衛星行業初創企業將遭遇困境

|

四年以來,麻省理工學院一直在舉行專注于企業家的新太空時代大會。該會議的變化速度之快,頗為令人側目。首先,與2019年的會議相比,第一屆大會召開的會議室很小,也沒有業界大拿參加,更沒有美味的早間點心。但更為重要的是,關注的焦點發生了兩個方面的變化。 |

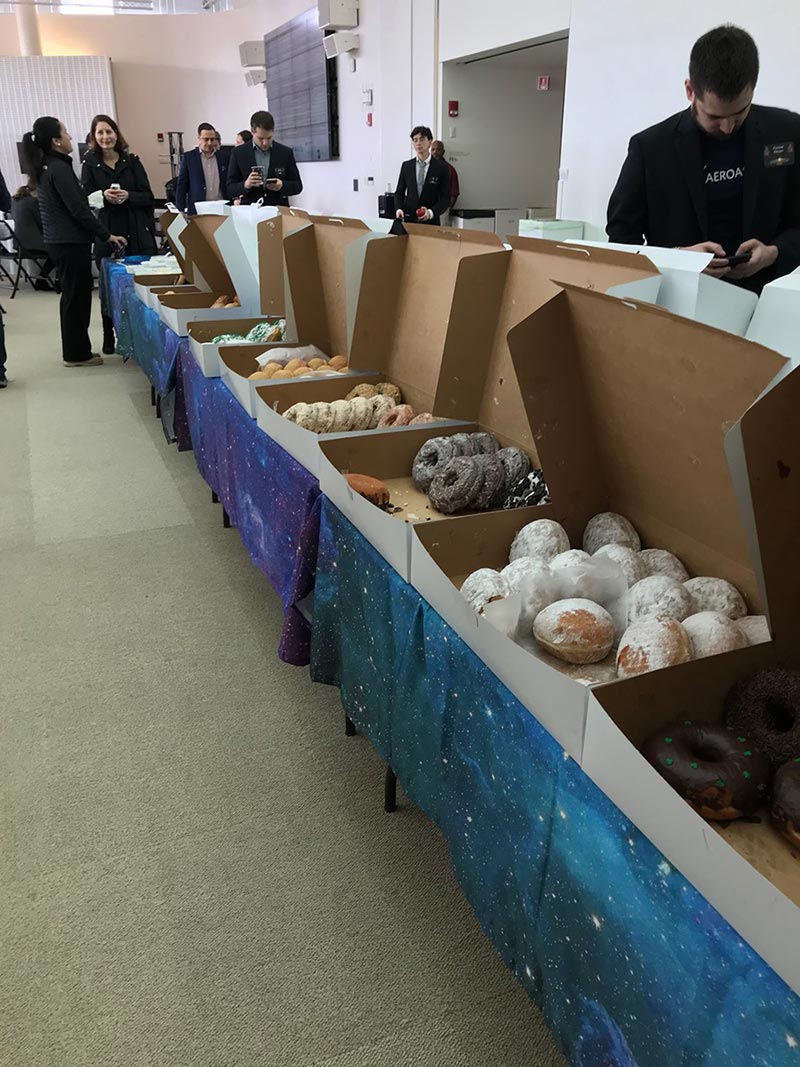

MIT has been holding its entrepreneur-focused New Space Age Conference for four years, and it’s notable how quickly things have changed. For one, the first iteration fit in a smaller room and lacked the giant and delicious mid-morning doughnuts supplied for the 2019 conference. But more importantly, the focus has shifted in two ways. |

