in Kraft Heinz; unsurprisingly, given the well-publicized issues at the food-and-beverage giant, its stock is down nearly 41% over the last year and it has delivered a negative return of nearly 38% in that time. Buffett himself admitted earlier this year that Berkshire Hathaway “overpaid for Kraft.” Moving away from the heavy-hitters, it is some of the firm’s relatively smaller positions that have delivered the most robust returns. Take its investment in internet domain name registry Verisign, in which Berkshire Hathaway held nearly 13 million shares at the end of 2018 and which has seen price appreciation and total returns of more than 65% in the last 12 months. An even smaller position is Procter & Gamble, which has climbed nearly 49% in that time and delivered a return of almost 54%; Buffett’s firm held only 315,000 shares in the consumer goods company at year-end. Other investments that have resulted in double-digit price appreciation and returns over the past year include STORE Capital (total return of 40%), Mastercard (34%), United Continental Holdings (30%), Visa (28%), Costco Wholesale (26%) and Delta Air Lines (14%). Meanwhile, the likes of American Airlines Group (negative total return of -19%), Suncor Energy (-14%) and Goldman Sachs (-11%) have been among the more notable underperformers. As Buffett himself noted in his annual letter to shareholders, managing such an expansive portfolio means he “will make expensive mistakes of commission and will also miss many opportunities.” But on balance, it’s hard to dispute that the Oracle of Omaha has still got it. |