|

回想2016年,波音曾是這一領域的大拿,曾經主宰了太空經濟數十年,為所有的初創企業以及觀眾席中即將創業的人士提供了其真知灼見。但公司研發別動隊的負責人納韋德·胡賽因聽起來則有點抵觸的意味,而且他堅持認為:“我們做好了競爭的準備。”它似乎成了一種預兆,就在大會開始的前一天,埃隆·馬斯克的SpaceX將其可重復使用的火箭降落在了海上的一艘駁船上。事后,人們明顯發現,這一領域改朝換代了。 在今年的新太空時代大會上,SpaceX成為了大拿,而且其火箭技術已經從演示階段發展至技術成熟的商業階段。 衛星入軌成本的大幅降低將讓數十乃至數百家新初創企業拿到用于開展業務的資金,繼而啟動新一輪的太空競賽。Starburst Aerospace Accelerator的執行合伙人范·厄斯帕博迪可能沒有意識到其聲明的戲劇性色彩:“十年前,來自于洛克希德和波音的高管會來這里參會。”(當時僅有三個,范·厄斯帕博迪。) 但厄斯帕博迪還在2019年的會議中提到了另一個常見的觀點,它代表了自2016年以來出現的第二個變化。然而在當時,初創企業依然在試圖博得硅谷的歡心,如今,它們似乎在這一方面做得過于成功。厄斯帕博迪擔心,過多的資金流入了過多的初創企業,而這些企業都在追逐著衛星發射領域為數不多的雷同機會。他諷刺地說道:“不會投資的人大有人在。” 令人印象最為深刻的首席執行官莫過于HawkEye 360的約翰·瑟拉非尼,該公司將發射多枚衛星,跟蹤地面的各類無線電波信號。他解釋道,公司的衛星可以幫助阻止“海事環境中的危險分子”從事數十億美元的“負面外部活動”。什么?他們要去捉海盜! 除了追逐有限機會的過度資金之外,SpaceAble的首席執行官朱麗恩坎特格雷爾從獨到的角度解釋了為什么太空市場的初創企業可能會開始出現墜毀的情況。實際上,軌道上能夠容納的衛星數量是有限的,否則,碎片和碰撞將成為一個大問題。他警告說:“我們無法繼續將更多的物體送入太空。在某些方面,我們需要停下來思考一下低軌環境。”但愿明年的大會上不會出現任何需要討論的實際案例。(財富中文網) 譯者:Charlie 審校:夏林 |

Way back in 2016, Boeing was the big incumbent, the company that had dominated the space economy for decades, offering its wisdom to all the startups and would-be startups in the audience. But Naveed Hussain, who headed the company’s R&D skunkworks, sounded a bit defensive as he insisted: “We are ready to compete.” Portentously, just the day before the conference, Elon Musk’s SpaceX landed one of its reusable rockets on a barge floating at sea. In hindsight, it’s obvious that a changing of the guard had occurred. At this year’s New Space Age conference, SpaceX was the big incumbent and its rocket technology has now moved from the demonstration stage to the workman-like commercial phase. Shattering the cost of putting satellites in orbit has allowed dozens, perhaps even hundreds, of new startups to attract funding and go into business, kicking off a new space race. Van Espahbodi, managing partner of the Starburst Aerospace Accelerator funding many of those startups, may not have realized the irony of his statement that “ten years ago there would have been executives from Lockheed and Boeing in this room.” (It was only three, Van.) But Espahbodi also sounded another common refrain from the 2019 edition of the conference, one that marks the second shift from 2016. While back then startups were still trying to figure out how to woo Silicon Valley, now it seems they may have succeeded too well. Espahbodi worried that too much money may have flowed into too many startups all chasing the same few satellite opportunities. “There’s lots of not so smart money out there,” he quipped. The most impressive CEO on stage may have been John Serafini from HawkEye 360, which is launching satellites to track all manner of radio frequency signals on the ground. The company’s satellites could help stop “bad actors in a maritime environment” from creating billions of dollars of “negative externalities,” he explained. What? They’re going to catch pirates! Aside from the excess financing chasing too few ideas, Julien Cantegreil, the CEO of SpaceAble, offered a unique reason why startups in the space market may start crashing out–literally. There’s actually a limit to how many satellites can go into orbit before debris and collisions become a big problem. “We cannot continue to send more objects to space,” he warned. “At some point we need to stop and think about the low earth (orbital) environment.” Hopefully there won’t be any actual examples of that problem to discuss at next year’s conference. |